Prosecutor Investigation Intensifies One Year After FSC's Planned Inspection

LS Securities Erases Real Estate Finance Division

Comprehensive Finance Division Established Under IB Business Unit

LS Securities (formerly Ebest Investment & Securities), which rebranded and started anew this year, has been subjected to a search and seizure due to misconduct related to real estate project financing (PF) by a current executive. This comes about a year after the Financial Supervisory Service (FSS) uncovered the executive's misconduct during a planned inspection of securities companies' real estate PF at the end of last year. Although the company aimed for a leap forward under its new brand, it is expected that the company's credibility will inevitably be damaged. Criticism that internal controls did not function properly is also likely unavoidable.

According to the financial investment industry on the 25th, the Anti-Corruption Investigation Division 3 of the Seoul Central District Prosecutors' Office conducted search and seizure operations on the 21st at about 10 locations, including LS Securities' Yeouido headquarters and Hyundai Construction's headquarters, in connection with allegations of violations of the Capital Markets Act by LS Securities executive Mr. A. The prosecution received the case from the FSS on charges including violations of the Capital Markets Act but is investigating illegal matters without limiting the scope of application beyond simple executive breach of trust and embezzlement charges.

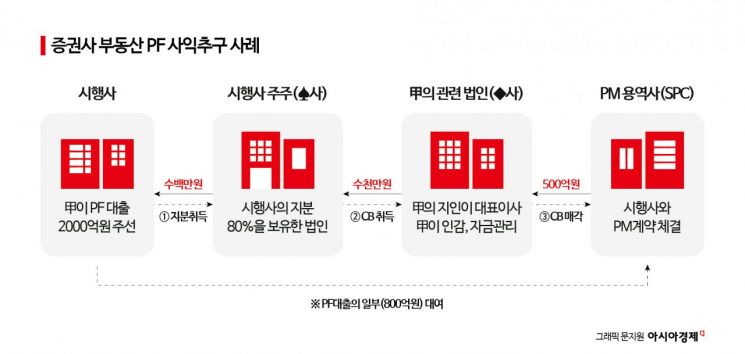

Earlier, the FSS conducted a planned inspection of PF loans for five securities companies over two months starting in October last year and detected signs of illegal gains by securities company executives including Mr. A, as well as weak internal controls at the securities companies, and reported and accused them to the prosecution. Hyundai Construction was identified as the construction company related to the real estate development project where Mr. A privately misused information. It was also confirmed that about 70 billion KRW was lent to four PF project operators, and interest exceeding the maximum legal interest rate (20% per annum) under the Interest Rate Restriction Act was received, resulting in an improper gain of 4 billion KRW.

Mr. A, who has been employed since July 2020, has been on leave for about a year until recently. At one time, Mr. A was considered a "rising star" in the real estate finance sector. He held the position of head of the real estate finance division until May but officially stepped down from the position at the end of May. On June 1, LS Securities carried out an organizational restructuring in line with its incorporation into the LS Group, abolishing the real estate finance division under the existing IB division and establishing a comprehensive finance division. The five-division system under the IB division was maintained.

It was reported through the media that Mr. A purchased a luxury residence worth 10 billion KRW in March. According to the Ministry of Land, Infrastructure and Transport's actual transaction price disclosure system, "The Penthouse Cheongdam PH129" located in Cheongdam-dong, Gangnam-gu, Seoul, with an exclusive area of 273.96㎡ (6th floor), was sold for 10.3 billion KRW in March this year. The buyers are two people including Mr. A, each holding half of the shares.

Within the financial investment industry, there is a sentiment that the misconduct by employees in the real estate PF department has crossed the line. A senior official at a securities company said, "For example, even front-running by an analyst causes a huge scandal, so it is absurd that someone would burn their own equity and raise financing. They tried to inflate things by setting up numerous PF projects, but all of this is turning into risk."

The financial supervisory authorities are also in the final stages of completing disciplinary measures and deciding the level of punishment. The level of discipline will be finalized later through the disciplinary review department and the Disciplinary Review Committee, an advisory body to the FSS governor, once decided internally. During this process, LS Securities' explanation procedures will also be conducted concurrently.

An FSS official said, "Since this matter is under investigation by the prosecution, we are cooperating as needed. Separate from criminal sanctions, the FSS will proceed with administrative sanctions, and we are working to expedite the process."

An LS Securities official said, "The executive in question is currently on leave, and personnel action will be decided after the final results are out. We will actively cooperate with the prosecution's investigation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.