Valuation Increased by Up to 911.7 Billion KRW in 42 Days

High Possibility of Partial Sale of Consigned Investment Volume

Attention on the 'Casting Vote' Role in Management Rights Dispute

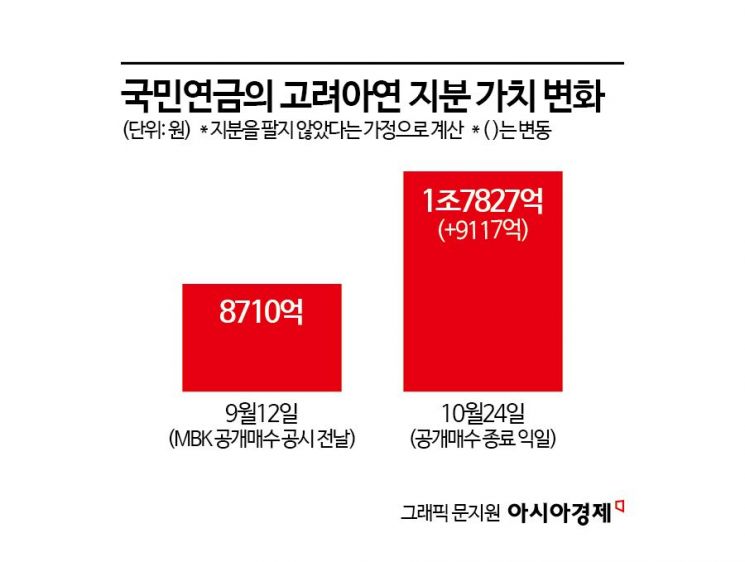

The National Pension Service (NPS) is emerging as 'another winner' in the management rights dispute of Korea Zinc. This is because Korea Zinc has become a 'royal stock,' surpassing 1 million won with a limit-up price, causing the valuation of its held shares to increase by up to 900 billion won in just over a month. It is extremely rare for the value of shares in a large listed company to double in such a short period.

According to the Korea Exchange on the 25th, based on Korea Zinc's previous closing price (1,138,000 won), the valuation of NPS's holdings of 1,566,561 shares (based on the latest disclosure) is 1.7827 trillion won. The valuation based on the price of 556,000 won on September 12, the day before MBK Partners and Young Poong alliance announced their public tender offer, was 871 billion won. This means an increase of 911.7 billion won in just 42 days. The ranking of NPS's portfolio also rose sharply. It climbed from around the 40th place to 14th based on valuation. NPS holds more than 5% stakes in 270 stocks, among which 23 have valuations exceeding 1 trillion won.

Likely Sold Some Shares... Even Selling Just 1% Would Yield Over 100 Billion Won in Gains

The maximum 900 billion won increase in valuation assumes that NPS has not sold any of its holdings since the management rights dispute began. However, the market believes that NPS likely realized some profits by selling part of its Korea Zinc shares. An investment banking (IB) industry insider said, "NPS's stock management is roughly half direct investment and half entrusted investment," adding, "Even if direct investments were untouched, it is highly likely that entrusted investment shares were sold during this dispute period." Entrusted asset managers handle the shares independently without NPS's involvement and are responsible for selling if prices rise or fall sharply.

As of the latest disclosure, NPS's stake in Korea Zinc is 7.83%. Considering only the entrusted investment portion, which accounts for about half, the stake is approximately 4%. If some shares are sold at the current market price, selling 1% of shares (209,085 shares) would generate enormous gains exceeding 100 billion won. Considering the average purchase price of NPS's Korea Zinc shares was estimated to be below 500,000 won, the current price is more than double.

According to the Financial Supervisory Service's electronic disclosure system, NPS did not sell Korea Zinc shares on the market at least during September. Currently, NPS's purpose for holding Korea Zinc shares is 'simple investment.' According to disclosure obligations, if there is a change in shares held for simple investment, it must be reported within 10 days of the following month of the quarter in which the change occurred. If shares were sold in September, disclosure should have been made between October 1 and 10. However, no such disclosure was made during this period. If shares were sold in October, disclosure would be made between January 1 and 10 of the following year, the next quarter (October to December). Therefore, whether NPS has sold shares cannot be determined from disclosures for the time being.

'Casting Vote' Role Emerging for the National Pension Service

The National Pension Service is also drawing attention as the 'casting vote' in the ongoing Korea Zinc management rights dispute. This is because it is estimated to hold a stake of over 4%, enough to influence the outcome even if some shares were sold. The gap in shareholding between the two disputing parties?the side of Chairman Choi Yoon-beom of Korea Zinc and the MBK-Young Poong alliance?is only about 2 percentage points, and neither side holds an absolute majority. According to a 'Public Perception Survey on the Korea Zinc Management Rights Incident' recently released by Realmeter at the request of a media outlet, 72.3% of respondents said that "NPS should exercise its voting rights."

If NPS exercises its voting rights, the Korea Zinc agenda is likely to be referred to the Stewardship Responsibility Committee (SRC) because it is a sensitive issue with sharply opposing positions. Normally, voting rights are decided by the Fund Management Headquarters, but if it is difficult to make an independent judgment or if more than one-third of SRC members request it, the SRC decides the voting rights. Some argue that because NPS has supported over 90% of the proposals at Korea Zinc shareholders' meetings over the past five years, it might currently be siding with the management. However, NPS's shareholder meeting opposition rate barely exceeds 10% annually across all companies, so attributing significant meaning to past voting behavior is considered an exaggerated interpretation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.