August 30 KOSDAQ Listing at an IPO Price of 32,000 KRW

Price Falls Back Without Recovering IPO Price After Listing

Challenge to Prove Growth Potential Through AI Textbook Business

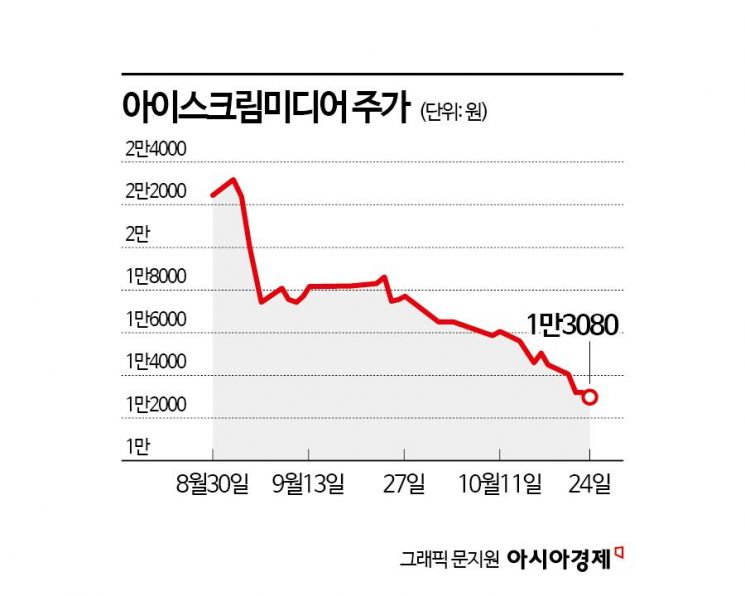

Icecream Media, which was listed on the KOSDAQ market on August 30, has been hitting new lows day after day. Amid controversy over the overvaluation of the IPO price even before listing, the stock price has not recovered since the listing.

According to the financial investment industry on the 25th, Icecream Media's stock price fell 59.1% compared to the IPO price just two months after listing. The stock hit a new low during the trading session the previous day, dropping to 12,930 KRW.

Founded in 2002, Icecream Media is a digital education platform company. It owns the digital multimedia education content archive 'EduBank AI' and provides over 160 digital teaching tools and software. The country's first digital education platform, 'Icecream S,' occupies more than 93% of elementary classrooms. It also operates 'HiClass,' the number one app for school communication used by 4 million parents and students.

Demand forecasting to determine the IPO price before listing showed low competition. From August 9 to 16, over five business days, demand forecasting was conducted targeting institutional investors, recording a competition rate of 31 to 1. The lead underwriter, Samsung Securities, initially proposed an IPO price range of 32,000 to 40,200 KRW but finalized the IPO price at 32,000 KRW. The subscription for general investors also failed to attract enthusiasm, recording a competition rate of 12 to 1.

Icecream Media traded below the IPO price even on the day of listing. It started trading at 29,700 KRW, rose to 31,700 KRW, but closed at 22,500 KRW. Since listing, Icecream Media has not recovered the IPO price and has been declining continuously. Consequently, on September 4, it signed a trust contract with Shinhan Investment Corp. to acquire treasury stocks. The board resolved to purchase treasury stocks worth 5 billion KRW to stabilize the stock price.

As Icecream Media's stock price continues to fall, controversy over the overvaluation of the IPO price persists. Samsung Securities selected two comparable companies, Samsung Publishing and Chegg. Applying an average price-to-earnings ratio (PER) of 21.5 times, they calculated a per-share valuation of 44,374 KRW. There are criticisms that a relatively high PER was applied compared to other education-related listed companies in the domestic stock market.

For Icecream Media to escape the controversy over IPO price overvaluation and for its stock price to rebound, it ultimately depends on expanding profit size. In the first half of this year, it recorded cumulative sales of 60.9 billion KRW and operating profit of 11.3 billion KRW. Last year, it achieved sales of 123.1 billion KRW and operating profit of 34 billion KRW. If it can prove that profits can increase, a stock price rebound seems possible.

Researcher Cho Jeong-hyun of Hana Securities expressed, "Icecream Media is expected to enter a growth phase in performance as it enters the artificial intelligence (AI) digital textbook market. He emphasized, "The pricing of AI digital textbooks is about 90,000 KRW, which is more than 10 times the current average price of Icecream Media's textbooks at 9,000 KRW," and added, "We expect stepwise growth following the opening of the AI digital textbook market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)