Export Amount of 48 Trillion KRW in Q1-Q3

Expansion of Exports to Australia and Japan

Petroleum product exports in the refining industry recorded an all-time high through the third quarter.

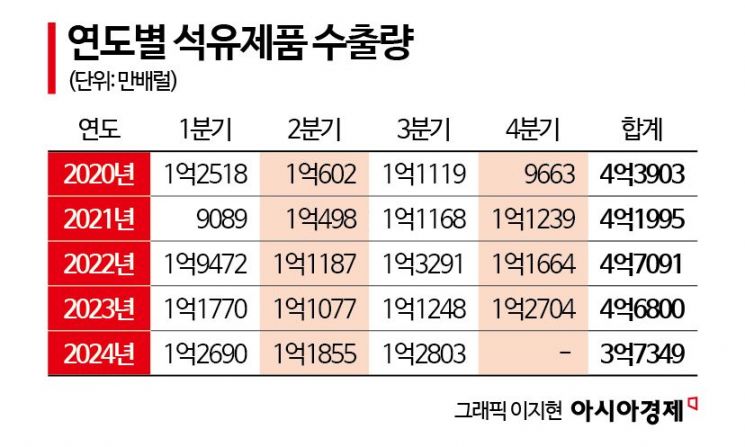

The Korea Petroleum Association announced on the 24th that the export volume of petroleum products from domestic refiners such as SK Energy, GS Caltex, S-OIL, and HD Hyundai Oilbank from the first to third quarters totaled 373.49 million barrels, a 9.5% increase compared to the same period last year. This surpassed the record set in 2018 (366 million barrels) for the first time in six years.

The export value of petroleum products reached approximately $35.15 billion, a 4.4% increase from the same period last year, equivalent to about 48 trillion KRW, ranking third among the country's major export items after semiconductors and automobiles, moving up one position compared to last year.

The largest export item was diesel, accounting for 41.1% of total exports, followed by gasoline at 22.6%, jet fuel at 18.3%, and naphtha at 8.4%.

Although global economic slowdown dampened oil demand, exports expanded to countries with some demand growth factors such as Australia and Japan.

Australia has been the largest export destination over the past three years. Amid a sharp decline in refining capacity, Australia has expanded new diesel storage facilities totaling 780 million liters from 2021 through the first half of this year to enhance energy security, and increased the mandatory diesel stockpiling days from 20 to 28, leading to increased diesel demand.

This year, diesel accounted for 67% of domestic refiners' exports to Australia, with diesel export volume increasing by more than 10%.

Gasoline exports to Japan, the third largest export destination, increased by 45%. Japan has seen a decline in gasoline production due to reduced internal combustion engine vehicle production and a preference for hybrid vehicles, and recorded low operating rates this summer due to regular refinery maintenance.

With the weak yen attracting a record number of tourists and a shortage of gasoline, imported gasoline has been used as a substitute, resulting in Korean gasoline holding an 81% market share in Japan's gasoline import market.

However, the association explained that despite the increase in exports, export profitability declined by about 35% year-on-year to $9.3 per barrel due to weak global refining margins, with a particularly sharp 72% drop in the third quarter.

An association official stated, "The domestic petroleum industry is an export-oriented industry with a higher export ratio than domestic consumption, and we are actively working to develop new export markets," adding, "We will continue to contribute to the national economy through sustained export expansion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.