Q3 Real GDP Growth Rate at 0.1%

Domestic Demand Recovers but Export Growth Slows

Growth Deceleration for Second Quarter, Annual Growth Forecast May Be Revised Downward

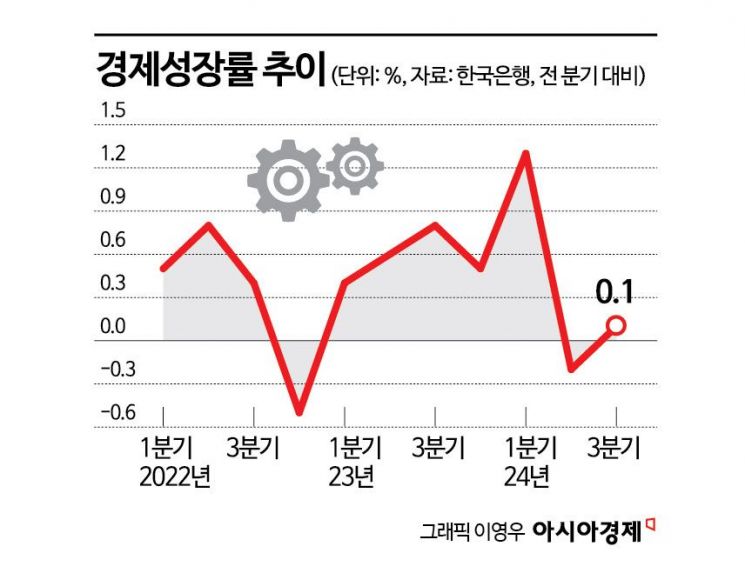

In the third quarter, South Korea's economic growth rate recorded a disappointing 0.1%, falling short of expectations. Exports, which had been driving the economy, retreated, leading to a slowdown in growth for the second consecutive quarter. The forecast for this year's economic growth rate is also likely to be revised downward.

On the 24th, the Bank of Korea announced that the preliminary real Gross Domestic Product (GDP) growth rate for the third quarter was 0.1% quarter-on-quarter. Although it turned positive from -0.2% in the second quarter, the recovery was minimal. It also fell significantly short of the Bank of Korea's initial forecast of 0.5%.

The slowdown in export growth had a major impact on the deceleration of the growth rate. By sector, exports decreased by 0.4%, mainly in automobiles and chemical products. Construction investment also declined by 2.8% due to sluggish building and civil engineering construction.

On the other hand, imports increased by 1.5%, mainly in machinery and equipment, and private consumption grew by 0.5%, rising in both goods such as passenger cars and communication devices, and services including medical and transportation sectors.

Facility investment also increased by 6.9%, centered on machinery such as semiconductor manufacturing equipment and transportation equipment like aircraft. Government consumption rose by 0.6%, influenced by social security benefits such as health insurance payments.

Looking at the contribution to the third quarter growth rate by sector, net exports (exports minus imports) recorded -0.8 percentage points. Export sluggishness is the biggest cause of the slowdown in the growth rate.

According to the Ministry of Trade, Industry and Energy, South Korea's exports in the third quarter showed an increase compared to the previous year, but the growth rate is slowing. In particular, the export growth rates of major items such as automobiles, chemical products, and semiconductors have recently decelerated.

Shin Seung-chul, Director of the Economic Statistics Bureau at the Bank of Korea, explained, "In the third quarter, exports of automobiles and secondary batteries were sluggish due to the Korea GM strike and the electric vehicle chasm (temporary demand stagnation), and the growth rate of IT exports such as semiconductors was lower than in the second quarter, causing the economic growth rate to fall short of expectations."

On the morning of the 24th, a briefing on the preliminary real Gross Domestic Product (GDP) for the third quarter of 2024 was held at the Bank of Korea in Jung-gu, Seoul. From the left in the photo: Park Chang-hyun, Head of the National Income Expenditure Team; Shin Seung-chul, Director of the Economic Statistics Bureau; Jang Eun-jong, Head of the National Income General Team; and Lee Ji-hyun, Manager of the National Income General Team. (Photo by Bank of Korea)

On the morning of the 24th, a briefing on the preliminary real Gross Domestic Product (GDP) for the third quarter of 2024 was held at the Bank of Korea in Jung-gu, Seoul. From the left in the photo: Park Chang-hyun, Head of the National Income Expenditure Team; Shin Seung-chul, Director of the Economic Statistics Bureau; Jang Eun-jong, Head of the National Income General Team; and Lee Ji-hyun, Manager of the National Income General Team. (Photo by Bank of Korea)

On the other hand, domestic demand, which had been a major concern, boosted the growth rate by 0.9 percentage points. The contribution by detailed items within domestic demand was 0.6 percentage points from facility investment, 0.2 percentage points from private consumption, and 0.1 percentage points from government consumption. Construction investment remained sluggish with -0.4 percentage points.

Director Shin said, "Private consumption is expected to show a gradual improvement in the fourth quarter as well, following the third quarter, with recent improvements in consumer sentiment indices. Facility investment is also improving, but construction investment is expected to remain weak in the fourth quarter."

By industry, electricity, gas, and water supply grew by 5.1%, centered on electric power companies, while agriculture, forestry, and fisheries and manufacturing increased by 3.4% and 0.2%, respectively. In the service sector, although wholesale and retail trade and accommodation and food services declined, the sector grew by 0.2% due to strong performance in medical, health, social welfare services, and transportation. However, construction decreased by 0.7%, mainly in building construction.

With the third quarter economic growth rate falling short of expectations, the Bank of Korea's annual economic growth forecast is also likely to be revised downward. The Bank of Korea had expected the South Korean economy to grow by 2.4% this year, but there is a possibility of a slight downward revision in the economic outlook to be announced next month.

A Bank of Korea official said, "As uncertainty related to the annual growth rate increases, we plan to closely examine the pace of domestic demand recovery, major countries' economies and IT cycles, and changes in global trade conditions, and announce related details in the November economic outlook. Under the current circumstances, there is a possibility that the annual growth rate forecast will be adjusted."

Kang In-soo, a professor in the Department of Economics at Sookmyung Women's University, said, "Exports may improve slightly in the fourth quarter, but the overall export sentiment does not look favorable. With significant uncertainty surrounding the U.S. presidential election, South Korea's exports could also be negatively affected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.