E-commerce Companies Move Away from Major Seoul Areas

New Lease Contracts Slow as Rent Increases

In the third quarter of this year, the vacancy rate of prime offices in Seoul increased, with clear differences emerging by industry. Luxury and cosmetics brands expanded their presence, while e-commerce companies withdrew from the three main zones (downtown area, Gangnam area, Yeouido area). This trend is expected to continue for the time being as consumers increase offline purchases following the COVID-19 endemic phase.

According to Savills Korea, a global real estate services firm, Louis Vuitton Korea, located in Signature Tower in Jung-gu, Seoul, expanded its leased area in the third quarter of this year. The cosmetics brand Vinau, which settled in GT Tower in Seocho-gu, also increased its space. This is a notable expansion case amid a 0.7 percentage point and 0.3 percentage point increase in vacancy rates in the downtown and Gangnam areas around Gwanghwamun and City Hall compared to the previous quarter.

However, the situation in the e-commerce market was different. 11st, which was located in Seoul Square in Jung-gu, downtown Seoul, moved to U Planet Tower in Gwangmyeong, Gyeonggi Province. Interpark, which was in an office building in Samseong-dong, Gangnam area, relocated to a new office in the 2nd Pangyo Techno Valley in Gyeonggi Province.

The withdrawal of e-commerce companies from the three main zones is expected to continue until the first half of next year. As the growth of the industry slows, these companies are moving to relatively cheaper rental areas to improve financial soundness and secure liquidity. SSG.com, which moved to Centerfield in Gangnam-gu in 2022, is reportedly planning to relocate its office to KB Yeongdeungpo Tower in Yeongdeungpo-gu in the first quarter of next year.

A representative from Savills Korea said, "Not only the COVID-19 endemic but also incidents like the Timf scandal and the entry of Chinese e-commerce companies such as Taemu into the domestic market have had an impact," adding, "It seems to reflect the weakened business performance of domestic e-commerce companies."

In the downtown area, the vacancy rate is expected to rise slightly in the fourth quarter. Seoul Square, which 11st left, is currently conducting rental marketing. The shared office WeWork Euljiro branch, which occupied five floors in Daeshin Finance Center in Jung-gu, is also expected to terminate its contract in the fourth quarter.

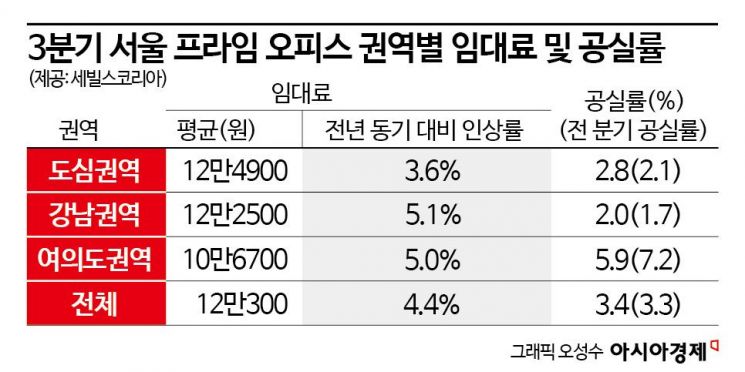

The problem is that rising rents and management fees are hindering new lease contracts. The average rent for offices in major Seoul zones was 120,300 KRW per 3.3㎡, up 4.4% compared to the same period last year. The downtown area was the most expensive at 124,900 KRW per 3.3㎡. The Gangnam and Yeouido areas were recorded at 122,500 KRW and 106,700 KRW per 3.3㎡, respectively. Management fees increased by 2.2% compared to a year ago, reaching 46,400 KRW per 3.3㎡ across Seoul.

A Savills Korea representative said, "Although the landlord-favored market with insufficient supply continues and the vacancy rate is not generally high, it is equally difficult for new tenants to enter the prime office market," adding, "The overall weakening of rental demand is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.