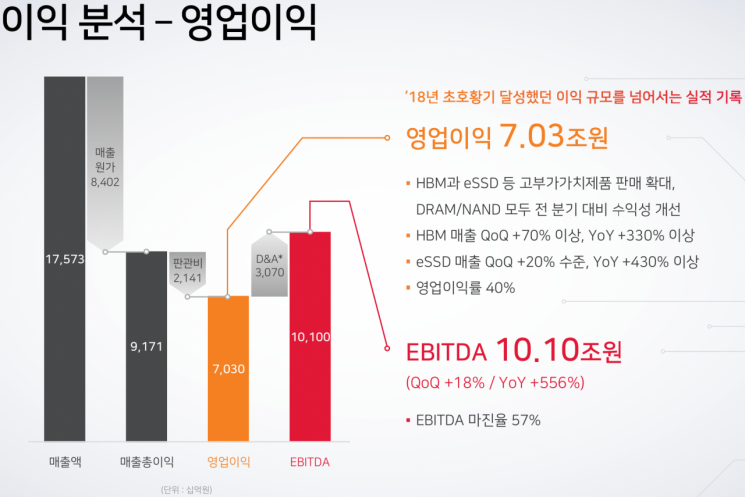

Q3 Revenue 17.5731 Trillion KRW, Operating Profit 7.03 Trillion KRW

Expansion of High-Value Products Sales Including HBM and eSSD

SK Hynix recorded its highest-ever sales and operating profit since its founding, driven by strong performance in high-bandwidth memory (HBM). It is expected to surpass Samsung Electronics' results as the market anticipated.

On the 24th, SK Hynix announced that it achieved sales of KRW 17.5731 trillion and an operating profit of KRW 7.03 trillion in the third quarter of this year.

The operating profit surpassed the previous record set in the third quarter of 2018 (KRW 6.4724 trillion). Following the second quarter of this year (KRW 5.4685 trillion), when it exceeded KRW 5 trillion for the first time in six years, it broke the all-time record. The operating profit margin reached 40%. Sales exceeded not only the semiconductor 'super cycle' period in the second quarter of 2018 (KRW 13.811 trillion) but also the highest record set in the second quarter of this year (KRW 16.4233 trillion).

Samsung Electronics' preliminary operating profit for the third quarter was KRW 9.1 trillion, with the semiconductor division's operating profit estimated between KRW 4 trillion and KRW 4.4 trillion. Accordingly, SK Hynix's operating profit is estimated to have significantly outpaced Samsung Electronics.

The main driver behind SK Hynix's strong performance was HBM. The demand for AI semiconductors surged rapidly, leading to a sharp increase in demand for AI accelerators and HBM.

SK Hynix explained, "Strong AI memory demand centered on data center customers continued, and in response, the company expanded sales of high value-added products such as HBM and enterprise solid-state drives (eSSD), achieving the highest sales since its founding. In particular, HBM sales showed outstanding growth, increasing by more than 70% compared to the previous quarter and more than 330% compared to the same period last year." The company also stated, "Sales of high value-added products with high profitability increased, raising the average selling price of both DRAM and NAND by the mid-teens percentage compared to the previous quarter, enabling us to achieve the highest operating profit in history."

SK Hynix has virtually monopolized the supply of 4th generation HBM (HBM3) and, in March, became the first memory company to start delivering the 5th generation HBM, HBM3E 8-stack products. At the end of last month, it announced the development of the world's first HBM3E 12-stack product, further solidifying its market leadership. The development of the 12-stack product was faster than Samsung and Micron, and mass production and delivery to Nvidia are expected to be quicker as well.

It is also encouraging that NAND flash recorded profits for three consecutive quarters. NAND had posted losses for six consecutive quarters from the third quarter of 2022 through the fourth quarter of last year. However, NAND prices, which had been stable for six months since March, fell by 11.44% at the end of September compared to the previous month, making it uncertain whether stability will continue into the fourth quarter.

According to market research firm DRAMeXchange's announcement at the end of last month, the fixed transaction price for general-purpose NAND products (128Gb 16Gx8 MLC) was $4.34, down from $4.90 between March and August. In terms of third-quarter sales composition, DRAM and NAND flash accounted for 69% and 28%, respectively.

Kim Woo-hyun, Vice President (CFO) of SK Hynix, said, "By achieving the highest management performance ever, we have solidified our position as the global number one AI memory company. Going forward, we will flexibly adjust our product and supply strategies according to market demand to secure stable sales while maximizing profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.