Office Chief Kwon Daeyoung Presides Over 'Household Debt Review Meeting'

Aimed at Preemptively Blocking Balloon Effects Due to Strengthened Bank Household Loan Management

Office Chief Kwon: "Considering Various Management Measures to Prepare for Increasing Balloon Effects"

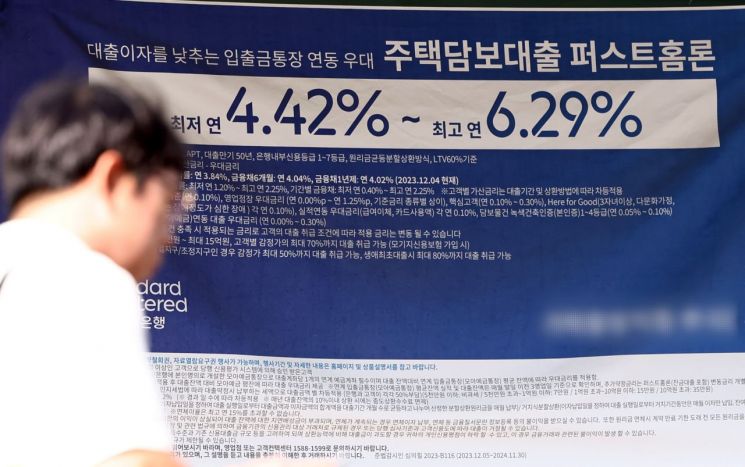

The financial authorities convened the secondary financial sector, regional banks, and internet banks, urging them to thoroughly manage their operations to prevent excessive competition or over-lending, as they have been exhibiting aggressive sales behaviors inconsistent with the policy to strengthen household debt management. This measure aims to preempt the so-called "balloon effect," where demand shifts to the secondary financial sector and regional banks as the banking sector raises the threshold for household loans.

On the 23rd, the Financial Services Commission announced that it held a "Household Debt Inspection Meeting" chaired by Secretary-General Kwon Dae-young. The meeting was organized to monitor and manage the increasing trend of household loans in the insurance sector, credit finance sector, savings banks, mutual finance sector, as well as regional banks and internet banks. Attendees included related government ministries such as the Ministry of Economy and Finance and the Ministry of the Interior and Safety, all financial sector associations, regional banks (Busan, Daegu, Gyeongnam), and the three internet banks.

Secretary-General Kwon Dae-young stated, "The financial authorities are consistently and firmly striving to stabilize the household debt ratio relative to Gross Domestic Product (GDP) and to establish a loan practice of borrowing (lending) within the Debt Service Ratio (DSR) limits and repaying in installments from the outset." He pointed out, "It is somewhat problematic that the secondary financial sector, including insurance and mutual finance, regional banks, and internet banks are showing aggressive sales behaviors that do not align with the policy to strengthen household debt management."

He emphasized, "I hope that frontline branches will thoroughly manage to prevent excessive competition centered on mortgage loans or over-lending beyond repayment capacity."

In response, the attendees clearly acknowledged that with the global benchmark interest rate pivot underway?such as the Federal Reserve's big cut in the base rate and the Bank of Korea's base rate reduction?the pressure for household debt increase is accumulating, and this is not the time to relax vigilance.

The attendees especially expressed concern that housing purchase demand could spread again due to market expectations of further interest rate cuts, and that even slight negligence in household debt management could lead to an expansion of the increasing trend at any time. They agreed on the significant need to maintain the current strict management stance until the downward stabilization trend of the household debt ratio is firmly established.

Furthermore, Secretary-General Kwon mentioned that various measures to block the balloon effect are under review and urged each sector to focus on their inherent roles. He explained, "We are closely monitoring household debt trends in each sector and are reviewing various management measures in preparation for an increase in the balloon effect." Although bank household loans increased by 5.2 trillion won in September, which is about half the increase compared to August, Saemaeul Geumgo increased by 200 billion won and insurance companies by 400 billion won, showing a clear rise compared to the previous month.

He added, "Since the roles assigned to each sector differ slightly, internet banks and the secondary financial sector need to focus more on their inherent roles, such as supplying funds to diverse financial needs or to medium- and low-credit borrowers, rather than concentrating on easy sales mainly centered on mortgage loans that are fulfilled by the banking sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.