US 2-Year Treasury Yield Rises 34bp After September FOMC

Similar to 1995 When Greenspan Achieved Soft Landing

US Economy Expected to Avoid Recession Beyond Soft Landing

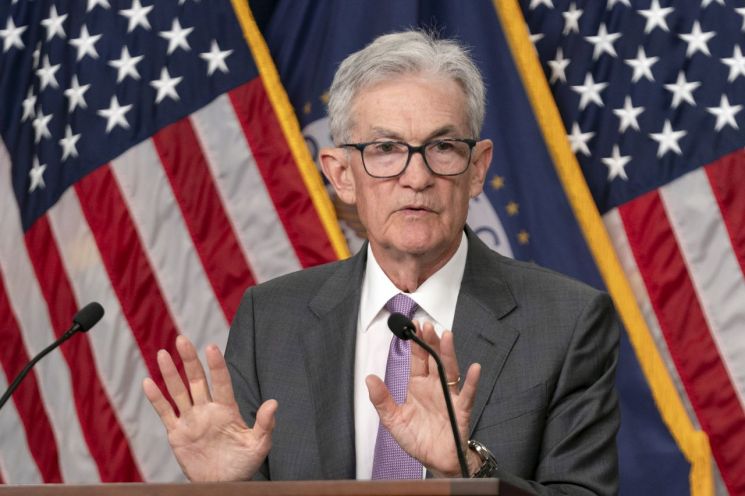

After the U.S. Federal Reserve (Fed) initiated a rate-cutting cycle, an unusual phenomenon has emerged where Treasury yields have instead surged. This is based on the outlook that the U.S. economy could succeed in a 'no landing' scenario, sustaining growth beyond a soft landing. Expectations are rising that Fed Chair Jerome Powell could replicate the 1995 'Greenspan masterpiece,' when the U.S. avoided recession during one of the six rate-cutting cycles since 1989.

According to the global bond market as of 3:27 p.m. local time on the 22nd, the 2-year U.S. Treasury yield stood at 4.03%, and the 10-year yield was around 4.2%. It is the first time in three months that the 10-year yield has surpassed 4.2%.

Bloomberg reported that after the Fed began its monetary easing policy by lowering the benchmark rate to 4.75-5.0% at the Federal Open Market Committee (FOMC) meeting on the 18th of last month, the 2-year Treasury yield rose by 34 basis points (bp) over about a month (23 trading days), and the 10-year yield increased by 40 bp. Historically, during the six monetary easing cycles since 1989, the 2-year Treasury yield typically fell by an average of 15 bp within a month after rate cuts began, as expectations of further rate cuts pushed bond yields down. However, this time, the opposite phenomenon of rising Treasury yields is occurring.

This is analyzed to be due to the U.S. economy showing robust growth contrary to concerns, leading to expectations that the Fed will slow the pace of rate cuts. Labor market and consumer data have proven stronger than expected, and some even mention a no-landing scenario. According to the U.S. Department of Labor, nonfarm payrolls in September increased by 254,000, marking the largest gain in six months. This exceeded both the market forecast of 147,000 and the August figure of 159,000. Additionally, retail sales in September rose by 0.4% month-over-month, surpassing the expected 0.3%. Consequently, expectations have spread that the Fed, which cut rates by 0.5 percentage points last month, will slow the pace of future cuts.

Neil Kashkari, president of the Minneapolis Federal Reserve Bank and a known 'hawk' (favoring monetary tightening) within the Fed, also attended an event in Wisconsin the day before and said, "I expect a more gradual pace of rate cuts over the next few quarters to reach a neutral rate level," adding, "For the pace of rate cuts to accelerate, there must be substantial evidence that the labor market is weakening rapidly," signaling a moderation in the pace of rate cuts.

Market expectations for rate cuts have also significantly retreated. Currently, the interest rate futures market anticipates the Fed will cut rates by a total of 127 bp by September 2025. Just a month ago, the expectation was for a 195 bp cut, indicating a substantial reduction in the expected magnitude of rate cuts.

Bloomberg suggested that this easing cycle under Chair Powell could be a d?j? vu of 1995 when former Fed Chair Alan Greenspan successfully achieved a soft landing without recession despite rate cuts. Since 1989, among six rate-cutting cycles, the Fed avoided recession only twice?in 1995 and 1998. Greenspan aggressively raised rates in 1994 to combat inflation but began cutting rates in July 1995 amid recession concerns due to employment contraction, ultimately succeeding in a soft landing for the U.S. economy. At that time, the 2-year Treasury yield rose by 34 bp and the 10-year by 39 bp about a month after Greenspan started cutting rates in July 1995. This is similar to the rise in Treasury yields since Powell began the easing cycle last month.

Steven Zeng, a rates strategist at Deutsche Bank AG, said, "The rise in Treasury yields reflects a reduced risk of recession," and added, "Given the strong economic data, the Fed may slow the pace of rate cuts."

There is also analysis that the rise in U.S. Treasury yields partly reflects the 'Trump trade.' With the U.S. presidential election just two weeks away, increasing forecasts of former President Donald Trump, the Republican candidate, winning have led to rising bond yields. Trump has pledged high tariffs and large-scale tax cuts, raising concerns that these policies could lead to higher inflation and an expanded federal deficit, which would push interest rates higher.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.