Hyundai Mobis Shows Differentiated Stock Performance from Automakers

Structural Growth in A/S Business, Collaboration with GM Expected

"High Potential for Shareholder Returns... Discount Factors Likely to Ease"

Despite the market downturn, Hyundai Mobis's stock price remains resilient. Analysts in the securities industry suggest that the after-sales service (A/S) division's growing performance, potential collaboration with North American automakers, and expectations for shareholder returns will drive further price increases.

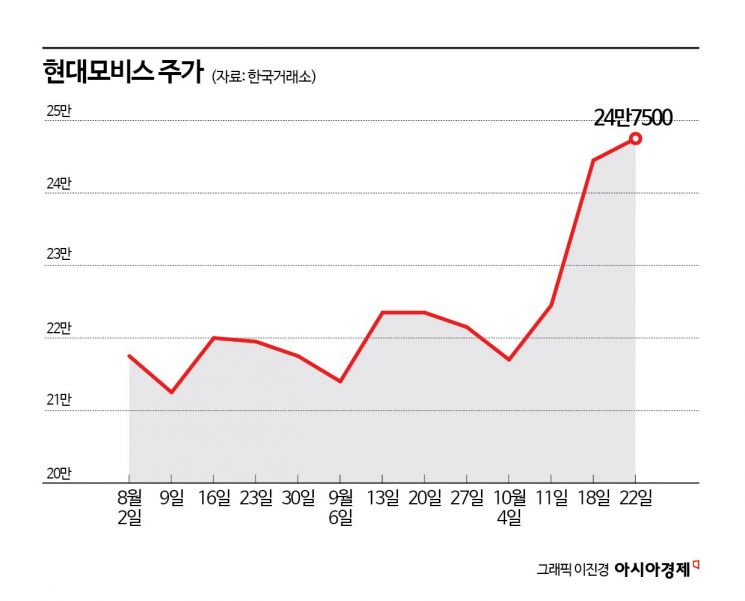

According to the Korea Exchange on the 23rd, Hyundai Mobis, an auto parts company, recorded a closing price of 247,500 KRW as of the previous day, marking a 13.79% increase this month. This contrasts with the declines of 3.89% and 7.41% for automakers Hyundai Motor Company and Kia, respectively, during the same period.

The divergence between the stock prices of automakers and parts suppliers is interpreted as stemming from differing earnings expectations. Above all, the A/S division, which serves as Hyundai Mobis's cash cow, is structurally growing. Changho Kim, a researcher at Korea Investment & Securities, stated, "The A/S division, which already achieves a high profitability of 22%, is expected to further expand its profitability. Particularly, since the brand value of Hyundai and Kia in the U.S. has significantly increased since 2021, and A/S demand arises after the initial three years of purchase, profitability improvements in the A/S division are expected to begin this year." He added, "Recently, new car sales in the U.S. have stagnated, which means existing vehicles are being used longer. As the proportion of aging vehicles increases, the likelihood of A/S parts replacement also rises."

Kim also explained that the popularization of sport utility vehicles (SUVs) will contribute to profitability expansion. He said, "A/S demand for key SUVs such as Hyundai's Palisade and Kia's Telluride will continue. Currently, strong sales of core SUV models are ongoing, creating an environment for stable growth. Higher-priced vehicles like SUVs tend to have a greater proportion of genuine parts usage, which raises the average selling price (ASP) of replacement parts, enabling profitability expansion."

Concerns remain about the electrification division's performance due to the slowdown in the electric vehicle (EV) market, but there are also forecasts that high growth in electrification sales will begin with the supply of EV parts to North American automakers. Eunyoung Lim, a researcher at Samsung Securities, noted, "General Motors (GM) produces electric vehicles based on internal combustion engine platforms without an EV platform, so there has been no progress in integrating electronic control units (ECUs). Therefore, it is highly likely that GM will license hybrid and EV platform technology from Hyundai Motor Company and naturally procure battery systems (BSA) and power electronics (PE) from Hyundai Mobis." She continued, "GM, which must compete with Tesla in the North American market, urgently needs cost competitiveness. Given its software technology is inferior to Tesla's, failure to secure price competitiveness will likely determine the outcome. In this context, Hyundai Mobis can secure GM as a new customer for electrification parts, improving its operating rate."

Expectations that shareholder return policies may be strengthened at the CEO Investor Day scheduled for the 19th of next month are also seen as a positive factor for the stock price. Yoonchul Shin, a researcher at Kiwoom Securities, said, "Hyundai Mobis will likely use Hyundai Motor Company, which most recently held a CEO Investor Day within the Hyundai Motor Group, as a reference. This could introduce the concept of total shareholder return (TSR) into Hyundai Mobis's shareholder return policy and raise the medium-term TSR target to at least 20%." He added, "This will largely resolve investors' questions about Hyundai Mobis's historically underwhelming performance compared to automakers from a governance perspective. Gradual easing of governance-related discount factors is expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)