The price of gold, considered a representative safe-haven asset, continues its rally by breaking record highs day after day. This is a result of heightened uncertainty due to the U.S. presidential election just two weeks away and geopolitical risks stemming from the Middle East. Even the sharp rise in Treasury yields and a strong dollar have not been able to halt the gold price rally. Silver prices also rose in tandem, reaching their highest level in 12 years.

On the 21st (local time) at the New York Commodity Exchange (COMEX), the December gold contract closed at $2,738.90 per ounce, up 0.32% from the previous session. During the session, it briefly surpassed the $2,750 mark. This marks the fifth consecutive day of gains. In the spot market, gold initially reached $2,740.37 per ounce but later retreated to the $2,720 range amid the impact of rising Treasury yields.

Typically, when Treasury yields rise or the dollar strengthens, gold demand tends to decrease, causing prices to fall, but this rally itself has not been stopped. Solita Marcelli, Chief Investment Officer (CIO) of UBS Americas, evaluated, "Despite the recent rally, gold's hedge characteristics remain attractive."

The recent gold price rally is primarily attributed to the worsening situation in the Middle East and uncertainties surrounding the U.S. presidential election. The interest rate cuts by major countries that began in earnest this year and record gold purchases by central banks have also played a significant role in pushing gold prices higher. CNBC reported, "Gold bar prices have risen more than 31% this year, repeatedly hitting record highs," adding, "This is thanks to a perfect storm for gold, from the Federal Reserve's rate cuts to safe-haven demand."

According to the World Gold Council, funds flowing into gold exchange-traded funds (ETFs) have increased for three consecutive months. Gold is classified as a representative refuge during times of market uncertainty and as an investment asset that can yield higher returns during periods of falling interest rates. Rona O’Connell of StoneX explained, "Gold prices rise when uncertainty is severe," adding, "Market anxiety is increasing as medium-term external policy uncertainty grows following the U.S. election results."

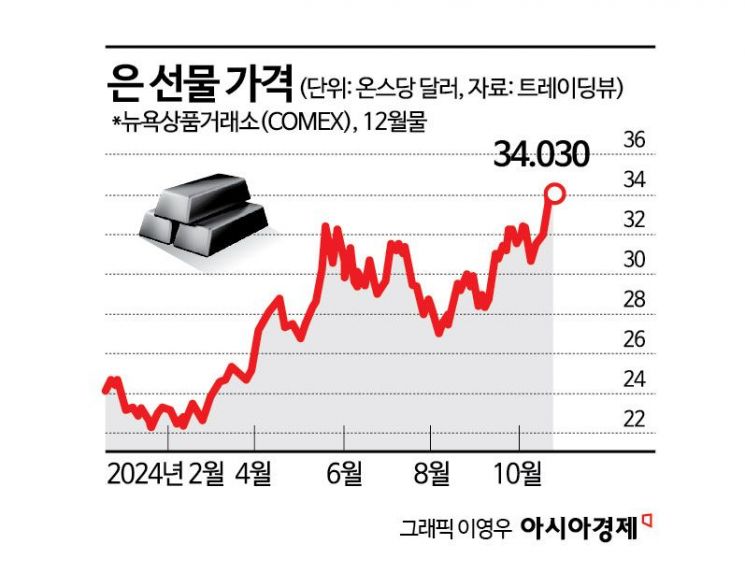

Silver prices are also rising in tandem. On this day, silver futures rose more than 3% during the session, surpassing the $34 per ounce mark. This is the highest level since late 2012. JP Morgan stated, "Silver is undervalued compared to gold," and predicted that silver prices could rise to $45 per ounce in the future.

Citigroup Research also raised its price forecasts for gold and silver in a report released on the same day. The 3-month gold price forecast was raised from $2,700 to $2,800 per ounce, and the 6-12 month gold price forecast was set at $3,000. Along with this, the 6-12 month silver price forecast was revised upward from $38 to $40. The report noted, "Despite weakening physical retail demand in China, gold and silver are showing very strong performance," citing the worsening U.S. labor market, additional Fed rate cuts, and purchases of physical gold and ETFs as reasons for the upward revisions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.