IT Industry Foreign Reports

"Heated Arguments During Executive Meeting Between Two Companies"

NVIDIA Raises Possibility of Changes in Contract Manufacturing

Focus on Samsung Electronics' Review

"Urgent Completion Needed for Taylor Plant"

There are forecasts that cracks may form in the relationship between Nvidia and TSMC, which has appeared solid through a close partnership over the past 30 years, drawing attention to whether this will affect the interests of Korean semiconductor companies such as Samsung Electronics and SK Hynix.

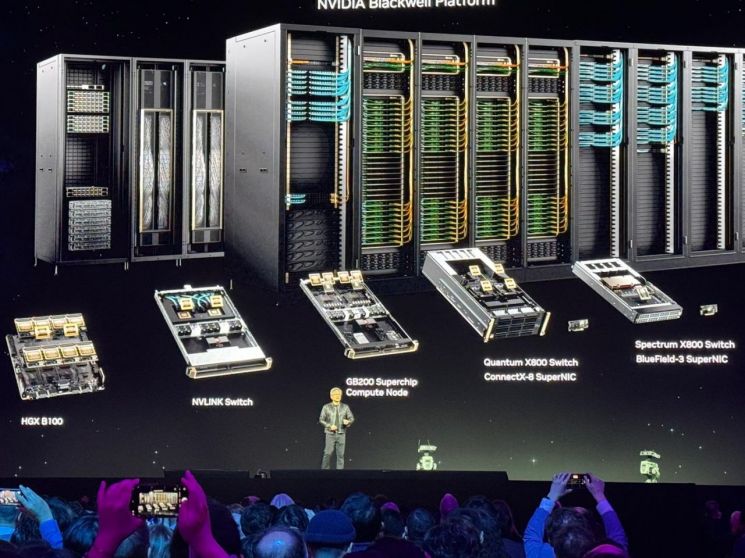

Jensen Huang, CEO of NVIDIA, explaining the next-generation AI chip Blackwell

Jensen Huang, CEO of NVIDIA, explaining the next-generation AI chip Blackwell [Image source=Yonhap News]

According to foreign media and industry sources on the 18th, Nvidia and TSMC have recently shown differences in stance regarding the production of the next-generation artificial intelligence (AI) chip Blackwell, leading to a tense situation. The IT specialized media The Information reported, "The two companies engaged in a blame game over defects found in Blackwell." Originally, Nvidia planned to officially launch Blackwell within this year, but the schedule was delayed due to defects discovered during the production process. Nvidia pointed out that there was a problem with TSMC's process after defects were found in prototypes made by TSMC during product testing. TSMC countered by saying that the problem existed from the design stage by Nvidia. It is reported that loud arguments even occurred among senior executives, including Jensen Huang, Nvidia CEO, and C.C. Wei, TSMC CEO, due to this issue. The Information added, "It could be a very minor issue, but there are also signs that Nvidia is trying to reduce its dependence on TSMC."

This is evaluated to reflect the recently changed dynamics. TSMC has grown its scale based on overwhelming influence secured in foundry (semiconductor contract manufacturing). Its net profit in the third quarter of this year reached 325.26 billion New Taiwan dollars (approximately 13.8 trillion KRW), a 54.2% increase compared to the same period last year, far exceeding the 300 billion New Taiwan dollars (about 12.7 trillion KRW) expected by market research firm LSEG. With generous support from the Taiwanese government and large-scale capital investment, it is continuously building factories worldwide. It started constructing its first European factory in Dresden, Germany, and has already begun reviewing plans for additional factory construction. In Arizona, USA, it built three factories with an investment of 65 billion USD (about 89 trillion KRW).

As news of a rift between the two companies spread, the industry is paying attention to whether Nvidia will consider Samsung Electronics as a rival to TSMC. There is speculation that Nvidia might distribute some of the production volume of the upcoming Blackwell to Samsung Electronics, potentially restructuring the contract manufacturing market, which TSMC has monopolized, into a competitive landscape.

It is reported that Nvidia has recently begun seeking cooperation with Samsung Electronics to create new gaming chips. If cooperation with Nvidia becomes possible, arguments for Samsung Electronics to expedite the completion of its foundry plant being built in Taylor, Texas, USA, are expected to gain more momentum. Having a factory in the US is advantageous for attracting customers. Recently, experts have advised that Samsung Electronics should quickly complete the Taylor plant, considering the impact of the upcoming US presidential election next month. The Korea Institute for Industrial Economics & Trade emphasized in its report titled ‘Impact and Response Directions of the Korean Industry by US Election Scenarios,’ published earlier this month, that "Compared to China’s SMIC and Taiwan’s TSMC, Samsung Electronics has lower geopolitical risks internationally, but as a comprehensive electronics company, it is still disadvantaged in securing advanced process foundry orders; therefore, securing local US customers and early completion and stabilization of local facilities is urgent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)