Conclusion Expected Around the 21st

MBK Currently Leads in Voting Rights

Temporary General Meeting Likely to Seize Board Control

Korea Zinc Has Capacity to Sell Treasury Shares

However, Immediate Sale Not Possible... Timing of General Meeting Is Key

The first hearing of the second provisional injunction lawsuit, which will determine whether to suspend the ongoing tender offer for treasury shares by Korea Zinc, was held on the morning of the 18th. It is expected to be a critical turning point that will decide the direction of the management rights dispute. Since Youngpoong and MBK Partners have become the largest shareholders through the tender offer, if the injunction is granted, they plan to take immediate actions to secure management rights, such as holding an extraordinary board meeting. Korea Zinc plans to complete the treasury share tender offer as scheduled, expecting the injunction to be dismissed as in the first case.

The Civil Division 50 of the Seoul Central District Court (Presiding Judge Kim Sang-hoon) held the first hearing of the provisional injunction lawsuit filed by MBK to halt the tender offer process and examined the treasury share purchase procedures.

MBK had applied for a provisional injunction to prohibit Korea Zinc from purchasing treasury shares last month, but after all were dismissed, they filed a second provisional injunction lawsuit earlier this month. The main issues are whether there was breach of trust and illegality in Korea Zinc’s treasury share purchase process, and the legality and scope of treasury share purchases related to discretionary reserves.

Korea Zinc counters that this injunction is merely a “repetition” of previously dismissed claims. Despite the court’s prior refusal to recognize any illegality in the treasury share purchases, MBK is increasing instability in the market and among investors regardless of the actual injunction outcome.

Since Korea Zinc’s treasury share tender offer is scheduled to end on the 23rd, the court is expected to reach a conclusion around the 21st, before the deadline.

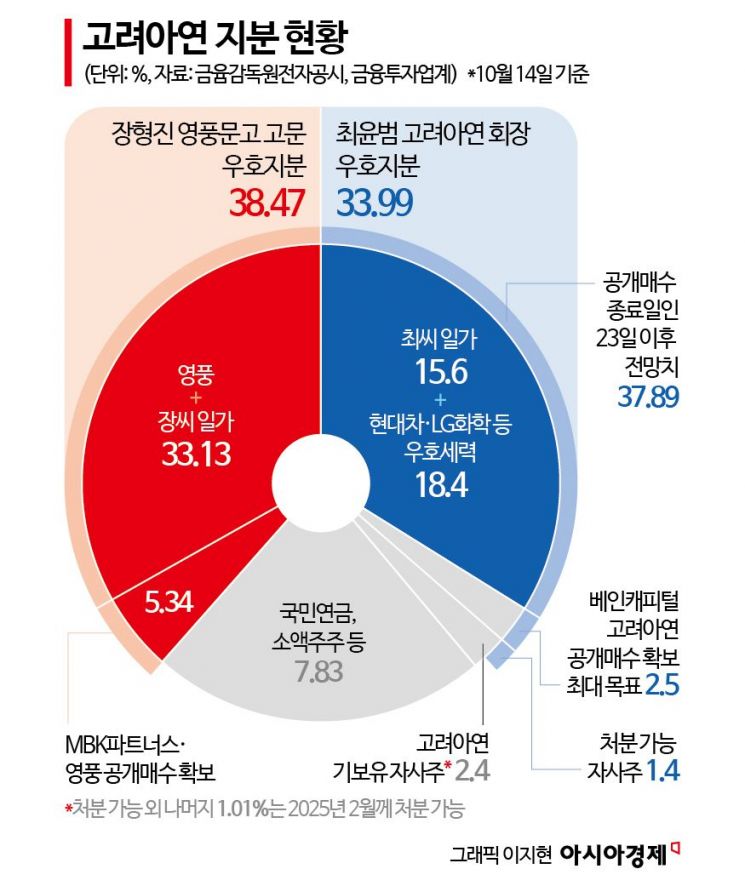

If the injunction is granted, Korea Zinc’s ongoing treasury share tender offer could be completely halted, but since the treasury shares are being purchased for cancellation without voting rights, it will not affect the shareholding structure. If the injunction is dismissed, MBK is likely to immediately hold an extraordinary shareholders’ meeting to attempt to seize control of the board. MBK has secured an additional 5.34% stake in Korea Zinc through the tender offer, bringing its total stake to 38.47%. Excluding treasury shares without voting rights, and assuming Bain Capital holds 2.5%, Chairman Choi’s faction, including friendly shares, holds 36.49%.

However, Korea Zinc is preparing a scenario to overturn this. In May and August, Korea Zinc signed two treasury share trust contracts worth 550 billion KRW, giving it the capacity to sell an additional 3.8% of treasury shares. Currently, treasury shares worth 150 billion KRW (1.4% stake) have been acquired, and the remaining 400 billion KRW worth of treasury shares (2.4% stake) are scheduled to be acquired by May next year, with about 1% of this already purchased. If all of this approximately 3.8% stake is sold, the shareholding advantage could be reversed. Although treasury shares themselves have no voting rights, selling them to friendly parties grants voting rights.

For treasury share purchases under trust contracts, there is a condition that sales are prohibited for six months from the contract date. The 1.4% stake acquired under the May contract can be disposed of next month, while the remaining 2.4% stake can only be sold in February next year. This is one of the reasons why Youngpoong and MBK are rushing to hold an extraordinary shareholders’ meeting.

The timing of the extraordinary shareholders’ meeting is also emerging as an important variable. MBK plans to proceed as quickly as possible to seize control of Korea Zinc’s board, but Korea Zinc is likely to refuse. If a legal dispute arises over whether to hold the shareholders’ meeting, the timing of the meeting is expected to be delayed. Earlier this year, when Youngpoong refused to hold the shareholders’ meeting of Seorin Corporation, Korea Zinc applied to the court for permission to convene the meeting. It took about three months for the meeting to actually be held in that case.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.