SV Inbe and Indonesia Near Formation of $100 Million Joint Fund

Attractive Indian and Indonesian Markets for 'Venture Capital'

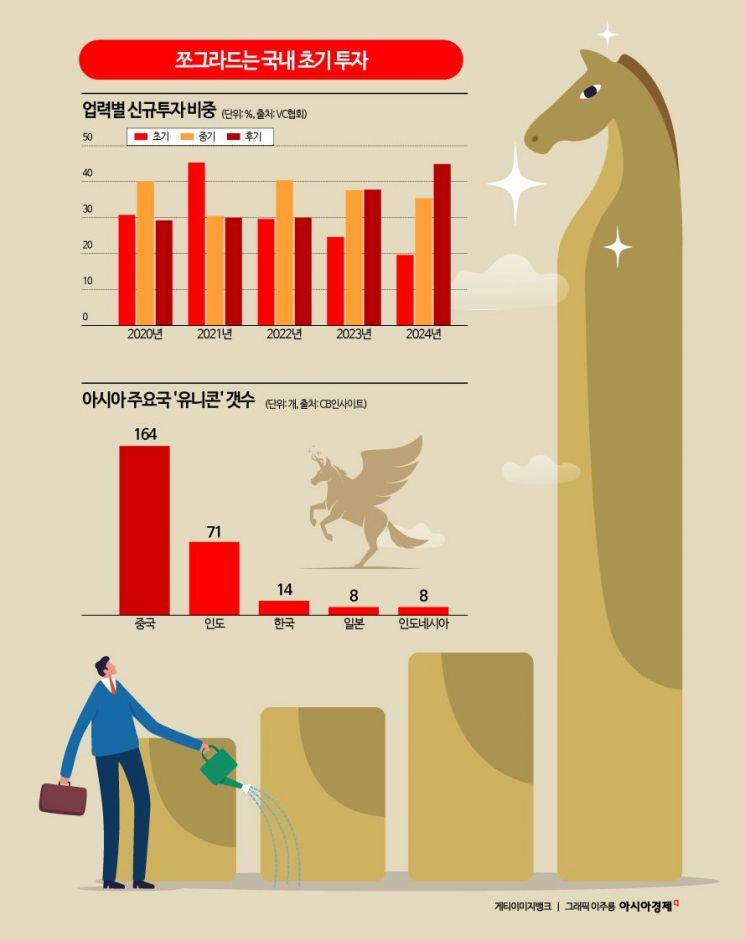

VCs 'Leaving Korea'... Declining Investment Share in Domestic Early-Stage Companies

Overseas expansion by domestic venture capital (VC) firms is diversifying. While previously focused on China and Japan, some VCs are now entering Indonesia and India. Overall, as the growth momentum of the domestic venture startup ecosystem weakens, there is a growing trend of turning attention overseas, which can be sensed in various places.

According to the VC industry on the 18th, SV Investment is on the verge of forming an offshore fund jointly managed with East Ventures, an Indonesian VC, with a size of around $100 million. This comes about a year after news of the fund formation was announced in June last year. East Ventures is the first VC established in Indonesia in 2009. After a year of investor recruitment, the fund formation is imminent. The first closing is expected to be completed at a slightly lower level than the initial target of $100 million. SV Investment is a large VC and a listed company managing assets in the trillion-won range. Another large listed VC, LB Investment, will attend Nexicon held in Bali, Indonesia, from the 23rd to the 25th. It is Indonesia's largest annual VC event. LB Investment, which has not yet entered Indonesia, is exploring opportunities while building local networks.

Overseas Expansion Trend Shifts from China to Japan, India and Indonesia Also Emerging as 'Lands of Hope'

In the past, domestic VCs' expansion into Asia was centered on China. However, after the deployment of the Terminal High Altitude Area Defense (THAAD), invisible regulations by Chinese authorities and concerns such as "funds could be frozen depending on political situations" increased risks, causing a sharp decline in preference. Japan filled this gap and emerged as the new trend. Recently, Southeast Asia's Indonesia and South Asia's India have also emerged as new 'lands of hope.' Samsung Venture Investment and Korea Investment Partners are directly investing in India.

Indonesia and India have strong domestic demand based on their massive populations, and most startup founders are fluent in English. Both governments actively support startups. India is the world's most populous country, and Indonesia ranks fourth. A representative from SV Investment said, "Both countries share the characteristic of having a low median age, making them young nations," adding, "They are countries with virtually unlimited potential for development, truly suitable for VC investment." Both India and Indonesia have a median age under 30, while South Korea's median age is 46.

Unicorns Disappearing in Korea... "Few Startups Worth Investing In"

There is also analysis that 'early-stage investment' demand is shifting overseas. As the domestic startup market enters a mature phase, there are fewer attractive 'new faces' to invest in, leading to increasing interest abroad. According to the Korea Venture Capital Association, from January to August this year, the proportion of early-stage company (less than 3 years old) investments by domestic VCs was 19.6%, the lowest since 2020. Compared to 45.3% in 2021, it is less than half. Meanwhile, the proportion of late-stage company (7 years or older) investments during the same period was 44.9%, showing an increasing trend year by year. This indicates a preference for stable investments that do not match the reputation of 'venture capital' in the domestic market.

Unicorns, defined as unlisted companies valued at over 1 trillion won, have also quietly disappeared. According to global research firm CB Insights, Korea has 14 unicorns. This is incomparable to India’s 71, while Japan and Indonesia each have 8 and are closely following. Cases of companies dropping out of unicorn status are emerging, such as Kurly, which was once valued at over 3 trillion won but has fallen below 1 trillion won. Domestic startups also see overseas markets as a breakthrough. According to a recent Google Play survey of 100 startup CEOs, 37.9% of respondents have entered overseas markets, and 52.4% are preparing to do so. Negative evaluations of the domestic startup ecosystem were 42.7%, about twice the positive responses at 24.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.