Smooth Progress in Immuno-Oncology Clinical Trials

Growing Interest in Solid Tumor and Bile Duct Cancer Treatment Pipeline

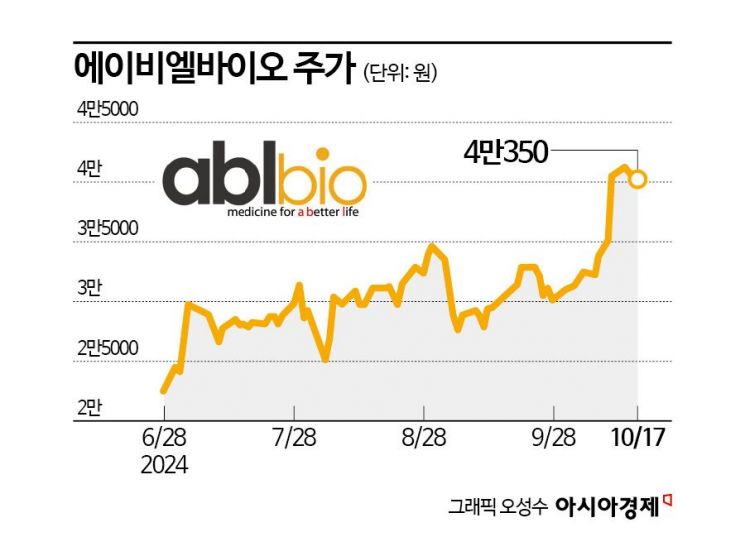

Stock Price Rises Amid Continued Foreign Net Buying

As investment sentiment in the bio sector revives in the domestic stock market, ABL Bio has reached a new all-time high. Expectations for its drug development pipeline are growing, steadily increasing the company's value. ABL Bio's market capitalization has grown to nearly 2 trillion KRW.

According to the financial investment industry on the 18th, ABL Bio's stock price rose 79% over about three months since July this year. During the same period, the KOSDAQ index fell by 9%. The return compared to the market reached 88 percentage points. The previous day, ABL Bio hit a new all-time high of 43,300 KRW. Its market capitalization increased to 1.94 trillion KRW. Recently, foreigners have been actively buying ABL Bio shares, purchasing 47.4 billion KRW worth this month.

ABL Bio is developing various immuno-oncology drugs based on its bispecific antibody platform, 'Grabody.' Clinical trials for multiple pipelines are progressing smoothly, boosting expectations.

Last month, ABL Bio signed a clinical trial collaboration and Keytruda supply agreement with Merck (MSD) in the U.S. to evaluate the combination therapy 'ABL103 + Keytruda' for patients with advanced or metastatic solid tumors. Hyunsoo Ha, a researcher at Yuanta Securities, explained, "ABL103 is currently in phase 1 clinical trials, and preclinical results suggest a low likelihood of liver toxicity," adding, "It showed tumor suppression effects proportional to B7-H4 expression."

B7-H4 is a type of protein overexpressed in cancers such as ovarian, breast, and endometrial cancers. B7-H4 expressed on tumor cells binds to T-cell receptors, inhibiting immune responses.

In August, patient enrollment for global phase 2 and 3 clinical trials of the bispecific antibody cholangiocarcinoma treatment (ABL001) was completed. The MD Anderson Cancer Center, the largest cancer center in the U.S., approved an investigator-initiated study (IST) to explore the potential of ABL001 as a first-line treatment, reflecting high expectations. Minyong Eom, a researcher at Shinhan Financial Investment, stated, "For cholangiocarcinoma treatment, a combination therapy of AstraZeneca (AZ)'s gemcitabine, cisplatin, and Imfinzi is used," and "MD Anderson Cancer Center will evaluate the possibility of adding ABL001 to this regimen."

ABL001 received Fast Track designation from the U.S. Food and Drug Administration (FDA) in April to support the rapid development of the drug. In addition to cholangiocarcinoma, phase 2 clinical trials targeting colorectal cancer patients are also underway.

The solid tumor treatment candidate (ABL503) is also one of the key pipelines driving ABL Bio's corporate value. At the 2024 American Society of Clinical Oncology (ASCO 2024), ABL503 presented interim phase 1 clinical trial results, including one complete response (CR) and six partial responses (PR).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.