September Seoul Apartment Transactions at 42% of Previous Month

Sales Price Index Rises for 6 Consecutive Months but Growth Slows

Housing Market Consumer Sentiment Index Seoul 117.8, Down 10.2p from Previous Month

Seoul Jeonse Rate Hits Highest Since January Last Year at 47.65%

It is forecasted that the Seoul real estate market will continue to experience a cautious stance on sales until the end of this year. This outlook is based on the current market condition where the volume of apartment transactions in Seoul has sharply declined and the upward trend in sales prices has slowed down due to strengthened real estate loan regulations implemented since August. Although there is a prediction that the rental price increases seen throughout the year will convert into sales demand during the traditional autumn moving season, analysis suggests that the shift toward monthly rent will proceed more rapidly.

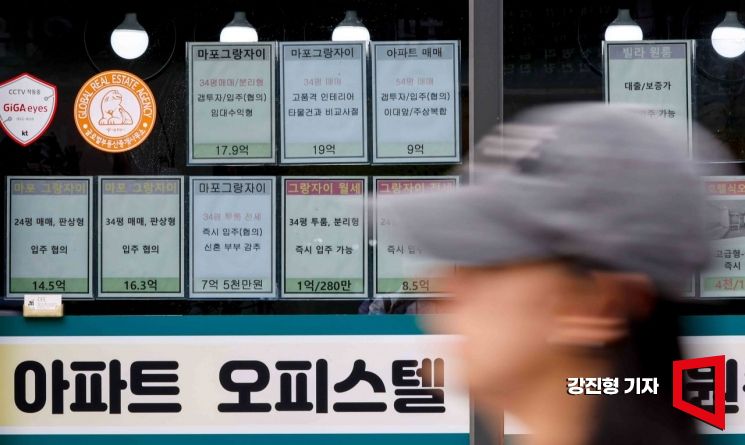

Apartment sale and jeonse prices are posted on real estate in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

Apartment sale and jeonse prices are posted on real estate in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

According to the Seoul Real Estate Information Plaza on the 19th, the number of apartment sales transactions in September was recorded at 2,629, which is about 42% of the 6,254 transactions in August. Considering the usual one-month reporting period after contract signing, the transaction volume is expected to remain around 3,000.

Slowing Growth in Sales Prices, Real Estate Consumer Sentiment Shifts to 'Stable'

According to KB Real Estate, the Seoul sales price index change rate in September was 0.49%. Although this marks six consecutive months of increase, the growth rate slowed compared to August (0.52%).

Consumer sentiment among homebuyers also shifted from 'rising' to 'stable' this month. The Korea Research Institute for Human Settlements reported that the housing market (sales and jeonse) consumer sentiment index for the Seoul metropolitan area in September dropped by 6.5 points from the previous month to 113.9. In Seoul specifically, the index fell by 10.2 points from 128.0 in the previous month to 117.8. This marks the first decline in the housing market consumer sentiment index in 10 months since December last year. The Seoul housing sales market consumer sentiment index has decreased for two consecutive months, dropping 0.1 points in August and sharply falling by 14.7 points to 125.8 in September compared to the previous month.

According to the weekly KB Apartment Market Trend report by KB Real Estate, Seoul apartment sale prices surged by 0.22% in one week. The photo shows the Granja Apartment in Mapo-gu, Seoul, on the 5th. Photo by Jin-Hyung Kang aymsdream@

According to the weekly KB Apartment Market Trend report by KB Real Estate, Seoul apartment sale prices surged by 0.22% in one week. The photo shows the Granja Apartment in Mapo-gu, Seoul, on the 5th. Photo by Jin-Hyung Kang aymsdream@

While the market appears to be entering a stabilization phase, the jeonse price increases observed throughout the year may intensify further in autumn. Traditionally, autumn is the moving season, which leads to increased demand for jeonse. When jeonse prices rise to a certain level, house prices tend to follow suit.

Since August last year, the upward trend in jeonse prices in the metropolitan area has continued for over a year. As of September, the Seoul jeonse price index change rate was 0.39%, slightly down from 0.55% in the previous month. However, the jeonse price ratio (jeonse price relative to sales price) in Seoul, compiled by Real Estate R114, reached 47.65% in September, the highest since January last year (48.08%). The rise in jeonse prices is also spreading to non-apartment properties. The Seoul non-apartment jeonse price index change rate was 0.21% in the third quarter, an increase from 0.01% in the second quarter.

Not only jeonse but also monthly rent is rising. The Seoul monthly rent price index change rate compiled by the Korea Real Estate Board in September increased by 0.11% compared to the previous month and by 1.23% compared to the same month last year. The shortage of listings in areas with good school districts and transportation near subway stations continues, driving up monthly rent prices, with Seongdong-gu seeing a 0.59% increase compared to the previous month.

Cautious Stance Until Year-End... Recovery Expected Early Next Year

Experts expect the current temporary cautious stance to continue until the end of the year. Yoon Soo-min, a real estate specialist at NH Nonghyup Bank, stated, "Jeonse prices continue to rise in the rental market, keeping the market unstable, and there is significant demand ready to switch to sales at any time. The rising jeonse prices remain the most concerning factor for next year." He added, "Although the government has forcibly tightened loan regulations, household loan restrictions in the financial sector may gradually ease after the year-end. The current market atmosphere is likely to persist until the end of the year and then enter a recovery phase early next year."

Ham Young-jin, head of the Real Estate Research Lab at Woori Bank, explained, "The combination of Stress DSR phase 2 and loan regulations, along with buyers hoping for price adjustments and sellers expecting price increases until next year, has intensified the 'transaction tug-of-war,' fueling the cautious stance. The volume of new completions in the metropolitan area will decrease further next year, making it difficult for jeonse prices to fall. With fewer jeonse listings and strengthened jeonse loan regulations, the shift toward monthly rent may accelerate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)