Although the 'pivot' signaling a shift in monetary policy was realized with the Bank of Korea's base rate cut, borrowers' sighs are growing louder. Despite the rate cut, mortgage loan interest rates at commercial banks are approaching 7%, continuing their upward trend. The industry expects this trend to persist at least until the end of the year.

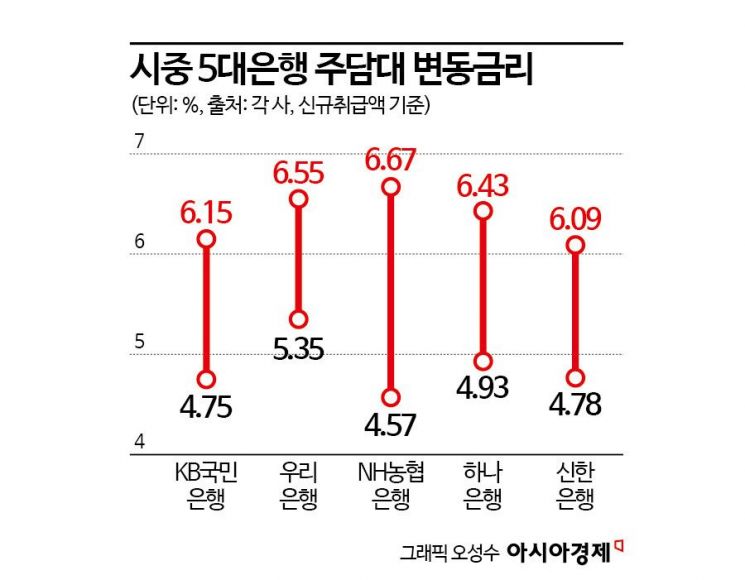

According to the financial sector on the 17th, the variable mortgage loan interest rates at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) reached between 4.63% and 6.73% as of the previous day. This was due to the rise in the September Cost of Funds Index (COFIX) announced on the 15th. As a result, mortgage loan interest rates are nearing 7% on a variable basis.

Some rates have already broken through the 7% ceiling. For KakaoBank's mortgage loans, the 6-month variable product interest rate ranges from 4.49% to 7.28%, with the upper limit exceeding 7%. The 5-year mixed (fixed) product interest rate also approaches the mid-6% range, ranging from 4.16% to 6.43%. The trend of loan interest rates nearing 7-8% during the rate hike period is being reproduced during this rate cut phase.

The primary reason for this reversal despite the pivot is the 'speed' of the rate cut. Although the Bank of Korea implemented a 0.25 percentage point base rate cut, the general view is that the next cut will likely occur around January or February next year. In fact, at a press conference on the 11th, Bank of Korea Governor Lee Chang-yong reportedly stated that five out of six Monetary Policy Committee members expressed the opinion that rates should be maintained at the current level of 3.25% for the next three months.

The U.S. Federal Reserve (Fed), which chose the pivot earlier than the Bank of Korea, is also expected to adjust the pace. Since the U.S. economy remains robust enough to be described as a 'Goldilocks economy'?an ideal economic situation with high growth and no inflation concerns?even after rate cuts, the scope of additional rate cuts within the year may be limited.

As a result, the 5-year bank bond yield, which had fallen to 3.145% on the 13th of last month?the lowest level in nearly two years?hovered around 3.2-3.3% before reaching 3.268% on the 15th. With expectations that the rate cut pace will not be as fast as anticipated, market interest rates, which had preemptively priced in rate cut hopes, are returning to their previous levels.

Another factor is the regulatory measures taken by authorities and banks to curb the rapidly increasing household debt. Despite the market interest rates falling amid rate cut expectations, the banking sector has raised the spread rates more than 30 times combined to block loan demand. Banks are adhering to their annual household loan growth targets set at the beginning of the year. Due to this, household loans at the five major banks turned to a decline in early this month.

The industry expects this trend to continue for the time being. If wrong signals are sent, household loans could increase repeatedly, and since the slope of rate cuts is expected to be gentle, market interest rates are likely to remain flat. A representative from a commercial bank said, "Borrowers for whom loan limits are important seemed to have concentrated in July and August, and it is true that demand has calmed down due to various restrictions and increases since then, but it is difficult to say that loan demand has completely dried up." He added, "The 5-year bank bond, which serves as the benchmark rate for fixed-rate mortgage loans chosen by most borrowers, is also likely to remain flat for the time being, so this situation is expected to continue at least until the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)