KOSPI Q3 Operating Profit Forecasts Drop Over 6% in Past Month

Q3 Earnings Season Kicks Off with Earnings Shocks from Samsung Electronics and LG Electronics

Annual and Next Year Earnings Forecasts Likely to Decline as Well

Expectations for the third-quarter earnings season this year are declining. This is because it started with earnings shocks from Samsung Electronics and LG Electronics. Market forecasts are also continuously being revised downward. Accordingly, there are projections that earnings expectations for the second half of this year and next year may be further lowered.

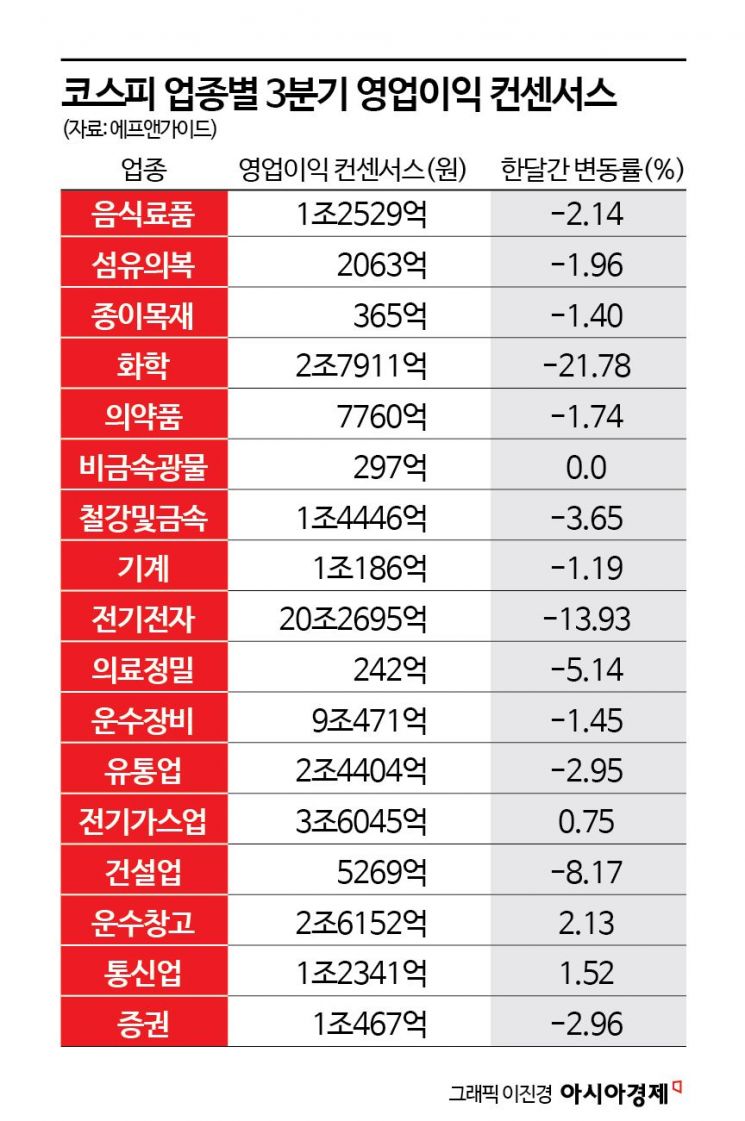

According to financial information provider FnGuide on the 16th, the consensus operating profit for the third quarter of the KOSPI (average securities firms' forecast) dropped by 6.57% compared to a month ago, standing at 62.2569 trillion KRW. Among the 17 industries with consensus estimates, 13 were revised downward. One industry remained at the same level as a month ago, and only three industries saw their expectations revised upward.

The chemical industry showed the steepest downward trend. The third-quarter operating profit consensus for the chemical sector was 2.7911 trillion KRW, down 21.78% from a month ago. The electrical and electronics sector, which includes Samsung Electronics and LG Electronics that already reported results below expectations, followed with a 13.93% downward revision. The construction industry was also revised down by 8.17%.

On the other hand, the transportation and warehousing sector was revised up by 2.13%, telecommunications by 1.52%, and electric and gas utilities by 0.75%.

Yeom Dong-chan, a researcher at Korea Investment & Securities, said, "In the past, when earnings estimates were revised downward in the month before the earnings season, actual results were often poor as well. As more information about earnings becomes available toward the end of the quarter, it is natural that downward revisions of earnings estimates just before the earnings season negatively affect actual results. The earnings per share (EPS) estimate for September was revised downward by 2.6%."

There is also a possibility of further downward revisions after the third-quarter earnings announcements begin in earnest. Choi Jae-won, a researcher at Kiwoom Securities, explained, "Looking at the manufacturing inventory cycle index, which leads corporate earnings changes by about one quarter, the index has been gradually lowering its peak after reaching a high point early this year. Additionally, the inventory cycle index related to IT components has also shown a gradual slowdown since January, which dampens investment sentiment, especially in the semiconductor sector where expectations for earnings recovery were high this year." He added, "Considering these factors, although earnings expectations were preemptively lowered ahead of the third-quarter earnings season, there is a high possibility that profit forecasts will be further revised downward through this earnings announcement."

Generally, the domestic stock market has seen weaker earnings in the second half compared to the first half, so the second-half earnings this year are also expected to fall short of expectations. Researcher Yeom explained, "Korean earnings tend to be better than expected in the first half and weaker than expected in the second half due to seasonality. This is because over 95% of Korean listed companies have a December fiscal year-end, and the characteristics of Korean accounting involve expense recognition or asset depreciation in the last quarter of the fiscal year."

Given the high earnings uncertainty, it seems necessary to respond with stocks that have earnings momentum and earnings turnaround potential. Researcher Choi said, "The overall poor earnings momentum across industries increases the likelihood of a differentiated market by stock. I suggest responding more stably to the volatile third-quarter earnings season by focusing on stocks with confirmed earnings turnarounds and earnings momentum."

Researcher Yeom added, "Financial stocks, which have recently shown favorable estimate changes and less burden on annual earnings, are less pressured sectors in this earnings season. Growth sectors such as communication and healthcare, based on positive experiences during interest rate decline cycles, can be approached with a somewhat longer-term perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.