Securities Industry Busy "Find the Second Korea Zinc"

Hostile M&A, 'Will Become a Trend' vs 'A Unique Case'

Accounting Firms May Expand 'Management Rights Defense' Services

As the management rights dispute over Korea Zinc has effectively concluded with the victory of the MBK Partners-Youngpoong alliance, the aftermath of this incident is also stirring strong waves. Movements to find the 'second Korea Zinc' are bustling, and there are forecasts that hostile mergers and acquisitions (M&A) led by private equity fund (PEF) operators will become more active. Securities firms, law firms, and accounting firms, often called the 'true winners,' are busily crunching numbers thanks to these 'new business opportunities.'

"Find Listed Companies Prone to Disputes" Busy Securities Industry

According to the financial investment industry on the 16th, securities firms and individual investors are on the hunt for the 'second Korea Zinc.' The perception that "management rights disputes are profitable" has firmly taken root, triggered by Korea Zinc, where investors who entered late to chase after the public tender offer competition between the two sides were able to benefit. Especially this year, as management rights disputes have increased, investors have experienced stock price rises through companies like Hanmi Science, FnGuide, and T'way Air.

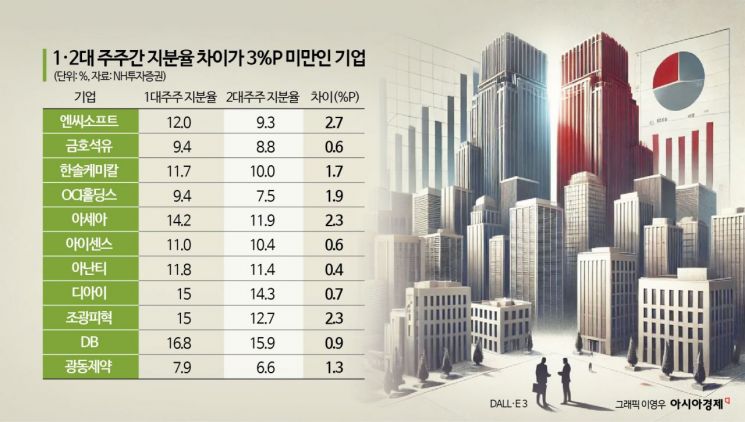

Lists of listed companies with potential management rights disputes are also emerging one after another. According to a recent report by NH Investment & Securities, 34 listed companies with a shareholding gap of less than 20 percentage points between the first and second largest shareholders were compiled and disclosed. The list considered the shareholding gap, corporate value, and abundant cash. Among these, 11 companies have a gap within 3 percentage points. Of course, many have amicable relationships between the first and second largest shareholders, but if relations turn hostile, disputes are quite possible. In the case of Korea Zinc, the founding family maintained a close partnership for 75 years across three generations but eventually split, becoming "worse than strangers." ResearchAlum pointed out companies such as Korea Steel, Sajo Daerim, Sindoh, Sammok S-Form, Dongwon Development, and Taeyang as firms that PEF operators might be interested in.

Hostile M&A "Will Become a New Trend" vs "Unlikely to Trend Due to Korean Sentiment"

Although MBK Partners denies it, the market generally views the Korea Zinc incident as a 'hostile M&A.' This is the first time a PEF operator-led hostile M&A has seized management rights of a listed company. It is a new strategy beyond the typical buyout of unlisted companies. Opinions are divided between those who say "it will spread in the industry" and those who believe "hostile M&A trends are impossible."

An anonymous PEF representative said, "It was possible because MBK is mostly foreign capital with massive funds, and most private equity funds cannot pursue this strategy," adding, "Considering Korea's unique sentiment, where limited degrees of separation mean investors and large corporations are closely connected, it is very difficult for this to become a trend." He also said, "Pension funds like the National Pension Service and other public funds and associations would not want to get involved in controversies," and "I believe MBK will find it difficult to receive domestic investments going forward." This suggests a high possibility of 'MBK passing' in future LP investments. Public opinion also shows considerable antipathy toward MBK. According to a recent Realmeter survey, about half of respondents agreed that it was a hostile M&A, and over 60% expressed concerns about technology leakage and the need for government intervention.

Meanwhile, as the true winners of this incident are said to be securities firms and law firms that will collect fees worth thousands of billions of won without significant risk, accounting firms, another key player in the M&A market, are also drawing attention. A representative example is the 'management rights defense service' for small and medium-sized enterprises offered by the deal division of Samil Accounting Corporation. The official name of this service is 'Shareholder Synergy Enhancement and Dispute Resolution Advisory,' established last year. It was the first service in the industry created by Samil to prevent disputes in advance for listed companies concerned about management rights disputes. A Samil representative said, "We have been receiving steady inquiries from companies around the Korea Zinc incident." As management rights disputes increase day by day, it is expected that more accounting firms besides Samil will offer management rights defense services.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.