Securing Position as Second Largest Shareholder

Expecting Synergy in Accommodation and Aviation Industries

Aiming to Become a Global Enterprise

Daemyung Sono Group's Sono International has secured the position of the second largest shareholder in Air Premia, a medium- to long-distance specialized airline. The company aims to leap forward as a global leader in the tourism and leisure industry by creating synergy between its core lodging business and the aviation industry.

Sono International announced on the 15th that it has signed a contract to acquire 50% of the shares of JC Aviation No.1 Limited Liability Company, held by JC Partners, for 47.1 billion KRW. The contract also includes a call option (share purchase right) to buy the remaining 50% of JC Aviation No.1 Limited Liability Company held by JC Partners after June 2025.

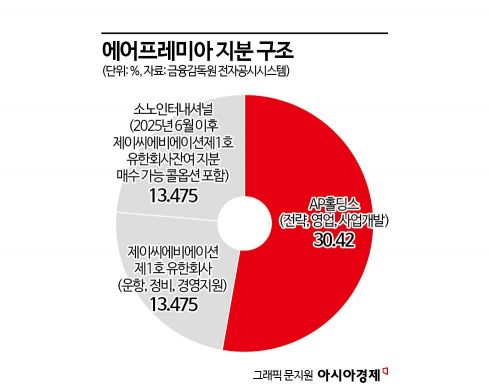

JC Aviation No.1 Limited Liability Company is a fund established by JC Partners for investment in Air Premia. Air Premia is co-managed by AP Holdings, which handles strategy, sales, and business development, and JC Partners, which is responsible for operations such as flight, maintenance, and management support. As of last year, the shareholding structure of Air Premia shows AP Holdings as the largest shareholder with 30.42%, and JC Aviation No.1 Limited Liability Company as the second largest shareholder with 26.95%. Through this contract, Sono International will secure half of the shares of JC Aviation No.1 Limited Liability Company and gain operational authority over Air Premia, co-managing the airline.

Earlier, in July, Daemyung Sono Group also secured a 26.77% stake in T'way Air for approximately 176 billion KRW. Sono International, the holding company, purchased 14.9% of shares from private equity firm JKL Partners for 105.6 billion KRW, and in August, its affiliate Daemyung Sono Season exercised a call option to acquire the remaining 11.87% stake for 70.8 billion KRW. However, the company stated that it does not currently consider acquiring management rights of T'way Air and regards this as a strategic investment.

A representative from Sono International said, "This acquisition of Air Premia shares goes beyond a simple entry into the aviation industry. It will serve as a driving force for Sono to become a global company through synergy between Sono's extensive domestic and international infrastructure and the aviation industry. We will achieve sustainable growth for both companies through Sono's 45 years of operational know-how and Air Premia's market competitiveness."

Meanwhile, Air Premia is a medium- to long-distance specialized airline operating highly efficient long-haul aircraft. It operates a fleet of five state-of-the-art Boeing B787-9 aircraft, focusing on routes to the Americas such as New York, Los Angeles (LA), and San Francisco. It is also expanding medium-distance routes to Bangkok, Thailand; Narita, Japan; Da Nang, Vietnam; and Hong Kong.

As the only premium hybrid airline (HSC) in the domestic aviation market, Air Premia is attempting a differentiation strategy between large full-service carriers (FSC) focused on long-haul routes and low-cost carriers (LCC) focused on short-haul routes. On long-haul routes, it offers premium seats and 12-inch touchscreens, while maintaining price competitiveness through operational efficiency.

From the end of this year to the third quarter of next year, Air Premia plans to introduce four additional aircraft, securing a total of nine aircraft and two spare engines. Sono International is the largest resort company in Korea, owning over 11,000 rooms across 18 hotels and resorts domestically. Since changing its name and brand from Daemyung to Sono in 2019 to enter the global market, it has been accelerating its overseas expansion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)