Half of Busan's Manufacturing Industry Faces Risk of Missing This Year's Performance Targets

Manufacturing Business Outlook '81', Below Standard for 6 Consecutive Quarters

Worsening Outlook Across All Sectors Except Chemicals, Rubber, Shipbuilding, and Equipment

Due to the prolonged high interest rates, high inflation, sluggish domestic demand, and instability in the Middle East, expectations for economic recovery have faded, raising concerns that more than half of the manufacturing companies in the Busan area may fail to achieve their target performance this year.

As a result, calls are growing for bold interest rate cuts and urgent, extraordinary measures to stimulate the domestic economy.

The Busan Chamber of Commerce and Industry (Chairman Yang Jae-saeng) announced this on the 15th through the release of the "2024 4th Quarter Busan Regional Manufacturing Business Survey," conducted on 250 local manufacturing companies.

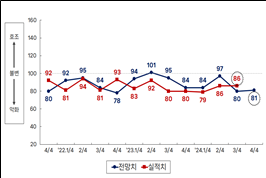

Quarterly Busan Manufacturing Industry Business Outlook Index Status.

Quarterly Busan Manufacturing Industry Business Outlook Index Status.

The manufacturing Business Survey Index (BSI) for the 4th quarter of 2024 recorded ‘‘81,’’ marking the sixth consecutive quarter of pessimistic economic outlook. This reflects expectations that unstable domestic and international business environments, such as high interest rates, high inflation, export slowdown, and geopolitical risks, will persist into the 4th quarter, causing the index to fall below the baseline (100). The BSI indicates economic improvement if it is 100 or above, and deterioration if below 100.

By type, export companies recorded ‘98’ while domestic companies recorded ‘76.’ Due to consumption contraction caused by increased household debt and the effects of sluggish domestic demand, the domestic companies are expected to face more difficulties than export companies in the 4th quarter.

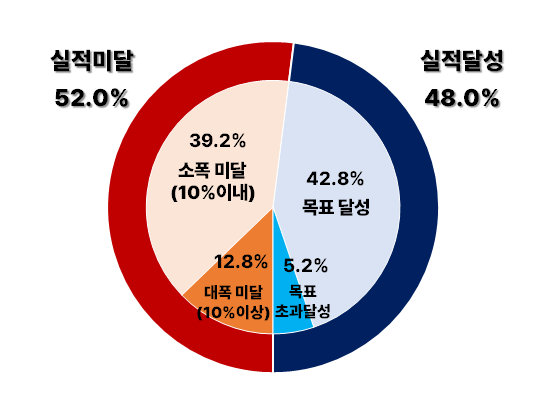

When asked whether they would achieve the target performance planned at the beginning of the year, 52.0% of surveyed companies responded that they would ‘not achieve’ it. This is a 4.4 percentage point increase compared to the previous year (47.6%), suggesting that negative factors in the business environment such as fluctuations in oil and raw material prices and delayed interest rate cuts have directly impacted local companies' ability to meet their goals.

By industry, all sectors except Chemicals & Rubber (115), which benefited from falling international oil prices and increased demand for synthetic rubber and paints, and Shipbuilding & Equipment (100), which was buoyed by increased demand for eco-friendly ships and a shipbuilding boom, forecast economic downturns.

Consumer goods sectors such as Footwear (67), Apparel & Fur (67), and Food & Beverages (60) showed significant sluggishness due to rising raw material costs, increased logistics expenses, and weakened consumer sentiment. The Electrical & Electronics sector (95), despite strong 3rd quarter performance driven by increased investment in new industries like AI, expressed concerns over demand slowdown and exchange rate fluctuations, projecting a slight decline in the 4th quarter.

In all management areas surveyed, including sales (82), operating profit (83), facility investment (90), and financial conditions (90), indices fell below the baseline, indicating concerns about economic downturn.

Regarding the recently re-emphasized geopolitical risks, 67.2% of surveyed companies responded that there is ‘no significant impact,’ while 31.2% reported suffering from temporary performance declines (20.4%) and competitiveness deterioration (9.2%). The types of damage included financial risks such as exchange rate fluctuations (24.7%), increased energy procurement costs (22.6%), raw material supply issues (18.3%), and increased inventory management and logistics costs (16.1%).

When asked about preparedness for global geopolitical risks, 60% of responding companies recognized the necessity, but only 7.6% of local companies were actually prepared due to difficulties in risk prediction, challenges in developing new sales channels, and limitations in available funds.

A representative from the Busan Chamber of Commerce and Industry’s Corporate Trend Analysis Center stated, “Due to prolonged domestic demand sluggishness and geopolitical risks, upstream and downstream industries in the region are facing difficulties,” adding, “Active policy support is needed not only to stimulate domestic demand but also to help local companies respond to internal and external risks by supporting the development of new sales channels.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.