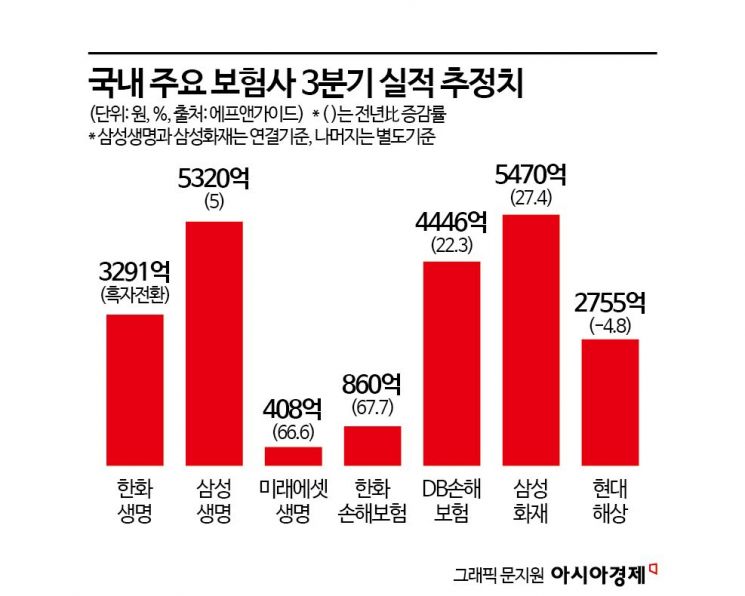

Estimated Q3 Net Profit of 7 Listed Insurance Companies at KRW 2.255 Trillion

Expected 38.8% Increase YoY

Samsung Fire & Marine Insurance Expected to Lead Ahead of Samsung Life Insurance

Analysis suggests that the earnings of major domestic insurance companies in the third quarter of this year will increase by nearly 40% compared to the same period last year. With the continued strong performance of the non-life insurance sector in the second half of the year, Samsung Fire & Marine Insurance is increasingly likely to overtake Samsung Life Insurance and claim the position of the 'eldest sibling' within the Samsung Financial Group.

According to financial information provider FnGuide on the 15th, the estimated net profit attributable to shareholders for seven insurance companies listed on the domestic stock market in the third quarter of this year is expected to reach 2.255 trillion KRW, a 38.8% increase from 1.624 trillion KRW in the same period last year. The momentum of record-high performance led by major non-life insurers in the first half of this year is expected to continue into the second half.

The estimated consolidated net profit for Samsung Fire & Marine Insurance, the leader in the non-life insurance industry, is 547 billion KRW for the third quarter, expected to surpass Samsung Life Insurance’s 532 billion KRW, which is the top player in the life insurance sector and the 'eldest sibling' of Samsung Financial Group. In the first half of this year, Samsung Life Insurance recorded a net profit of 1.3685 trillion KRW, while Samsung Fire & Marine Insurance posted 1.3124 trillion KRW. In the first quarter, Samsung Fire & Marine Insurance led with a net profit of 701 billion KRW compared to Samsung Life Insurance’s 622 billion KRW, but Samsung Life Insurance reversed this in the second quarter, narrowly leading in overall first-half results.

Samsung Life Insurance has consistently maintained the top annual performance position within Samsung Financial Group so far. However, this position may be reversed for the first time this year. While the life insurance industry faces challenges due to low birth rates and an aging population, the non-life insurance sector is growing as various risk factors emerge with industrial advancement. Moreover, the trend of lowering benchmark interest rates is more disadvantageous to life insurers than to non-life insurers. Looking solely at insurance underwriting profits, the core business of insurers, Samsung Fire & Marine Insurance (1.198 trillion KRW) has already surpassed Samsung Life Insurance (712 billion KRW) in the first half of this year. Samsung Life Insurance barely maintained its pride by significantly outperforming Samsung Fire & Marine Insurance (519 billion KRW) in investment gains (1.113 trillion KRW vs. 519 billion KRW).

Hanwha Life Insurance is expected to turn a profit with a net income of 329.1 billion KRW (on a separate insurance company basis), compared to a loss of 40.8 billion KRW in the same period last year. Last year in the third quarter, Hanwha Life Insurance suffered a loss of 252.5 billion KRW in the investment sector alone due to rising interest rates and a downturn in the stock market. The market environment in the third quarter of this year is different, raising expectations that results will exceed market forecasts. Kim Do-ha, a researcher at Hanwha Investment & Securities, predicted, "Hanwha Life Insurance’s investment gains are expected to improve by about 500 billion KRW year-on-year, reflecting a 250 billion KRW capital gain from the sale of the Janggyo-dong building in the third quarter."

Hanwha General Insurance’s third-quarter net profit is estimated at 86 billion KRW, a 67.7% improvement from the same period last year. The base effect of costs related to the new International Financial Reporting Standard (IFRS 17) guidelines reflected in the third quarter of last year and the turnaround in the difference between expected and actual profits (earnings variance) are expected to increase insurance underwriting profits by 49% in the third quarter of this year. Investment gains are also expected to increase by 20 billion KRW as last year’s third-quarter investment losses caused by rising interest rates turn into profits this time.

DB Insurance’s third-quarter net profit is expected to increase by 22.3% year-on-year to 444.6 billion KRW. Park Hye-jin, a researcher at Daishin Securities, said, "With the exclusive license obtained in April for its strength in driver insurance, DB Insurance’s new corporate agency (GA) contracts in the third quarter surpassed Samsung Fire & Marine Insurance." She added, "Although a decline in interest rates will increase alternative asset valuation gains by 20 billion KRW, general insurance profits will decrease due to reinsurance premium adjustments related to accidents in Hawaii and Guam last year."

Hyundai Marine & Fire Insurance’s third-quarter net profit is expected to decrease by 4.8% year-on-year to 275.5 billion KRW. Researcher Park said, "New contract sales have increased, so the Contractual Service Margin (CSM) is favorable," but added, "There will be a slight earnings variance, and profits from general insurance and automobile insurance will significantly decline."

Mirae Asset Life Insurance’s third-quarter net profit is estimated at 40.8 billion KRW, a 66.6% improvement compared to the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)