Yeongpung and MBK Secure Additional 5.34% Stake Through Tender Offer... Advantageous Position in Shareholders' Meeting Vote

Chairman Choi Yun-beom's Side Faces Dilemma as MBK's Voting Rights Increase with Successful Buyback

Yeongpung and MBK Expected to Hold Extraordinary General Meeting to Seize Board Control and Demand Investment Information Amid Embezzlement Allegations

MBK Partners and Youngpoong have gained the upper hand in the management rights dispute over Korea Zinc by securing more than a 5% stake through a tender offer. Although the tender offer price proposed by the MBK-Youngpoong alliance (830,000 KRW) is lower than the 890,000 KRW offered by Chairman Choi Yoon-beom of Korea Zinc, investors are believed to have responded to the tender offer by dividing their shares, considering the uncertainties of the company’s own stock tender offer, taxes, and proportional allocation issues in case of oversubscription. Now, Chairman Choi’s side faces a dilemma where the more successful their own stock tender offer is, the closer it brings the competitor’s voting rights stake to a majority. Going forward, the Youngpoong-MBK alliance is expected to convene an extraordinary general meeting to take control of the board of directors and demand detailed decision-making processes and accounting information related to investments that have raised suspicions of breach of fiduciary duty.

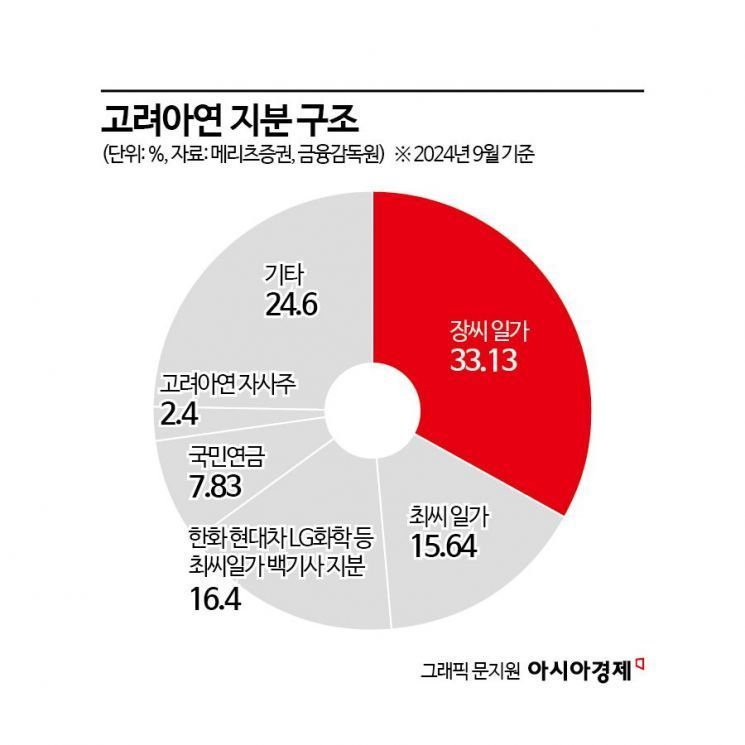

According to the investment banking (IB) industry on the 15th, the Youngpoong-MBK alliance added an additional 5.34% stake in Korea Zinc through the tender offer conducted until the previous day, bringing them close to a majority of voting rights. As a result, the Youngpoong-MBK alliance’s stake in Korea Zinc increased from the existing 33.13% to 38.47%. The Youngpoong-MBK alliance celebrated, stating, "We have achieved our target figure," and "This will remain a significant milestone in the Korean capital market." The Youngpoong-MBK alliance is evaluated to have achieved their intended goal by securing more than a 5% additional stake in Korea Zinc at a lower tender offer price than Chairman Choi’s side. Chairman Choi’s side is conducting a counter tender offer for treasury shares, and if they purchase and cancel all remaining circulating shares (about 15%) as promised, MBK’s stake based on voting shares will approach a majority. MBK plans to check the subscription competition rate for Korea Zinc’s treasury stock tender offer and convene an extraordinary general meeting soon to take control of the board.

Chairman Choi Yoon-beom’s Side Faces Dilemma: The More Successful Their Treasury Stock Tender Offer, the More They Increase Competitor’s Voting Rights...

Youngpoong-MBK Alliance Expected to Hold Extraordinary General Meeting to Take Control of Board and Demand Investment Information Related to Breach of Fiduciary Duty Suspicions

As the Youngpoong-MBK alliance gathered more shares than expected at a relatively lower price than Chairman Choi’s side, Chairman Choi’s side found itself at a disadvantage in the vote battle. The treasury shares tendered by Korea Zinc have no voting rights. Also, since the treasury shares are scheduled to be canceled, exchanging shares with friendly forces is impossible. Only the 2.5% stake that Bain Capital can maximally secure through Korea Zinc’s tender offer has voting rights. Moreover, as the subscription volume for the treasury stock tender offer increases, the proportion of treasury shares is excluded from the denominator in voting rights calculations, effectively increasing the Youngpoong-MBK alliance’s voting rights proportion.

Assuming Chairman Choi’s side achieves 100% of the target volume in their treasury stock tender offer, the Youngpoong-MBK alliance’s voting rights stake would reach 48%. MBK has emphasized that holding voting rights in the mid-40% range is advantageous in shareholder meeting vote battles, considering Korea Zinc’s shareholder meeting attendance rates over the past two years. Taking into account the proportion of investors who do not attend shareholder meetings, they consider this as effectively securing a majority of voting rights.

The Youngpoong-MBK alliance plans to convene an extraordinary general meeting next month. If the MBK alliance appoints new directors at the extraordinary general meeting and controls the majority of the board, they can take over Korea Zinc’s management rights. Korea Zinc’s articles of incorporation do not limit the number of directors, so it is possible to take control of management rights simply by increasing the number of newly appointed directors without dismissing the existing board. Currently, Korea Zinc’s board consists of 13 members, with 12 members aligned with Chairman Choi except for Jang Hyung-jin, an advisor to Youngpoong. After taking control of the board, the Youngpoong-MBK alliance is expected to request detailed materials related to various investments that have raised suspicions of breach of fiduciary duty, such as investments in Ignio Holdings and One Asia Partners, from Korea Zinc.

Youngpoong-MBK Alliance Focuses All Efforts on Halting Treasury Stock Tender Offer Financed by Trillions in Borrowings...

Legal Risk Concerns Also Observed Within Korea Zinc’s Board... Decision on Whether to Halt Treasury Stock Tender Offer Expected on the 21st

Ahead of the court’s ruling on the injunction to prohibit the purchase of treasury shares, the Youngpoong-MBK alliance plans to focus all efforts on halting the treasury stock tender offer over the next week. In a statement released after the tender offer ended the previous day, they said, "We will focus all efforts to ensure that the treasury stock tender offer conducted by Chairman Choi’s side is halted." They added, "The large-scale treasury stock tender offer financed by borrowings exceeding 3 trillion KRW will cause irreversible damage to Korea Zinc, harming the company’s financial structure and transferring such damage to the remaining shareholders. To prevent this, we will explore all possible measures, including relief through ongoing litigation." Since the likelihood of the Youngpoong-MBK alliance winning the shareholder meeting vote battle has increased, investing such a large sum of 3 trillion KRW may become meaningless and could cause fatal damage to the company. The court’s decision on the injunction filed by the Youngpoong-MBK alliance is expected on the 21st, which is before the end date of Chairman Choi’s tender offer on the 23rd. While awaiting the court’s ruling, the justification for halting the treasury stock tender offer has gained practical significance. Previously, some directors from the law firm and Hyundai Motor Company consecutively abstained from Korea Zinc’s board meetings that decided on the treasury stock tender offer and price increase, indicating significant legal risk concerns within Korea Zinc’s board regarding the treasury stock tender offer. The fact that institutional investors responded significantly to the Youngpoong-MBK alliance’s tender offer, which had a lower price, is also interpreted as reflecting legal risk concerns about Korea Zinc’s treasury stock tender offer.

Korea Zinc downplayed the Youngpoong-MBK alliance’s tender offer, judging that it did not reach the target, and stated that they would respond appropriately in the future. Since neither side has reached an absolute majority, both must focus on securing allies for the voting rights battle. Major shareholders such as Hanwha, Hyundai Motor, LG Chem, and the National Pension Service, classified as Chairman Choi’s friendly forces, hold the casting vote.

Meanwhile, on the 12th of last month, Korea Zinc’s largest shareholder Youngpoong and MBK signed a sudden management cooperation agreement and immediately started a tender offer the next day. During the approximately one month of the tender offer, the Youngpoong-MBK alliance raised the tender offer price twice from the initial 660,000 KRW per share to 750,000 KRW and then 830,000 KRW. Chairman Choi’s side, aiming to defend management rights, started a counter tender offer for treasury shares at 830,000 KRW per share and then raised the price once to 890,000 KRW. The treasury stock tender offer conducted by Chairman Choi and his ally Bain Capital will continue until the 23rd.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)