On the 12th, stimulus measures announced

Focus on infrastructure investment over direct support

No specific size for special government bonds

Experts evaluate as "disappointing"

China has been rolling out stimulus measures daily to achieve its 5% economic growth target this year, but some in the financial market have given a harsh assessment, citing a lack of details such as scale. Experts believe that above all, a groundbreaking consumption stimulus plan must be prepared, but they point out that the measures announced by Chinese authorities in this regard are still minimal.

On the 12th, China announced a stimulus plan centered on significantly expanding government debt and issuing special government bonds to bolster the capital of state-owned banks.

Lan Foan, China's Minister of Finance, stated at a press conference that “to support state-owned banks mobilized by the authorities' successive stimulus measures, special government bonds will be issued, and local governments will be allowed to issue special bonds to purchase idle land and unsold housing.” This is the third stimulus plan following the monetary easing policies announced on the 24th of last month, which included cuts to reserve requirement ratios, policy interest rates, and real estate loan rates, and the early allocation of budgets for strategic industries and infrastructure investment announced on the 8th.

Experts expressed disappointment over the absence of specific figures regarding the scale of government bond issuance. Bloomberg reported, “Economists do not believe China is making efforts to overcome deflation (a decline in prices amid economic downturn).” Foreign media anticipate that specific figures may be disclosed at the upcoming Standing Committee meeting of the National People's Congress, China's highest legislative body, scheduled for the end of this month. Most foreign media predict government bond issuance in the range of 1 trillion to 3 trillion yuan in the financial market, while The Wall Street Journal (WSJ) reported that some forecasts suggest it could reach as high as 10 trillion yuan.

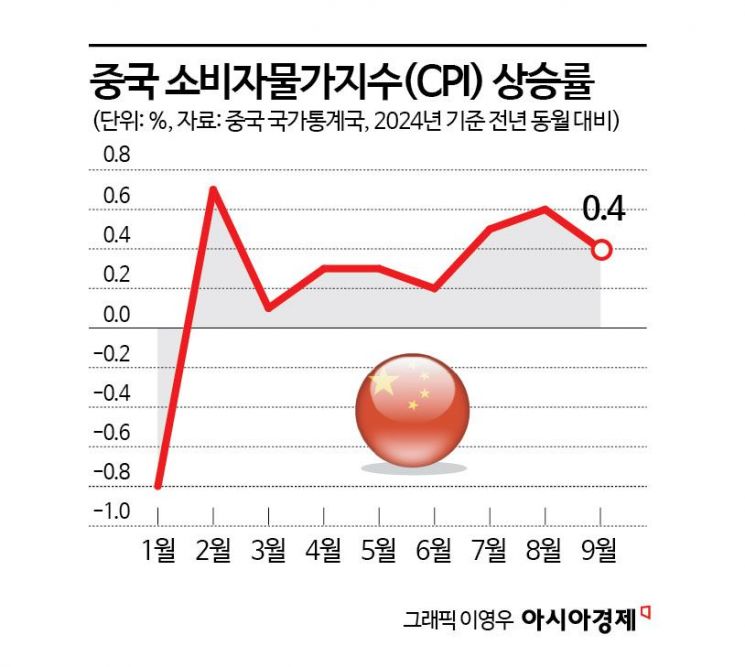

Furthermore, experts point out that despite growing concerns about deflation in China following the release of the September Consumer Price Index (CPI), there are almost no stimulus measures related to boosting consumption. According to the National Bureau of Statistics of China on the 13th, the September CPI rose 0.4% year-on-year, which was lower than the 0.6% increase in August. This figure also fell short of the market forecast of a 0.6% increase compiled by Bloomberg. The Producer Price Index (PPI) for September dropped 2.8% compared to a year earlier, marking the longest consecutive decline of 24 months since 2016.

WSJ explained, “Economists believe China needs to shift its growth model from one long dependent on investment and exports to one driven by household consumption,” but added, “(Looking at this stimulus package) there is no mention of large-scale support for consumers.” It is known that this stimulus plan focuses on infrastructure investment rather than large-scale direct support due to concerns about excessive welfare.

However, Brittney Lamb, Head of Long-Short Equity at Magellan Investment Holdings, said, “There is still room for China to announce additional stimulus measures related to consumption.” Experts believe that if Chinese consumption, which slowed after COVID-19, recovers, it will help reduce export dependence amid growing trade disputes with countries around the world such as the United States and Europe due to dumping issues.

The Chinese financial market rallied at the end of last month on expectations of the authorities' stimulus efforts, but concerns that the policy strength may be insufficient have recently halted the upward momentum. The CSI300 index, composed of the top 300 stocks by market capitalization on the Shanghai and Shenzhen stock exchanges, rose 27% from the start of the stimulus until the 8th, but then fell 8.7% over the next three days. Despite the real estate stimulus measures announced earlier this year, the Chinese stock market has experienced a prolonged slump since COVID-19.

Opinions on the Chinese stock market on Wall Street are divided. Morgan Stanley set a target for the CSI300 index at 4000 by June next year. Considering that the CSI300 index closed at 3887.17 on the 12th, this essentially means there is little room for further gains. On the other hand, Renaissance Macro Research forecasts that the CSI300 index will reach the 6000 level within 12 months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.