The Proportion of Households Receiving Two or More Mortgage Loans in the Past Three Years is 32.5%

It has been revealed that 32% of households who took out new mortgage loans in the past three years have taken out two or more loans. Household loans are rapidly increasing, especially among high-income groups, prompting calls for the government to establish regulatory measures to curb speculative loans.

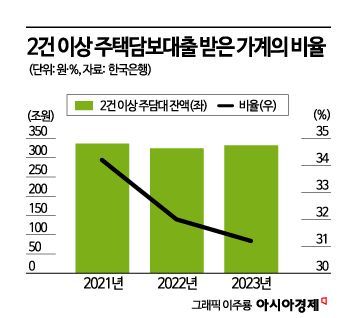

According to data submitted by the Bank of Korea to Assemblyman Cha Gyugeun of the Innovation Party, a member of the National Assembly's Planning and Finance Committee, the average proportion of households with two or more mortgage loans from 2021 to 2023 was 32.5%.

By year, the figures were 34.2% in 2021, 32% in 2022, and 31.2% in 2023. Estimating the loan amounts based on the total outstanding mortgage loan balances, the amounts were KRW 336.6 trillion in 2021, KRW 324.2 trillion in 2022, and KRW 332 trillion in 2023.

When examining total household loans and mortgage loans by debt quintiles, most of the loan amounts were concentrated in the top 20% by debt holdings. As of last year, the top 20% accounted for 78.1% of total household debt and 93.7% of mortgage loans.

Assemblyman Cha explained, "Household loans and mortgage loans are concentrated among high-income groups," adding, "Among mortgage loans, multi-homeowners with two or more mortgage loans account for 32%." He stated, "This phenomenon appears to be high-income groups taking out financial loans not for actual residence purposes but to gain profits from real estate speculation," emphasizing, "The government must prepare measures to prevent financial inequality from leading to asset inequality."

Lee Chang-yong, Governor of the Bank of Korea, is attending the Bank of Korea audit by the Planning and Finance Committee held at the Bank of Korea in Jung-gu, Seoul on the 14th. Photo by Kang Jin-hyung aymsdream@

Lee Chang-yong, Governor of the Bank of Korea, is attending the Bank of Korea audit by the Planning and Finance Committee held at the Bank of Korea in Jung-gu, Seoul on the 14th. Photo by Kang Jin-hyung aymsdream@

Total household loans, including mortgage loans, are also increasing significantly among high-income and high-credit borrowers. They are leading the recent rise in household loans and are considered a major cause of the increase in household debt.

According to data submitted by the Bank of Korea to Assemblyman Park Seonghun of the People Power Party, as of the end of the first half of this year, the outstanding household loan balance for high-credit borrowers with credit scores of 840 or above reached KRW 1,458.9 trillion. This is a very high figure compared to the outstanding household loan balances of KRW 330.9 trillion for medium-credit borrowers (credit scores 665?839) and KRW 69.5 trillion for low-credit borrowers (664 or below).

The higher the borrower's credit rating, the steeper the increase in household loans. The outstanding household loan balance for high-credit borrowers rose 25.2% from KRW 1,165.5 trillion at the end of the first half of 2019 to KRW 1,458.9 trillion at the end of the first half of this year.

In contrast, during the same period, the outstanding household loan balance for medium-credit borrowers decreased by 7.2%, from KRW 356.6 trillion to KRW 330.9 trillion. The outstanding household loan balance for low-credit borrowers also fell by 20.2%, from KRW 87.1 trillion to KRW 69.5 trillion. The average household loan balance per person as of the end of the first half of this year was KRW 110.83 million for high-credit borrowers, KRW 67.49 million for medium-credit borrowers, and KRW 42.04 million for low-credit borrowers, showing a significant gap.

By age group, the increase in household loans was mainly driven by younger people in their 30s and 40s. As of the end of the first half of this year, the outstanding household loan balance by age group was highest among those in their 40s at KRW 536.2 trillion, followed by those 30 and under at KRW 496.3 trillion, those in their 50s at KRW 457 trillion, and those 60 and over at KRW 369.7 trillion.

Compared to five years ago, the largest increase in loan balances was among those 30 and under, with an increase of KRW 98.9 trillion. This was followed by those 60 and over with KRW 84.2 trillion, those in their 40s with KRW 64.8 trillion, while those in their 50s saw a modest increase of KRW 1.1 trillion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.