Germany's Climate Analytics Releases Report

A warning has emerged that excessive investment in liquefied natural gas (LNG) carriers could actually lead to significant losses. While Korean shipbuilders continue to place large-scale new orders for LNG carriers, advice has also been raised that expanding investment in eco-friendly vessels is necessary to maintain future competitiveness.

On the 14th, Climate Analytics, a German climate analysis institute, released a report titled "Still Adrift: Assessing the Impact of the Global Energy Transition on the LNG Shipbuilding Industry." The report compared LNG demand forecasts from the International Energy Agency (IEA)'s World Energy Outlook with the latest LNG carrier order status.

According to the report, far more LNG carriers are being ordered than the IEA scenarios predict. From 2024 to 2026, 251 LNG carriers are scheduled for delivery. This corresponds to 38% of the total LNG carrier capacity currently in operation as of 2023. In 2023, 64 vessels were ordered, and already 55 new orders have been placed within just five months this year.

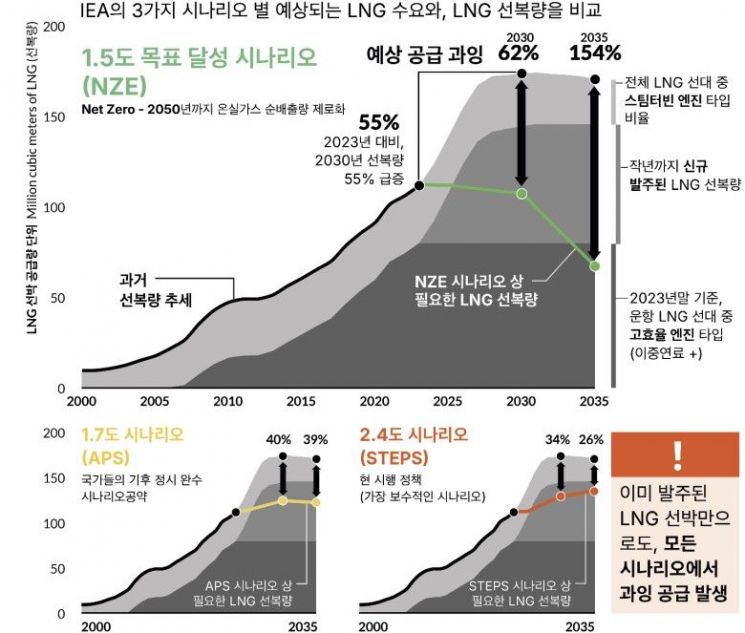

Comparison graph of IEA's three scenarios and LNG carrier fleet capacity trends. Image source=Climate Analytics, from the report "Still Adrift: Assessing the Impact of the Global Energy Transition on the LNG Shipbuilding Industry."

Comparison graph of IEA's three scenarios and LNG carrier fleet capacity trends. Image source=Climate Analytics, from the report "Still Adrift: Assessing the Impact of the Global Energy Transition on the LNG Shipbuilding Industry."

However, gas demand forecasts are diverging from the golden age. All three climate scenarios presented by the IEA anticipate a large-scale oversupply of LNG carriers. For example, under the Net Zero Emissions (NZE) pathway, which aligns with the goal of limiting global temperature rise to 1.5°C, not a single new LNG carrier is needed. Considering current orders, the expected LNG carrier oversupply by 2030 under the Net Zero pathway is projected to exceed approximately 400 vessels.

Even under the most conservative IEA scenario, the "Stated Policies Scenario (STEPS)," LNG carriers are already in oversupply as of 2024. By 2030, about 40% of the fleet capacity as of the end of 2023 is expected to be oversupplied, equivalent to approximately 275 carriers.

Korea, which accounts for the majority of LNG carrier orders, faces significant risks. The report warned, "Most of the ordered LNG carriers are scheduled to be built in China and Korea," adding, "As the energy transition accelerates, investing in fossil fuel transport assets could be a risky gamble for investors, shipyards, and shipowners alike."

According to the shipbuilding industry, Korea accounts for about 70% of global LNG carrier orders this year. By 2030, approximately 120 additional LNG carriers are expected to be delivered from Korea alone.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.