First Phase of the Month-Long Korea Zinc Management Dispute Ends on the 14th

Prolonged Conflict Expected if Voting Rights Battle Continues

Korea Zinc Continues Tender Offer at 60,000 Won Until the 23rd

Key Issue for Korea Zinc: Preventing Voting Rights Defection by White Knights Including Hyundai Motor

The public tender offer by the Yeongpung-MBK Partners alliance aiming to secure management rights of Korea Zinc, which began on the 13th of last month, will end on the 14th. Although the MBK alliance did not raise the tender offer price (830,000 KRW), Chairman Choi Yoon-beom of Korea Zinc, defending management rights through a treasury stock tender offer, raised the price to 890,000 KRW, securing a favorable position. However, considering the varying tax conditions for each investor, the uncertainty of injunction lawsuits, and the proportional allocation issue in case of oversubscription, it is difficult to predict the outcome until the final result is announced.

MBK Tender Offer Ends, Immediate Preparation for Extraordinary General Meeting... Tender Offer Price War Shifts to Shareholder Vote Battle

According to the investment banking (IB) industry on the 14th, the MBK alliance, whose tender offer period ends first, is expected to immediately start preparing for an extraordinary general meeting without a break. The industry expects that since MBK’s tender offer price is lower than Korea Zinc’s, it will be difficult to reach the maximum target quantity (14.6% of total issued shares), but it is anticipated to secure a single-digit percentage of shares. After the first round of the tender offer ends and the battle shifts to the shareholder vote, both sides are expected to engage in a battle for voting rights considering various variables.

Chairman Choi’s side’s treasury stock tender offer does not have voting rights even if subscription volume increases, so although the MBK alliance has stepped back in the price competition, it is unlikely to easily retreat in the vote battle. The dilemma that as treasury stock increases, the voting rights proportion of other shareholders including the MBK alliance also increases is another variable. The industry analyzes that institutional investors who avoid uncertainty are likely to split their subscription volumes appropriately between the MBK alliance’s tender offer and Korea Zinc’s treasury stock tender offer.

To prevent this, Korea Zinc recently requested the court to advance the hearing date for the injunction case to suspend the treasury stock tender offer procedure, but it was dismissed. The fact that both MBK alliance and Korea Zinc apply proportional allocation in case of oversubscription is also a source of anxiety for investors. If investors’ subscriptions exceed the maximum purchase quantity, the tender offeror does not buy all the subscription volume but purchases proportionally.

Investors worried that subscriptions will flood Korea Zinc’s treasury stock tender offer, which has a higher price, may first subscribe to some shares in the MBK alliance’s tender offer, which ends earlier, and then subscribe to the remaining shares in Korea Zinc’s tender offer. Korea Zinc states that except for passive (index-tracking) funds and the National Pension Service, the free float is only in the low 20% range, so the possibility of oversubscription in the treasury stock tender offer is low. Conversely, the MBK alliance considers that passive funds and the National Pension Service may participate, which could raise the free float to up to 35% of total issued shares.

Korea Zinc Continues Tender Offer Until the 23rd... Full Effort to Prevent Voting Rights Defection of White Knights like Hyundai Motor and Secure Shares

Korea Zinc will continue its treasury stock tender offer at 890,000 KRW until the 23rd. Korea Zinc plans to secure up to 17.5% of total shares through the treasury stock tender offer. Its ally Bain Capital will separately conduct a tender offer for 2.5%.

The issue is that the treasury stocks Korea Zinc is tendering do not have voting rights. Also, since treasury stock cancellation is planned, exchanging shares with friendly forces is impossible. Only the 2.5% that Bain Capital can secure has voting rights.

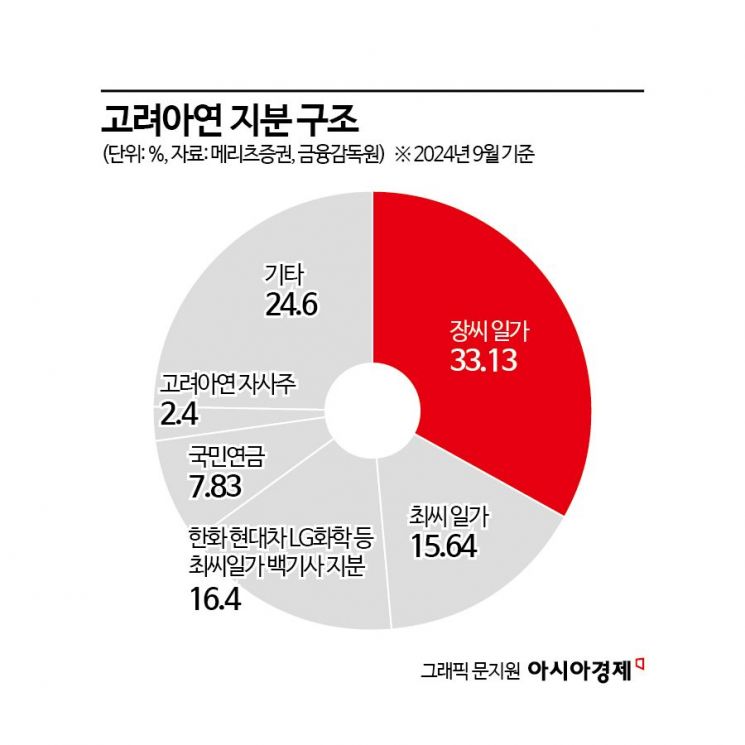

Moreover, as subscription volume increases through the treasury stock tender offer, the denominator in voting rights calculation excludes the treasury stock proportion, which increases the voting rights proportion of competing shareholders. Based on the current total issued shares of 20,703,283, Yeongpung holds 33.13%, and Chairman Choi’s side, including allies, holds 33.99%.

Assuming Korea Zinc’s treasury stock tender offer is fully successful, considering Korea Zinc’s already held treasury stock (2.4%) and shares with restricted voting rights such as Kyungwon Cultural Foundation (0.04%), the number of shares with voting rights is calculated at 16,573,062.

Under the condition that Korea Zinc’s tender offer reaches 100% of the target volume, the voting rights shares of the Choi family are estimated to be about 45%. Under the same condition, if the MBK alliance obtains about 3.5% of total issued shares through the tender offer, it will surpass the Choi family’s voting rights. Securing around 7% would exceed half. MBK’s calculation is that even if only 1-2% of subscriptions come in, the voting rights shares will reach the 40% range, making it worth putting to a shareholder vote.

In particular, it has been reported that recently, directors from Hyundai Motor, known as white knights supporting Chairman Choi, consecutively missed board meetings deciding Korea Zinc’s treasury stock tender offer and price conditions, making the prevention of white knight share defection a key issue for Korea Zinc alongside the success of the tender offer. Whether these directors attend the shareholder meeting and how they exercise their voting rights is crucial.

Korea Zinc states it will strictly monitor and not miss even the smallest shares. Meanwhile, Korea Zinc announced that it will purchase all shares bought through the Ulsan citizens’ “One Person One Share of Korea Zinc” campaign at the tender offer price of 890,000 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.