Sono International Secures 45 Billion KRW Loan Using Nationwide Resorts as Collateral

Plans to Raise Trillions with Major Securities Firms

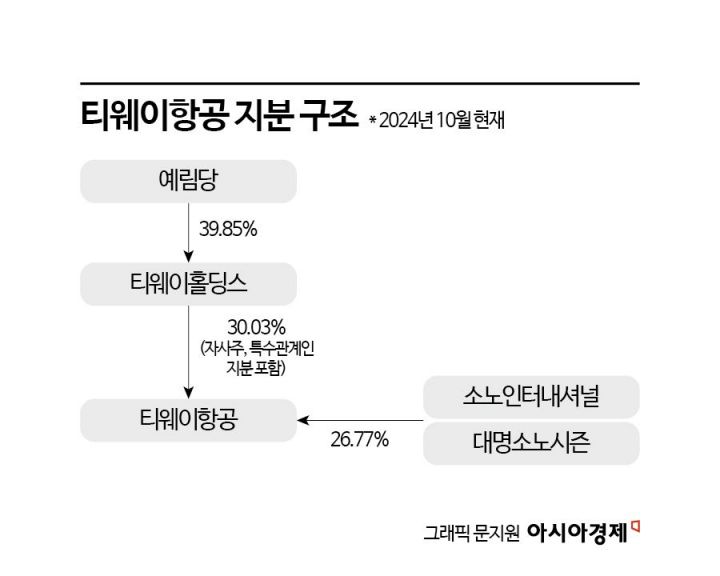

Acquires 26.77% Stake in Daemyung Sono Season and T'way Air

Potential to Gain Management Control Through Additional Share Purchases

Funds Expected for Business Expansion Including Overseas Hotel Acquisitions

Daemyung Sono Group, which recently became the second-largest shareholder of T'way Air, is raising large-scale funds through several financial institutions. It recently secured a secured loan of 45 billion KRW from Shinhan Bank and is reportedly pushing to raise several hundred billion KRW through a certain securities firm. At the same time, there are expectations that Daemyung Sono Group will seek to acquire management rights of the low-cost carrier T'way Air, and observations suggest that the funds will be used for overseas investments such as acquiring overseas resorts.

According to the investment banking (IB) industry on the 14th, Daemyung Sono Group has embarked on large-scale fundraising through multiple financial companies. Its core affiliate, Sono International, recently received a 45 billion KRW three-year maturity loan under the lead of Shinhan Bank. In this process, resort land and buildings located nationwide were provided as collateral. As Sono International mainly focuses on the resort business, it essentially pledged a significant portion of its core assets as collateral to raise funds.

The raised funds are known to have been used to repay existing borrowings. Sono International reached the maturity of a 70 billion KRW loan borrowed from Shinhan Bank with a five-year term during the former Daemyung Hotel & Resort era. This secured loan, which was to be repaid in 10 installments, had about 47.5 billion KRW remaining after partial principal repayment.

T'way Air introduced an A330-300 aircraft capable of flying over 100,000 km at Gimpo International Airport on the 17th. The A330-300, with 347 seats, is a model suitable for medium- to long-haul routes. Photo by Airport Photographers Group

T'way Air introduced an A330-300 aircraft capable of flying over 100,000 km at Gimpo International Airport on the 17th. The A330-300, with 347 seats, is a model suitable for medium- to long-haul routes. Photo by Airport Photographers Group

Daemyung Sono Group is also reportedly pushing to raise funds worth several hundred billion KRW through a certain securities firm. Although the specific use of the funds has not been confirmed, it is said that the money will be used for acquiring large overseas resorts. As of the end of last year, Daemyung Sono Group held cash-equivalent assets worth 400 billion KRW, and its aggressive external fundraising has sparked various speculations in the stock market.

Recently, there have been rumors about acquiring management rights of T'way Air. In June, Sono International purchased 32,091,467 common shares (14.90%) of T'way Air held by the private equity fund JKL Partners (JKL PE) at 3,290 KRW per share, paying 105.6 billion KRW. During the initial share purchase process, Sono International also borrowed 50 billion KRW from Daemyung Station, a group affiliate in the funeral services sector. This caused controversy as the advance payments from customers in the funeral business were borrowed and used as funds to acquire airline shares.

Two months later, in August, another affiliate, Daemyung Sono Season, exercised a call option to acquire the remaining 11.87% stake from JKL PE for 70.8 billion KRW. Through these two rounds of share purchases, Daemyung Sono Group's stake in T'way Air reached 26.77%, making it the second-largest shareholder. The gap with the largest shareholder, T'way Holdings (29.99%), has narrowed to 3.2%.

Currently, T'way Holdings holds 29.99% of T'way Air shares together with its related parties. Among them, Yelimdang and Vice Chairman Na Seong-hoon hold 46.94% of T'way Holdings. The governance structure flows from Yelimdang → T'way Holdings → T'way Air.

Within the related industry, there are expectations that Daemyung Sono Group might launch a public tender offer for T'way Air, similar to the dispute involving Korea Zinc. However, Daemyung Sono Group maintains the position that "there will absolutely be no public tender offer." Although acquiring shares from specific shareholders is also being discussed, there are currently no institutional investors holding more than 5% of shares.

An IB industry official said, "It is unlikely that Daemyung Sono Group will remain as the second-largest shareholder after investing large-scale funds to acquire T'way Air shares," adding, "They are expected to secure management rights soon by either launching a public tender offer or signing share purchase agreements with other shareholders to acquire additional shares."

However, the official also noted, "During the four months since Daemyung Sono Group first purchased T'way Air shares, no defensive moves from the major shareholder Yelimdang to protect management rights have been detected," and added, "It is possible that they are moving quietly behind the scenes to avoid stock price increases or that the shares were acquired with an agreement with Yelimdang."

There are also observations that the funds are for acquiring overseas resorts and hotels. In April, Sono International consecutively acquired the Hawaii Waikiki Resort of Hanjin Group and hotels in the United States and France. It is analyzed that Chairman Seo Jun-hyuk, the second-generation leader of Daemyung Sono Group, is securing funds for additional overseas investments.

An industry insider said, "T'way Air inherited four European routes due to the merger of Korean Air and Asiana Airlines," and added, "Chairman Seo appears to be drawing a plan to expand domestic and overseas resort and hotel investments while securing management rights of T'way Air to seek synergy between leisure and airline businesses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)