61,300 KRW → 59,300 KRW

23 Consecutive Trading Days of Net Selling Since September

Many Negative Evaluations on Samsung Electronics' Rebound

Foreign investors sold more than 1 trillion KRW worth of Samsung Electronics shares in October alone. They have been continuously net selling for 23 trading days since September 3, relentlessly driving the stock price down.

According to the Korea Exchange on the 14th, foreign investors net sold 1.9408 trillion KRW of Samsung Electronics shares from October 2 to 11. During the same period, institutions sold 262.1 billion KRW, while individuals bought 2.1573 trillion KRW.

The foreign investors' trading trend shows that investment sentiment is extremely subdued. From September 3 to October 11, foreign investors net sold Samsung Electronics shares worth 10.6993 trillion KRW every single trading day for 23 consecutive days. In contrast, individuals and institutions net bought 10.2109 trillion KRW and 190.6 billion KRW worth of shares, respectively, during the same period.

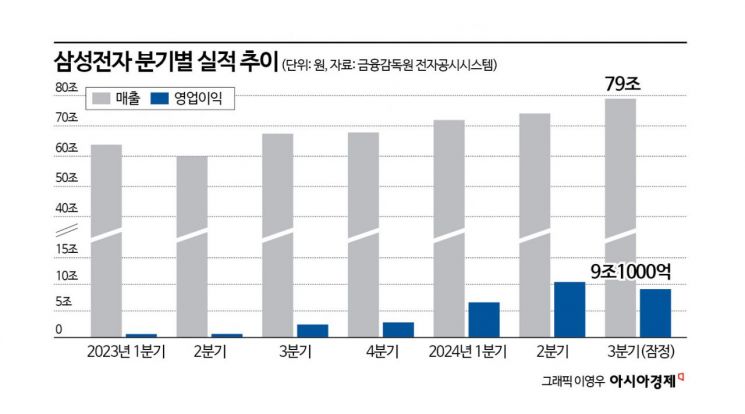

The stock price also collapsed from 72,500 KRW (closing price on September 3) to 69,000 KRW within two trading days. Subsequently, due to foreign investors' selling pressure, Samsung Electronics ended at "50,000 KRW level" on October 10. This is 25.5% lower than the price at the first trading day of this year, which was 79,600 KRW.

The outlook on Samsung Electronics is generally negative. Securities firms have been continuously lowering their target prices. Recently, some reports have evaluated that Samsung Electronics' stock price has hit bottom but expressed negative opinions on buying.

The reasons for the negative view on Samsung Electronics can be summarized into four main points. First, concerns and debates over a peak-out in the global semiconductor industry have intensified. This has led to a downward revision of earnings expectations across the global semiconductor sector. The current lukewarm stock price and supply-demand situation are interpreted in this context.

Seung-yeon Seo, a researcher at DB Financial Investment, stated, "Amid weak B2C (business-to-consumer) demand, resistance to memory price cuts from set customers is inevitable," and added, "Samsung Electronics' operating profit for Q4 is expected to be 9.9 trillion KRW."

The second point is the manufacturing industry cycle. Samsung Electronics has a strong position as an intermediate goods supplier in the global tech value chain. As a company specialized in legacy semiconductors, the recovery of the global manufacturing investment cycle is considered a prerequisite for a stock price rebound. This issue should reflect the cumulative effects of major countries' interest rate cut cycles and the proactive fiscal stimulus and trickle-down effects following the inauguration of the new U.S. administration.

The third point is supply and demand. Samsung Electronics' supply-demand dynamics are controlled not by domestic investors (individuals and institutions) but by foreign investors. Currently, foreign investors hold 53.3% of Samsung Electronics shares, exceeding the long-term average of 51.9%. Yong-gu Kim, a researcher at Sangsangin Securities, analyzed, "In the triple hardship phase of intensified global semiconductor peak-out debates, weakening industrial competitiveness of Samsung Electronics, and deepening earnings uncertainty, foreign investors' supply-demand response is likely to follow a neutral or below-neutral path for the time being."

He added, "While voices advocating the justification and urgency of bargain buying based on the excessive drop in Samsung Electronics' stock price and Vice Chairman Young-hyun Jeon’s apology letter are growing, this is a fragmented tactical response limited to a very small number of ultra-long-term individual investors who can afford a prolonged time battle and have limited additional opportunity costs from holding Samsung Electronics shares."

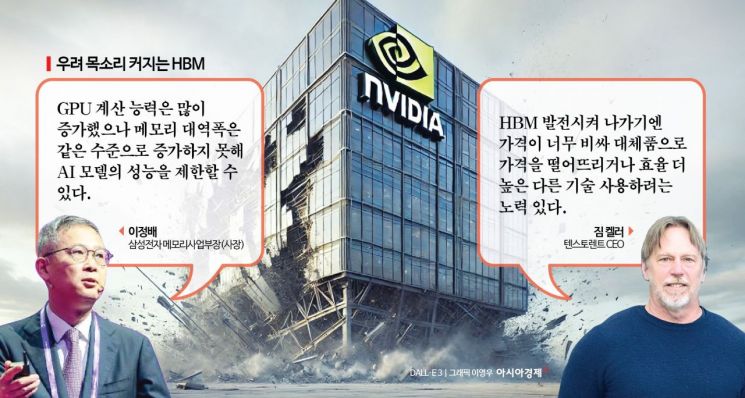

Lastly, the worsening performance and stock momentum gap in HBM semiconductors compared to SK Hynix is also a problem. The earnings momentum gap, which precedes the relative stock price of Samsung Electronics to Hynix, is trending toward SK Hynix’s relative advantage expanding.

Jaewon Lee, a researcher at Shinhan Investment Corp., explained, "Following TSMC’s strong earnings announcement, U.S. semiconductor stocks and SK Hynix are rising together, but Samsung Electronics, which does not benefit from artificial intelligence (AI), is being left out," and added, "As shown in Vice Chairman Jeon Young-hyun’s apology letter and the investor relations (IR) materials, HBM supply will be an important variable going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.