Korea Zinc is projected to have a debt ratio of 244.7% by 2030, even if it generates an annual cash flow of 1.2 trillion KRW over the next six years. This calculation takes into account the repayment of borrowings from the treasury stock tender offer, interest and dividends, corporate taxes, investment and maintenance costs for smelting facilities, and investment costs related to Troika Drive.

On the 12th, MBK Partners stated, "Korea Zinc claims that with an average annual cash generation of 1.2 trillion KRW, its debt ratio will decrease to 20% six years after the treasury stock tender offer in 2030, but this is an unrealistic assertion."

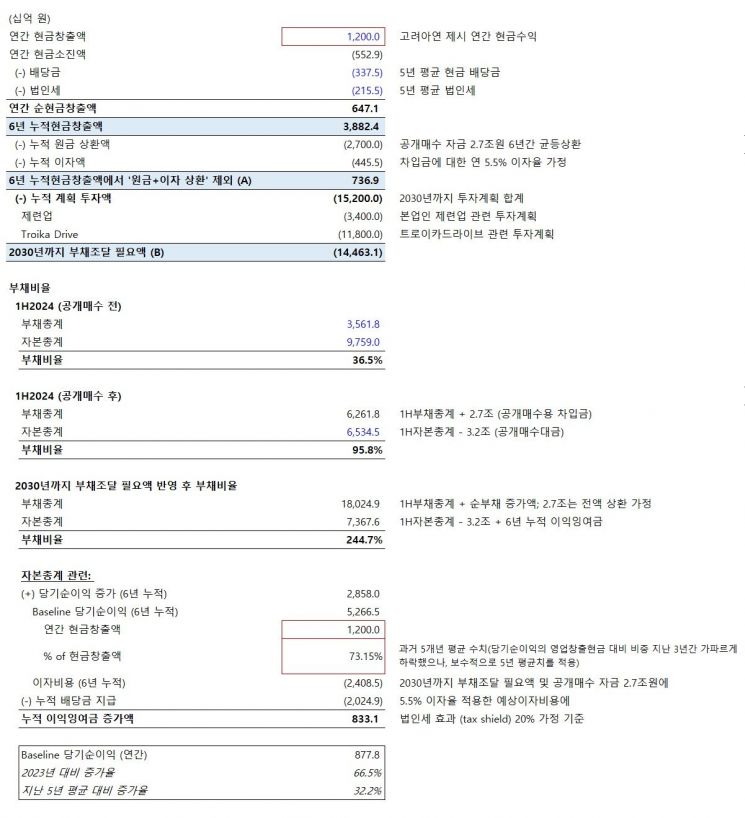

Assuming Korea Zinc generates 1.2 trillion KRW in cash annually for the next six years as announced, and considering the average annual dividends and corporate tax payments over the past five years, as well as principal repayments and interest payments on borrowings of 2.7 trillion KRW, the cumulative cash generated over six years amounts to 736.9 billion KRW (A).

Adding the planned investment of 15.2 trillion KRW in smelting operations and Troika Drive from 2024 to 2030, as per Korea Zinc's IR materials, the required debt financing by 2030 totals 14.4631 trillion KRW (B).

Before the treasury stock tender offer, Korea Zinc's consolidated debt ratio was 36.5% as of the end of the first half of 2024 (1H2024). Reflecting the increase in borrowings and decrease in equity due to the treasury stock tender offer, the debt ratio rises to 95.8%. Furthermore, considering the required debt financing (B) until 2030, i.e., the cumulative net increase in debt, Korea Zinc's debt ratio will rise to 244.7% by 2030.

MBK commented, "To reduce the debt ratio to the 20% range six years after the treasury stock tender offer as Korea Zinc claims, cash expenditures must be minimized by halting investments related to the core smelting business and Troika Drive, and only repaying borrowings from the treasury stock tender offer. This essentially means disregarding the company's present and future to preserve Chairman Choi Yoon-beom's position."

On the 8th, Korea Ratings stated in a special comment that Korea Zinc plans to purchase all tendered shares even if the number of shares tendered is below the target quantity, which could require up to 2.7 trillion KRW in funding. If treasury stocks are acquired and canceled as targeted, the debt ratio is expected to sharply increase from 36.5% as of the end of June 2024 to around 86%, and the net debt/EBITDA ratio is expected to reach 1.6 times, significantly exceeding the current downgrade thresholds.

Meanwhile, Korea Zinc's projections of debt ratios under MBK and Youngpoong management were also criticized for lacking validity. MBK's investment returns come from an increase in Korea Zinc's corporate value, i.e., stock price appreciation, which differs from private loan investors like Bain Capital Credit who require principal and interest payments from Chairman Choi's side to meet target internal rates of return.

Additionally, since MBK will hold a maximum of only 25% equity on its own, it is not possible for MBK alone to receive special dividends through asset sales and borrowings from Korea Zinc. MBK maintains that it will continue the existing dividend policy and increase dividends per share alongside the company's profit growth, so this claim is also considered a distorted assertion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.