Seoul Apartment Sales Up 0.03% · Jeonse Prices Up 0.02%

Expectations for Base Rate Cut, Limited Impact on Capital Region Housing Prices Anticipated

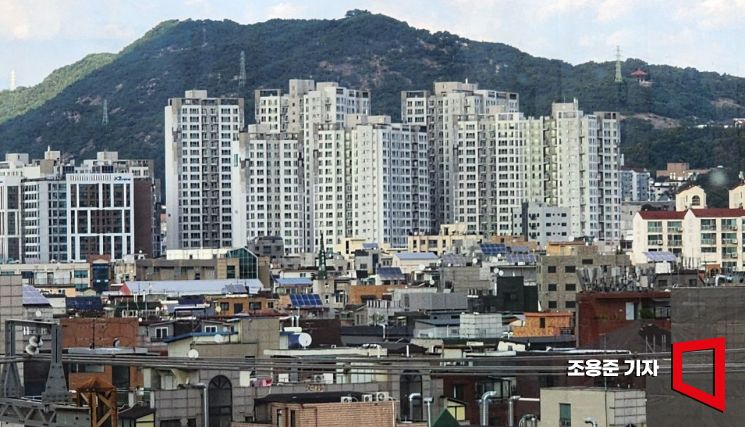

Seoul Walking Column - A residential complex in downtown Seoul where apartments and houses coexist. Photo by Yongjun Cho jun21@

Seoul Walking Column - A residential complex in downtown Seoul where apartments and houses coexist. Photo by Yongjun Cho jun21@

The sale prices of reconstruction apartments in Gangnam, Seoul, rose by 0.07% compared to the previous week, marking the largest weekly increase in 2 years and 5 months.

This week alone, Woosung 4th Complex in Jamsil-dong, Songpa-gu, which recently reached its previous peak price, jumped by about 75 million KRW, while Jugong Gocheong 6th Complex in Gaepo-dong, Gangnam-gu, and Sinbanpo 7th Complex in Jamwon-dong, Seocho-gu, also increased by 30 to 50 million KRW, expanding the rise.

The strong housing prices are understood to be driven by asset owners with low loan dependency actively purchasing mainly in Seoul Gangnam area redevelopment projects, where supply is scarce and future asset value appreciation is expected.

The apartment sale prices in Seoul increased by 0.03%, expanding the rise from the previous week. Reconstruction apartments rose by 0.07%, and general apartments increased by 0.02%.

New towns recorded a flat trend (0.00%) for three consecutive weeks, showing limited price movement. Gyeonggi and Incheon were adjusted upward by 0.01%.

In Seoul, among all 25 districts, there were no areas with price declines, with notable increases centered on large-scale apartments in the northeastern area and redevelopment projects in Gangnam.

By individual areas, Dongdaemun (0.08%), Gangnam (0.07%), Gwangjin (0.06%), Seongdong (0.04%), Seongbuk (0.03%), Mapo (0.03%), and Gangdong (0.03%) showed price increases.

In new towns, Paju Unjeong Dongpae-dong and Dayul-dong saw a 0.01% rise mainly in newly built apartments, and Bundang was adjusted upward by 0.01% with Seohyeon-dong’s Shibeom Hanyang, Shibeom Samsung, and Hanshin complexes rising by 1 to 2.5 million KRW.

In Gyeonggi and Incheon, Uijeongbu (0.03%) and Suwon (0.03%) increased, while Bucheon declined by 0.01% as Sangdong Lilac Sinsung Misojium and Chunui-dong Unam Prumia fell by 2.5 to 5 million KRW.

The jeonse (long-term lease) market maintained the same rate of increase as last week. In Seoul, jeonse prices rose by 0.02%, mainly for apartments priced below 600 million KRW. New towns and Gyeonggi·Incheon each increased by 0.01%.

Among Seoul’s individual areas, Dongdaemun (0.10%) showed the largest weekly increase of 0.10%. Next were Mapo (0.04%), Seongbuk (0.03%), and Gangnam (0.03%). In new towns, Dongtan rose by 0.06%, while other areas remained flat (0.00%).

In Gyeonggi and Incheon, increases were mainly seen in Ansan (0.09%), Incheon (0.04%), Uijeongbu (0.03%), Suwon (0.02%), and Guri (0.02%).

A representative from Real Estate R114 stated, "On October 11, the Bank of Korea held a Monetary Policy Committee meeting and decided to lower the base interest rate by 0.25 percentage points to 3.25%. Although there are concerns that the rate cut could stimulate real estate investment sentiment due to increased liquidity, the timing of the rate cut had already been factored into the housing market as a given for the second half of this year."

He added, "Considering the strengthened loan regulations and increased financial burdens making it difficult for buyers to follow through, the impact of the base rate cut on the immediate housing prices in the metropolitan area is expected to be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)