Draft Budget Proposal for Next Year Released

The French government, suffering from a massive fiscal deficit, is finally embarking on an unprecedented austerity plan. The draft budget for next year aims to cut public spending by approximately 41.3 billion euros (about 60.96 trillion won) while increasing taxes on large corporations and the wealthy to secure an additional 19.3 billion euros (about 28.5 trillion won) in revenue. The goal is to reduce the fiscal deficit to below 5% of the Gross Domestic Product (GDP). However, it remains uncertain whether this budget will pass through the hung parliament. Criticism is also pouring in that this move deviates from President Emmanuel Macron’s long-standing pro-business policies.

"Unprecedented Single Austerity Measure" Draft of French Budget Released

The new French cabinet led by Prime Minister Michel Barnier unveiled the draft budget for 2025 on the 10th (local time). The budget includes measures to improve finances by 60 billion euros through public spending cuts and additional revenue from tax increases over the next year. This corresponds to about 2% of France’s annual GDP. Prime Minister Barnier emphasized the necessity of the austerity budget, saying, "Our fiscal deficit is serious," and "We cannot sacrifice the future of our children. We cannot keep writing bad checks that will fall on them."

First, the French government plans to cut spending by 41.3 billion euros in next year’s budget. Specifically, it will abolish programs encouraging companies to hire blue-collar unskilled workers (16 billion euros) and delay the timing of pension increases due to inflation from January 1 to six months later. Subsidies for medicine purchases, green subsidies for insulation materials and electric vehicle purchases, and foreign aid budgets will also be reduced. The number of public servants will be cut, with thousands expected to be laid off. The New York Times (NYT) reported, "This is the largest single austerity measure in modern French history," adding, "The biggest measure is the cut in public spending."

Antoine Armand, French Minister of Economy and Finance (right), and Laurent Saint-Martin, Minister in charge of the budget, announcing the 2025 budget plan

Antoine Armand, French Minister of Economy and Finance (right), and Laurent Saint-Martin, Minister in charge of the budget, announcing the 2025 budget plan [Image source=AFP Yonhap News]

Temporary Tax Increase on Large Corporations and the Wealthy

The budget also includes previously announced tax increase measures. The additional revenue from these tax hikes is expected to total 19.3 billion euros. The French government will temporarily raise corporate taxes on profits for 2024 and 2025 for large corporations with annual sales exceeding 1 billion euros. Corporate tax rates will be increased by 20.6% for companies with sales between 1 billion and 3 billion euros, and by 41.2% for those with sales over 3 billion euros. Approximately 400 companies are expected to be affected by this temporary corporate tax increase.

Additionally, a one-time tax will be imposed on the top 0.3% of ultra-high-income earners. For single-person households, this applies to those with annual incomes exceeding 250,000 euros, and for couples without children, those exceeding 500,000 euros. The minimum income tax rate will be adjusted to 20% for these taxpayers. The government estimates that about 65,000 households will contribute approximately 2 billion euros this year. This tax will apply starting from income earned this year through income in 2026.

The environmental tax on new cars that cause pollution above a certain threshold will be increased sevenfold. The French government is also pushing to raise taxes on airline tickets and private jets. Currently, France imposes a tax of 2.6 euros per flight, which government officials say is lower than in the UK and Germany. The electricity tax, which had been reduced to near zero following the surge in energy prices after Russia’s invasion of Ukraine, is also expected to be restored to a higher level than before.

Why Is France Tightening Its Belt?

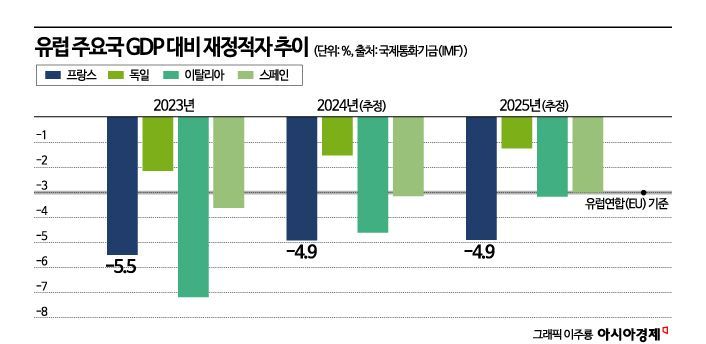

The reason behind France’s large-scale austerity is its particularly high fiscal deficit within Europe. Last year, France’s fiscal deficit reached 5.5% of GDP, and it was expected to exceed 6% this year if the current trend continued. As the situation showed little sign of easing, the EU issued a warning in June that the fiscal deficit was excessive. The EU regulates that member states’ debt and fiscal deficits should not exceed 60% and 3% of GDP, respectively, because the financial deterioration of one member can affect others. If a member state refuses to amend its budget according to EU rules, fines and other penalties may be imposed.

Accordingly, the new cabinet led by Prime Minister Barnier plans to reduce the fiscal deficit to below 5% through next year’s budget. The goal is to align with the EU’s 3% rule by 2029. Laurent Saint-Martin, Minister Delegate for Budget at the Ministry of Economy and Finance, emphasized, "The deficit worsened due to excessive spending, so we will solve it by cutting expenditures." He added, "Our effort of 60 billion euros is unprecedented in scale. To avoid painful choices later, we must make courageous choices now."

However, it is uncertain whether the new budget will pass parliament. Since the early general election in July, a hung parliament has been formed in France, with no party holding an outright majority, leading to political deadlock. The appointment of the next prime minister also faced difficulties for over two months. In this situation, the approval of this budget will be the first test for the Barnier cabinet.

There are also concerns that the budget could hinder economic growth. Former Prime Minister Gabriel Attal criticized, "There are too many tax increases," and said, "This deviates from President Macron’s pro-business policies." Local media pointed out that since the budget includes not only public spending cuts but also tax increases such as higher electricity taxes, all taxpayers, not just corporations and the wealthy, will inevitably be affected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)