"3 Years of Innovation Impacting the Entire Financial Services Sector"

Toss Bank has celebrated its 3rd anniversary since its launch. It stated that the innovations achieved over the past three years have impacted not only individual products but also the overall financial services enjoyed by customers.

Among the major innovations, it highlighted the ‘freedom of interest’ and ‘freedom of currency exchange.’ Since launching ‘Receive Interest Now,’ 5.9 million customers have been able to receive a total of 574 billion KRW in interest. Until now, the bank-friendly rule of ‘interest is paid once a month on a fixed date’ was common. However, at Toss Bank, customers can receive interest daily, whenever they want, with just one click. Through the ‘Receive Interest First Time Deposit,’ customers can receive interest immediately upon depositing money, and the ‘Split Savings Account’ allows customers to enjoy daily compound interest automatically. The same applies to currency exchange. Toss Bank, which claims to have provided a free currency exchange experience worth a total of 13 trillion KRW to about 1.62 million customers, revealed that it saved 130 billion KRW in fees.

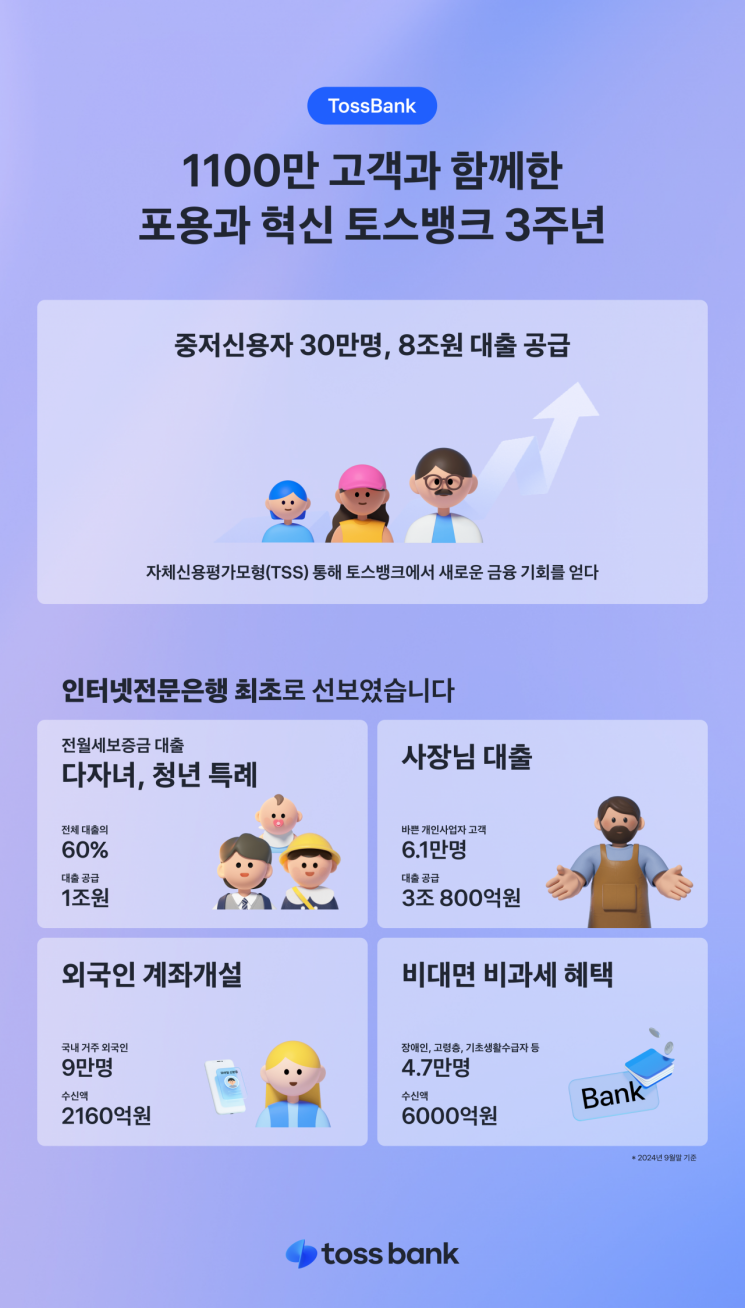

Toss Bank has also focused on inclusive finance over the past three years. It explained that it developed products and services that all customers can participate in regardless of asset size, gender, occupation, skin color, disability status, from youth to elderly, from multi-child families to self-employed individuals. Toss Bank, the first internet bank to introduce loans for sole proprietors, supplied 3.08 trillion KRW in loans to about 61,000 small business owners and sole proprietors who find it difficult to visit bank branches due to busy work schedules through the ‘Boss Loan.’

With its advanced proprietary credit evaluation system, Toss Bank maintains the highest proportion of low-to-medium credit customers (about 34%) among internet banks. It supplied 8 trillion KRW in loans to 300,000 sound low-to-medium credit customers, including startup youth, and customers who used Toss Bank’s refinancing loan service from the secondary financial sector enjoyed an average interest rate reduction of more than 4.1 percentage points. This translates to an average annual interest saving of about 410,000 KRW per person.

The ‘Together Loan,’ launched in collaboration with Gwangju Bank, supplied 70 billion KRW within a month. As the first innovative financial product co-developed by an internet bank and a regional bank, Toss Bank combined its machine learning-based proprietary credit evaluation model with Gwangju Bank’s loan handling and post-management experience to establish the banking sector’s first customer-oriented win-win model. Toss Bank explained that this contributed to coexistence with local regions facing the ‘extinction’ problem.

Toss Bank’s efforts to examine and solve social issues have led to the expansion of positive influence. Examples include policies that proactively protect customers from various financial crimes such as voice phishing, secondhand transaction fraud, and jeonse fraud. Through the compensation policy ‘Safe Compensation System,’ introduced and operated for customers who suffered financial fraud, 5,565 customers were able to recover from 3.7 billion KRW in financial fraud damages. The fraud suspicion siren, which activates when a transfer attempt is made to accounts with a history or suspicion of fraud, sounded a total of 560,000 times, preventing 152.4 billion KRW in suspected fraudulent transfers.

Lee Eun-mi, CEO of Toss Bank, said, “Relentless innovation, boundless inclusion, and the expansion of positive influence are words that succinctly represent the achievements Toss Bank has made over the past three years.” She added, “As Toss Bank symbolizes a bank that changes banks, we will continue sustainable innovation based on trust while preserving these values.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)