Financial Market Trends in September

Slowing Growth in Household and Mortgage Loans

Impact of Government's Strengthened Loan Regulations

Due to the government's strengthened loan regulations, the growth of household loans and mortgage loans in the banking sector slowed down last month.

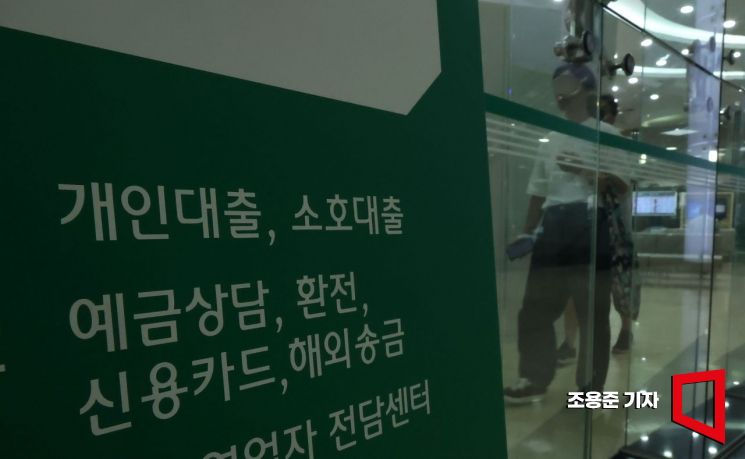

Commercial banks are raising mortgage loan interest rates one after another to slow down the pace of household loan growth. On the 3rd, a loan information board was posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Jo Yongjun jun21@

Commercial banks are raising mortgage loan interest rates one after another to slow down the pace of household loan growth. On the 3rd, a loan information board was posted at a commercial bank branch in Euljiro, Jung-gu, Seoul. Photo by Jo Yongjun jun21@

According to the 'Financial Market Trends in September' released by the Bank of Korea on the 11th, mortgage loans in the banking sector increased by 6.2 trillion won compared to the previous month. This is a significant reduction from the 8.2 trillion won increase in the previous month. Mortgage loans in the banking sector have been increasing for 1 year and 7 months since March last year.

The Bank of Korea explained that the substantial reduction in the increase of mortgage loans was due to the combined effects of the government's macroprudential policy strengthening, banks' efforts to manage household loans, preemptive demand ahead of last month's loan regulations, and temporary and seasonal factors such as the Chuseok holiday in September.

Household loans in the banking sector, including mortgage loans and other loans, increased by 5.7 trillion won compared to the previous month. The growth rate significantly slowed compared to the previous month (9.2 trillion won). Bank household loans have been increasing for six consecutive months since April.

Other loans turned to a decrease of 500 billion won due to the resolution of temporary increase factors such as the summer vacation season and demand for stock investment funds in the previous month, inflow of Chuseok bonuses, and the effects of quarter-end bad debt sales and write-offs.

Meanwhile, corporate loans in banks increased by 4.3 trillion won in September compared to the previous month, showing a reduced growth scale from the previous month (7.2 trillion won). Loans to large corporations showed only a slight increase due to temporary repayments for quarter-end financial ratio management despite some companies' demand for facility funds. Loans to small and medium-sized enterprises slowed in growth compared to the previous month due to the effects of bad debt sales and write-offs despite demand for Chuseok funds and facility funds.

Bank deposits last month increased by 18.9 trillion won compared to the previous month, maintaining a high growth rate. Demand deposits continued to increase significantly due to corporate fund inflows for quarter-end financial ratio management, and time deposits maintained an increasing trend despite the expansion of maturities, thanks to banks' efforts to attract deposits, according to the Bank of Korea.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)