"Seoul Housing Prices Already Increased Reflecting Anticipation of Interest Rate Cuts"

"High Proportion of Fixed-Rate Mortgages Limits Impact of Base Rate Cuts"

"Loan Regulations Like Stress DSR Phase 2 More Influential on Housing Prices"

Although the Bank of Korea lowered the base interest rate by 0.25 percentage points for the first time in 3 years and 2 months, experts predict that "the impact of the rate cut on this year's Seoul real estate market will be minimal." The expectation of a rate cut has already been reflected in housing prices in advance. In particular, the baby step (0.25 percentage point cut) is seen as too weak to further drive up Seoul housing prices. Unlike financial authorities who were concerned about a rise in housing prices due to the rate cut, the market is analyzing that the possibility of obtaining loans is considered more important than changes in the interest rate policy.

"Limited Impact of Base Rate Cut on Seoul Housing Prices This Year"

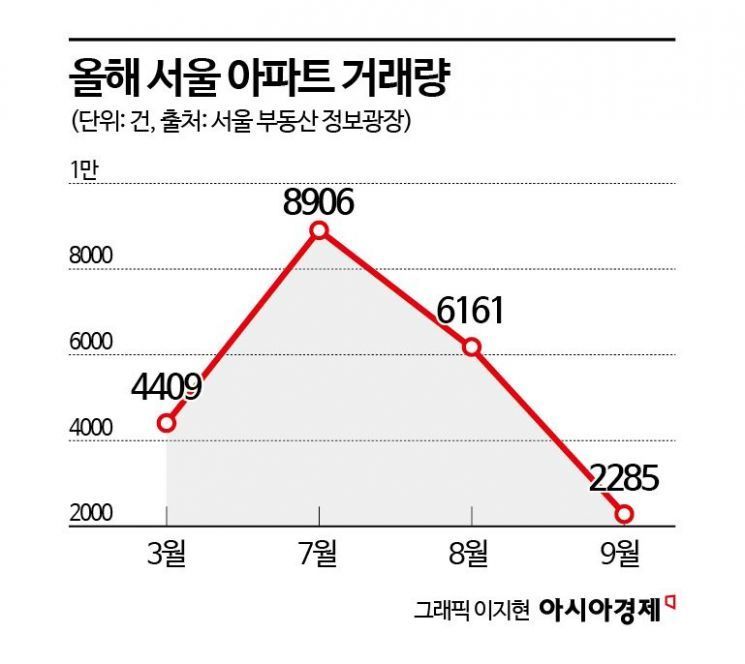

On the 11th, Park Won-gap, Senior Real Estate Specialist at KB Kookmin Bank, analyzed, "Recently, mortgage loan interest rates at commercial banks have dropped to the lowest level in the 2% range annually (2.9% in June)." He added, "As a result, apartment transaction volume in Seoul peaked in July." He continued, "Due to buyers' cautious stance recently, transaction volume is decreasing, and accordingly, the rate of housing price increase is also slowing down. This trend is expected to continue until the end of the year regardless of the rate cut."

According to the Seoul Real Estate Information Plaza, the number of apartment transactions in Seoul surpassed 4,000 in March with 4,408 cases and rose to the highest level this year in July with 8,894 cases. After that, transaction volume declined to 6,144 in August and 2,172 last month.

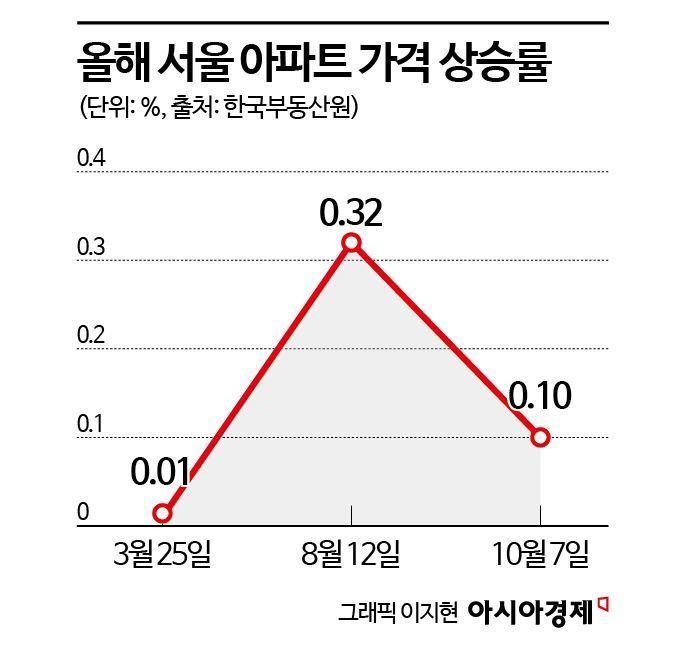

The rate of housing price increase is also slowing. According to the Korea Real Estate Board, Seoul apartment prices have been rising for 29 consecutive weeks since the fourth week of March. However, the rate of increase peaked at 0.32% in the second week of August and began to decline, recording 0.10% this week.

Kim Hyo-sun, Senior Real Estate Specialist at NH Nonghyup Bank, also said, "There has been a forecast throughout this year that interest rates would be lowered," adding, "This expectation has been reflected in advance, leading to the recent rise in Seoul housing prices."

Uncertain Whether Financial Costs Will Decrease Even If Base Rate Is Lowered

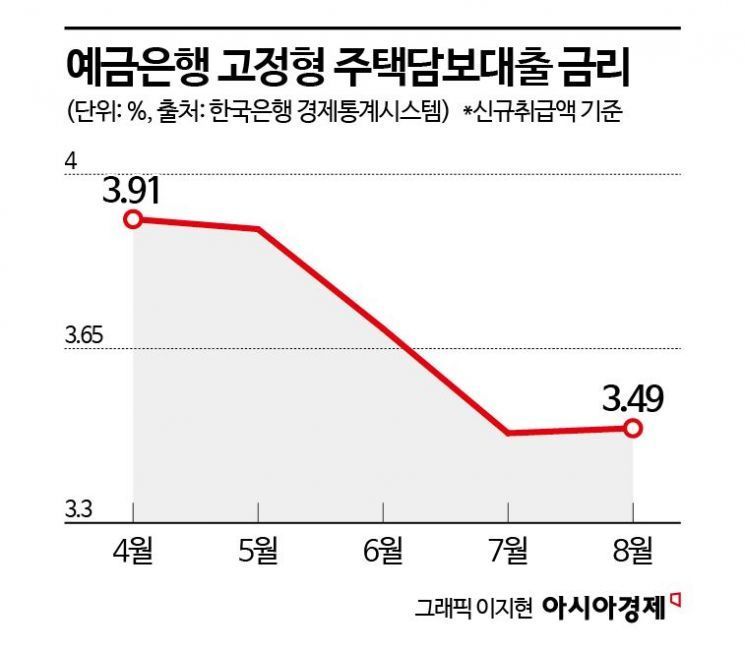

Experts said that even if the base rate is lowered, it is difficult for financial costs to decrease immediately. Specialist Kim said, "This year's loan interest rates were already low enough that they did not have to move in tandem with the base rate," adding, "Due to the authorities' household debt management policy, it will be difficult for already low loan interest rates to decrease further."

According to the Bank of Korea Economic Statistics System, the gap between the average mortgage loan interest rate (fixed type) at deposit banks based on new loan amounts and the base rate (previously 3.50%) has been narrowing. The mortgage loan rate was 3.91% in April but gradually decreased and fell below the base rate in July (3.48%).

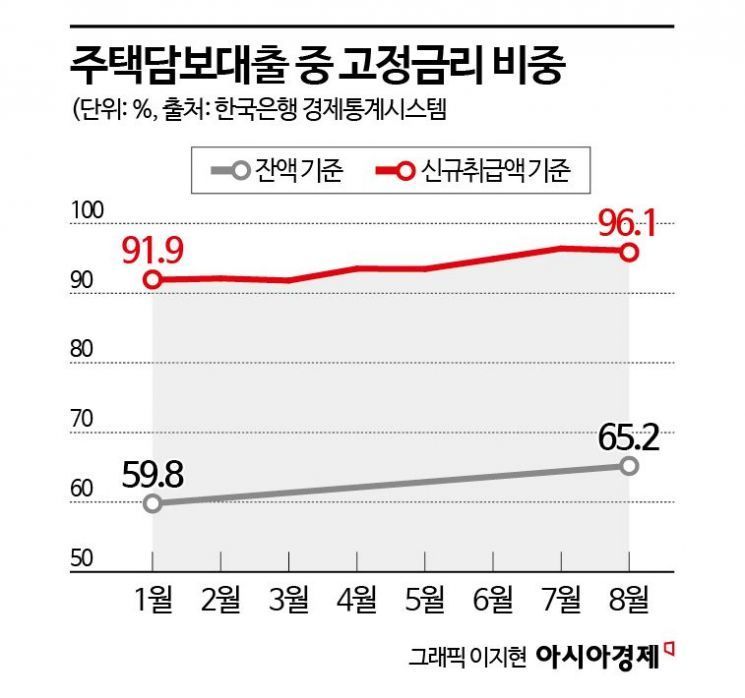

There is also an analysis that the impact of the base rate cut is limited because the proportion of fixed-rate mortgages is high. Specialist Park said, "Looking at recent mortgage loan statistics, the proportion of fixed-rate loans is higher," adding, "This means that the impact of interest rate fluctuations is relatively less, and loan regulations will have a greater effect than interest rates." According to the Bank of Korea Economic Statistics System, the proportion of fixed-rate mortgages based on outstanding balance increased monthly from 59.8% in January to 65.2% in August. Based on new loan amounts, the fixed-rate proportion exceeds 90% every month.

Experts believe that loan regulations by financial authorities have a greater impact on the real estate market than the base rate policy. Specialist Park said, "In key areas of housing price increases such as the three Gangnam districts in Seoul or Mayongsung (Mapo-gu, Yongsan-gu, Seongdong-gu), prices are high, so the possibility of obtaining loans is more important than interest rates," adding, "Recent real estate research papers also show that in the Seoul housing market, loan variables have a stronger correlation than interest rate variables."

Ham Young-jin, Head of Real Estate Research Lab at Woori Bank, said, "Loan regulations by authorities have a greater impact on housing prices than the base interest rate." He explained, "Last month, the government implemented the second phase of the Debt Service Ratio (DSR) stress test and reduced the loan limit for living safety funds for multi-homeowners (from 200 million KRW to 100 million KRW). Also, conditional ownership transfer jeonse loans were suspended to prevent gap investments," adding, "In this situation, while a rate cut can reduce borrowers' interest burdens, it is difficult for it to directly raise housing prices or increase transaction volume."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)