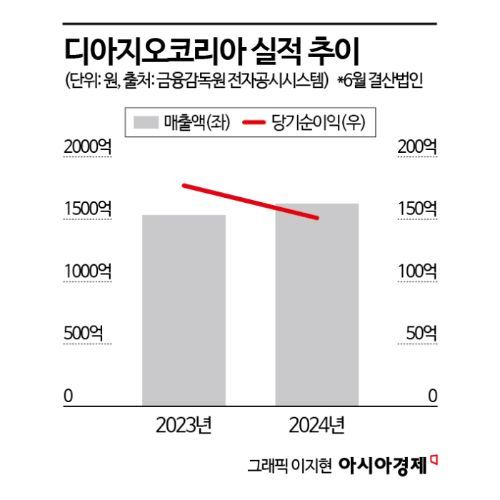

Diageo, 6% Sales Increase Last Year... 15% Decrease in Net Profit

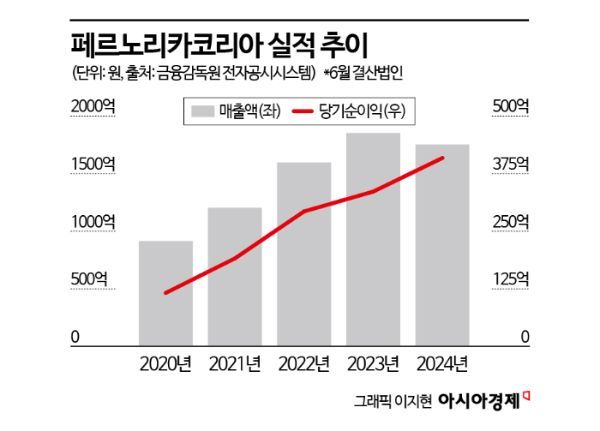

Pernod Ricard Responds to Sales Decline by Reducing Costs

Market Response Expected with Diverse Liquor Types and Brands

Diageo Korea and Pernod Ricard Korea, the two leading companies in the domestic whiskey market, recorded contrasting performances last year. While Diageo Korea focused on increasing sales through lineup expansion, Pernod Ricard Korea concentrated on improving profitability by reducing costs. As the popularity of single malt whiskey, which has driven the whiskey market in recent years, wanes and 'mixology'?mixing various beverages with alcohol?becomes a staple drinking culture, both companies are expected to respond by introducing new types of liquor and brands alongside their existing flagship brands.

According to the Financial Supervisory Service's electronic disclosure system (DART) on the 11th, Diageo Korea, a corporation with a fiscal year ending in June, reported sales of 162.49241 billion KRW for the 2023 fiscal year (July 2023 to June 2024), a 5.9% increase compared to the previous year (153.36888 billion KRW). However, net profit for the period was 15.1349 billion KRW, down 14.7% from the previous year (17.74861 billion KRW).

In July 2022, Diageo Korea spun off all businesses except for the local whiskey brand 'Windsor.' The former Diageo Korea, which retained only the Windsor business unit, changed its name to 'Windsor Global,' and the newly established company was named Diageo Korea. This is the second set of financial results since the spin-off.

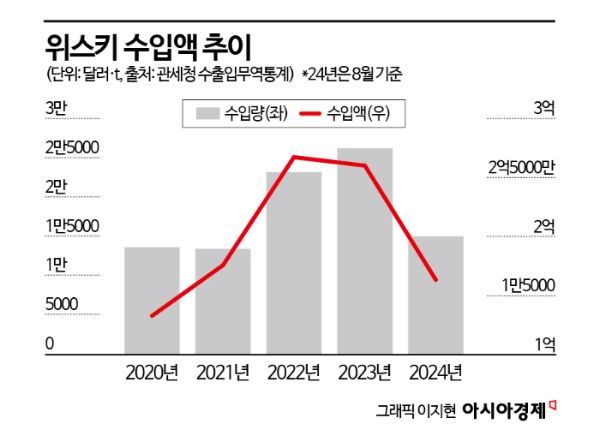

Diageo Korea, which owns flagship brands such as 'Johnnie Walker,' 'Lagavulin,' 'Talisker,' and 'Singleton,' has continued quantitative growth fueled by the clear rise in whiskey popularity over recent years. According to customs import-export trade statistics, domestic whiskey import value, which was about 132.47 million USD (approximately 179 billion KRW) in 2020, nearly doubled to 259.67 million USD (approximately 350 billion KRW) last year. Import volume also significantly increased from 15,922 tons to 30,586 tons during the same period. Although imports as of August this year were 162.89 million USD (approximately 220 billion KRW), down 10.8% from the same period last year (182.66 million USD), the level remains high compared to previous years.

Although Diageo Korea succeeded in growing sales for two consecutive years after the spin-off, profitability showed some weakness. Selling and administrative expenses for this fiscal year rose 16.3% to 87.6 billion KRW compared to the previous fiscal year. Among these, advertising expenses, the largest portion, increased 17.0% from 42.4 billion KRW to 49.6 billion KRW, and salaries rose 64.3% from 11.2 billion KRW to 18.4 billion KRW.

Diageo Korea is responding to the decline in profitability by raising prices. Starting in July, when the new fiscal year began, the company increased prices of five alcoholic products, including whiskey and tequila, by an average of 18%. The company explained this as an unavoidable decision to maintain consistent pricing policies across countries. Previously, in December last year, Diageo Korea also raised prices of Johnnie Walker Red, Green, 18-Year, and Guinness Draft by 5-9%.

Meanwhile, Pernod Ricard Korea, which owns brands such as 'Ballantine's' and 'Royal Salute,' posted contrasting results compared to Diageo Korea. Pernod Ricard Korea, also a corporation with a fiscal year ending in June, reported sales of 175.16164 billion KRW for the 2023 fiscal year, a slight decrease of 5.4% from the previous year (185.26087 billion KRW). However, net profit increased by 21.7% to 40.9 billion KRW from 33.6 billion KRW a year earlier. Selling and administrative expenses decreased by about 7.5%, from 86.6 billion KRW to 80.1 billion KRW, including a reduction in advertising expenses from 54.6 billion KRW to 48.7 billion KRW, offsetting the sales decline through cost reduction.

While the popularity of single malt whiskey, which led the recent whiskey boom, has relatively slowed, the popularity of highballs continues, prompting both companies to respond quickly to market trends with a variety of liquor types and brands beyond their existing flagship brands. An industry insider said, "As mixology becomes mainstream, highballs have now become a constant in the market," adding, "We expect not only diversification of whiskey lineups but also increased focus on other liquor types such as tequila, gin, and brandy."

In fact, Diageo Korea has been focusing on raising awareness of the tequila brand 'Don Julio' this year. The company is also putting effort into product diversification, such as launching 'Guinness 0.0,' a non-alcoholic version of the stout beer 'Guinness,' for the first time in Asia. Pernod Ricard Korea is also scheduled to introduce its first Scotch peat whiskey, 'Deacon,' to the domestic market this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.