KIRI Seminar on "2025 Insurance Industry Outlook and Challenges"

Next Year's Premium Growth Expected at 2.4%, Half of This Year's Level

"Insurers Must Adapt to Mega Trend Changes"

Next year, the insurance industry is expected to experience a slowdown in growth, weakening profitability, and deterioration in soundness. It is advised that insurance companies respond to changes in mega trends by establishing a growth foundation and transforming their business models.

Hwang In-chang, Head of Financial Market Analysis at the Korea Insurance Research Institute, stated at the "2025 Insurance Industry Outlook and Challenges" seminar held on the 10th at the Conrad Hotel in Yeouido, Seoul, "The growth rate of gross written premiums in the insurance industry next year is expected to be 2.4%, about half of this year's forecasted 4.7%." Gross written premiums refer to the premiums earned by insurance companies, equivalent to sales in manufacturing.

Ahn Cheol-kyung, President of the Korea Insurance Research Institute, is delivering the opening remarks at the seminar "2025 Insurance Industry Outlook and Challenges" held on the 10th at the Conrad Hotel in Yeouido, Seoul.

Ahn Cheol-kyung, President of the Korea Insurance Research Institute, is delivering the opening remarks at the seminar "2025 Insurance Industry Outlook and Challenges" held on the 10th at the Conrad Hotel in Yeouido, Seoul.

By sector, the growth rate of life insurance gross written premiums next year is expected to increase by only 0.3% compared to the previous year. Although the market dominance of health insurance portfolios is expected to expand, decreases in savings-type insurance and variable insurance are a concern. Hwang said, "Savings-type insurance premiums are expected to decline due to a reduction in new single-premium annuity insurance sales caused by falling interest rates," adding, "Variable insurance may see an expansion in new sales supported by a recovery in the stock market, but it will be difficult to escape the downward trend."

The growth rate of non-life insurance gross written premiums is expected to increase by 4.3% year-on-year. Hwang said, "Long-term non-life insurance is expected to show moderate growth centered on accident and sickness insurance, and automobile insurance will continue low growth if there is no premium adjustment," adding, "General non-life insurance will see moderate growth in fire insurance and continued high growth in marine and special insurance."

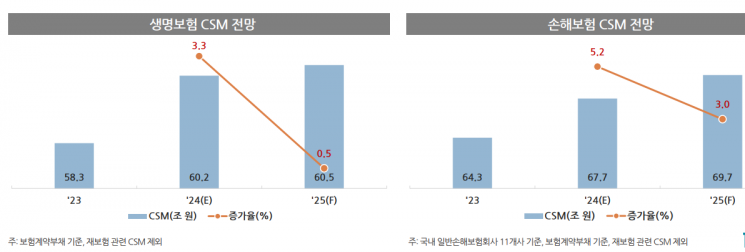

Under the new International Financial Reporting Standards (IFRS 17) system introduced last year, the insurance contract service margin (CSM), a key profitability indicator for insurers, is expected to increase for both life and non-life insurance this year and next, but the growth rate will gradually slow. The CSM for life insurance is estimated at KRW 60.2 trillion this year and KRW 60.5 trillion next year, with growth rates of 3.3% and 0.5%, respectively. For non-life insurance, the CSM is expected to be KRW 67.7 trillion this year and KRW 69.7 trillion next year, with growth rates of 5.2% and 3%, respectively.

Insurance companies' projected Contractual Service Margin (CSM) for next year. [Source: Korea Insurance Research Institute]

Insurance companies' projected Contractual Service Margin (CSM) for next year. [Source: Korea Insurance Research Institute]

Insurers’ soundness is also expected to worsen compared to this year. The decline in interest rates is anticipated to have a more negative impact on the solvency ratio (K-ICS) of life insurance than on non-life insurance. Hwang explained, "Considering the additional decline in available capital and the increase in interest rate risk amounts, the K-ICS will fall further next year," adding, "However, there will be significant variation depending on each insurer’s insurance product portfolio, asset composition, and risk management level."

There was also a suggestion that insurance companies should prepare future growth foundations in line with mega trend changes such as population, climate, and technological innovation. Jung Sung-hee, Head of Research Coordination at the Korea Insurance Research Institute, emphasized the need to expand business models into financial and non-financial markets in response to rising elderly support costs, platform-based services, and experience-oriented consumption tendencies. Jung advised, "As a method to convert assets into retirement income, securitization of insurance assets such as insurance claim trust and life insurance collateral loans should be considered," adding, "It is also necessary to strengthen investment capabilities and discover new investment destinations to enhance the role as institutional investors in response to asset formation demand for retirement preparation." Ahn Cheol-kyung, President of the Korea Insurance Research Institute, said, "Next year, the insurance industry will see changes such as a shift to low-interest monetary policy and improvements in the insurance system through the Insurance Reform Council," and added, "The long-term success of the insurance industry lies not only in overcoming the current crisis but also in preparing for the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)