September FOMC Minutes Released

Other Participants Besides Bowman Also Advocate Small Cuts

Strong Employment Likely to Slow Rate Cut Pace

November Hold Probability Rises to 20% Range

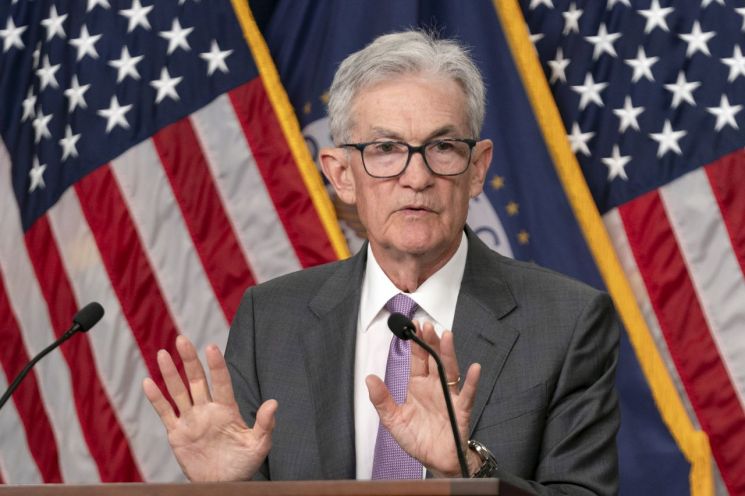

The U.S. Federal Reserve (Fed) implemented a 'big cut' (0.5 percentage point rate cut) in September, but it has been revealed that some members advocated for a 0.25 percentage point cut. The minutes of last month's Federal Open Market Committee (FOMC) meeting revealed differences of opinion among members regarding the pace of rate cuts, and with a surprising increase in employment in September, there is growing speculation that the pace of future rate cuts may slow down. Expectations that the Fed will hold rates steady next month have also increased significantly.

On the 9th (local time), the Fed released the minutes of the September FOMC meeting, stating, "Some participants preferred lowering the target range by 25 basis points (1bp = 0.01 percentage point) at this meeting, and several indicated they could support such a decision."

The minutes also noted, "Several participants mentioned that a 25bp cut would be consistent with a gradual path toward monetary policy normalization," adding, "This could give policymakers time to assess the degree of policy constraints as the economy progresses." Furthermore, "Some participants added that a 25bp cut would signal a more predictable path regarding policy normalization."

Previously, on the 18th of last month, the Fed initiated a monetary easing cycle by cutting the benchmark interest rate by 0.5 percentage points from 5.25?5.5% to 4.75?5.0% at the regular FOMC meeting. Of the 19 FOMC members, 12 have voting rights on rate decisions, and among them, only Michelle Bowman, a Fed governor, voted against the big cut. However, the release of the FOMC minutes last month revealed that many members advocated for a 0.25 percentage point cut (small cut) during the pre-vote discussions. This indicates significant differences in diagnosis and outlook on the U.S. economic situation among members.

The Fed ultimately decided on a 0.5 percentage point rate cut to balance progress on inflation and labor market risks. Some members argued that the Fed should have already started cutting rates in July when it held rates steady. Those advocating for the small cut believed that inflation was steadily declining but had less concern about a cooling labor market. Subsequent employment data showed that the U.S. labor market was more resilient than feared at the time of the big cut decision last month. According to the September employment report released by the U.S. Department of Labor on the 4th, nonfarm payrolls increased by 254,000 from the previous month, marking the largest increase in six months. This significantly exceeded the market forecast of 147,000 and the previous month's increase of 159,000.

In the market, differing views among Fed members on the pace of rate cuts and stronger-than-expected employment data have led to forecasts that the pace of future rate cuts may slow. Some also criticize that the Fed's big cut last month was overly aggressive.

Following the release of the FOMC minutes, expectations for a rate hold in November have increased. According to the Chicago Mercantile Exchange (CME) FedWatch tool, the federal funds futures market has priced in the probability of the Fed holding rates steady next month at 20.6%, up from 14.8% the day before. Just a week ago, the probability of a hold was 0%. The likelihood of a 0.25 percentage point rate cut in November has decreased from 85.2% to 79.4% over the same period. The probability of a 0.5 percentage point cut remains priced at 0%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.