First Half Loan Volume Lower Than First Year of Registration System Implementation

Due to Prolonged High Interest Rates Increasing Default Risk

"Institutional Investment Delays and Financial Accidents... Industry Recovery Difficult for the Time Being"

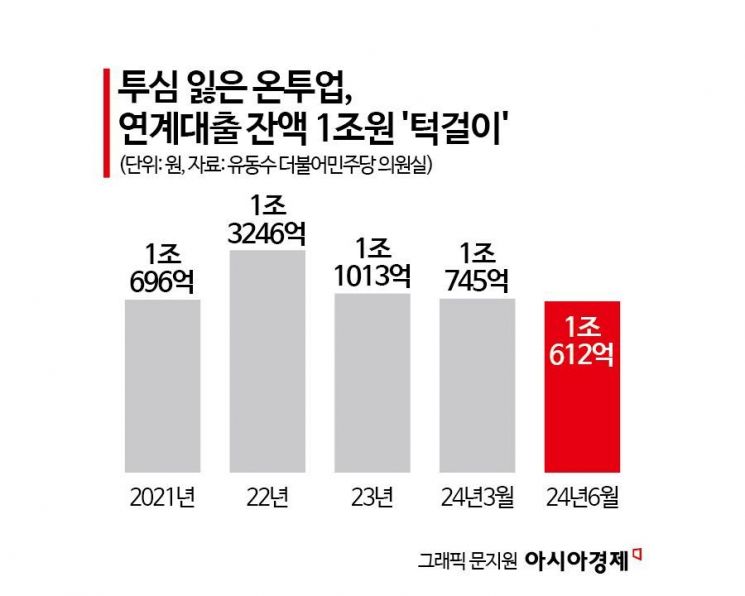

Amid shrinking investor sentiment, the outstanding balance of linked loans in the online investment-linked finance industry (OnTu industry) has sharply declined, with the loan volume barely maintaining the 1 trillion won mark in the first half of this year. The long-awaited institutional investment service is unlikely to be implemented within the year, and a series of financial accidents have further heightened the industry's sense of crisis.

According to data requested by Representative Yoodongsoo of the Democratic Party from the Financial Supervisory Service on the 8th, the outstanding balance of linked loans from 50 registered OnTu companies was recorded at 1.0612 trillion won as of the end of the first half of this year. This is about 8.4 billion won less compared to the end of 2021 (1.0696 trillion won from 36 companies), the first year of the OnTu registration system.

The outstanding loan balance in the OnTu industry reached 1.3246 trillion won (51 companies) at the end of 2022, but by the end of last year, it had decreased by more than 200 billion won to 1.1013 trillion won (53 companies). By the end of the first quarter of this year, it further dropped to 1.0745 trillion won (50 companies).

The reduction in loan volume is due to the prolonged high interest rates, which have frozen investment demand. The OnTu industry operates by pooling investor funds to lend to borrowers, but the risk of delinquency is increasing due to credit loan defaults caused by high interest rates and delayed recovery in the real estate market. A representative from the OnTu industry explained, “Especially in the first half of this year, many real estate-related loans such as real estate project financing (PF) or mortgage loans, which were issued during the real estate boom, matured at the end of last year, leading to a sharp decline in the outstanding loan balance.”

Although financial authorities have introduced regulatory improvement measures to ‘revive the OnTu industry,’ it remains uncertain whether the business conditions will improve. In July, the Financial Services Commission enabled the OnTu industry’s long-standing wish of three years to attract investments from domestic financial institutions. Accordingly, 29 savings banks planned to execute linked investments for OnTu credit loan borrowers in the second half of this year, but the implementation of this service is expected to be postponed until next year. This delay is due to the time required to build a system for money flow between sectors and to reassess debtor information. A senior official from the OnTu industry stated, “Developing and connecting the IT systems is not easy,” adding, “Although we initially expected the institutional investment to start by the end of November, judging by the current progress, it will likely be next year.”

Not only institutional investment but also attracting individual investors is facing difficulties. After the Tmon and Wemakeprice (Timep) unsettled payment crisis in July, some OnTu companies experienced delays in repayment related to Timep’s advance payment claims, highlighting risks to soundness and causing sluggish investor recruitment. In particular, when the industry’s fourth-largest company, Cross Finance, faced an unsettled payment crisis amounting to 70 billion won in August, investor sentiment across the industry worsened. Another OnTu industry official said, “The business conditions were already poor, but recently they have become the worst,” adding, “The delayed settlements at large OnTu companies have damaged the industry’s image. Although new products are scheduled to be launched soon, investors are actually withdrawing.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)