National Pension Service Likely to Abstain from Tender Offer

Possibility of Exercising Voting Rights in Future Exists

Some Foreign Investors Negative Toward Current Management

As the management rights dispute over Korea Zinc escalates into a 'chicken game' to hold even one more share than the opponent, attention is also focused on the responses of the National Pension Service and foreign investors. This is because the balance could tip to one side depending on their choices.

According to the Korea Exchange on the 8th, the National Pension Service holds a 7.57% stake in Korea Zinc, while foreign ownership stands at 17.85%. This volume can exert considerable influence during the tender offer process and the upcoming shareholders' meeting. Even setting aside the National Pension Service, which is likely to remain 'neutral,' attracting foreign investors to participate in the tender offer is key to gaining the upper hand in this dispute.

National Pension Service Likely to 'Sell on Market'... Voting Rights Exercise to Be Watched

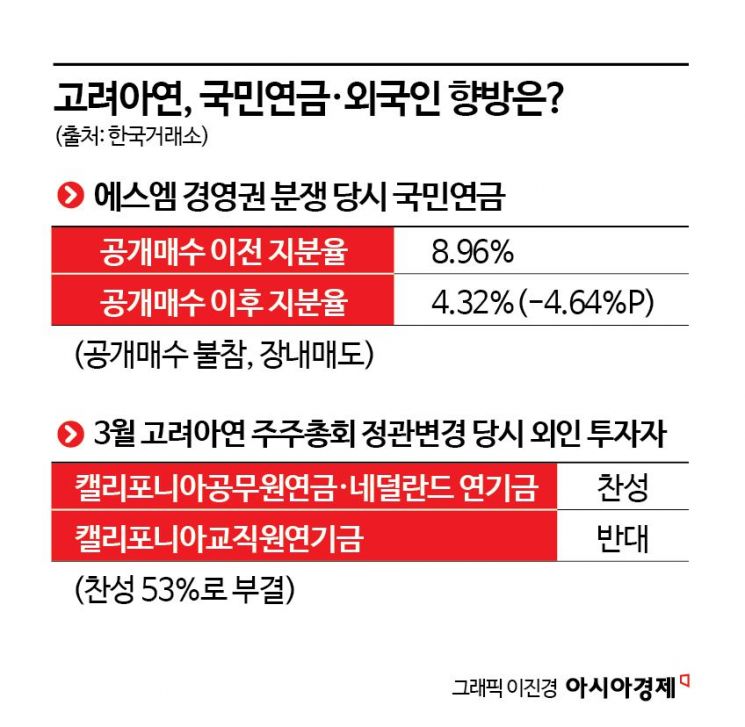

The general consensus is that the National Pension Service will not respond to either side's tender offer. This is because it has not participated in tender offers related to management disputes in the past. However, since the stock price has surged in the short term, there is a very high possibility that it will mechanically realize profits by selling some shares. During the 2023 SM Entertainment management dispute, the National Pension Service reduced its holdings by nearly half, from 8.96% before the dispute to 4.32%. It did not respond to the tender offer at all during that period. If it sells on the market, the increase in circulating shares could further increase stock price volatility. The National Pension Service discloses changes in shareholding with a time lag for large holdings (5% or more). Since March, the National Pension Service has not yet disclosed any changes in its stake in Korea Zinc as of the 7th of this month.

A source familiar with the National Pension Service said, "There is still a possibility that the National Pension Service will become a casting vote during the upcoming shareholders' meeting after the tender offer process ends," adding, "It will exercise its voting rights based on a comprehensive judgment aimed at the long-term value of Korea Zinc." If this happens, even if one side gains an advantage during the tender offer, there is a possibility that the agenda could be rejected if the National Pension Service exercises its 'opposing' voting rights. However, since the National Pension Service's purpose for holding shares in Korea Zinc is 'simple investment,' many analysts believe it is likely to maintain 'neutrality' by abstaining. Simple investment is the most passive form of investment that does not participate in management.

Foreign Investors, the Key 'Target' of Tender Offer, Busy Calculating Until the Last Moment

Ultimately, the key to the tender offer lies with foreign investors holding a combined stake of over 17%. Interest is focused on their participation in the tender offer, and the regular shareholders' meeting in March provides a slight hint about their stance toward the current management through their voting behavior. At that time, the management proposed an amendment to the articles of incorporation to facilitate new share issuance, but it was rejected with 53% approval. Since amendments to the articles require a special resolution, at least two-thirds of attending shareholders must approve for passage.

This proposal was opposed by the Youngpoong side, claiming it was intended to strengthen the current management's control. During this process, the California Public Employees' Retirement System (CalPERS) and the Dutch pension fund (APG) voted against it, while the California State Teachers' Retirement System (CalSTRS) voted in favor, showing divided opinions. The two major global proxy advisory firms that greatly influence them, ISS and Glass Lewis, also split, with ISS opposing and Glass Lewis supporting. An investment banking (IB) industry insider said, "The current situation is even harder to predict than when the vote on the articles amendment was split," adding, "They are likely calculating until the last moment which side will benefit, considering taxes and legality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)