Raising Short-Term Funds Under One Year

Then Managing with 3-5 Year Maturity Products

Repeated Maturity Mismatches...Mandatory Detailed Reporting

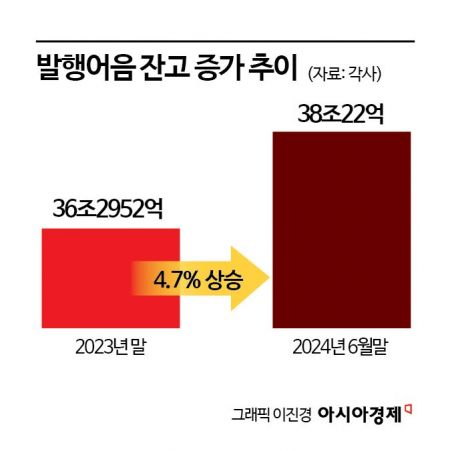

Domestic financial authorities are increasing the level of supervision over securities firms regarding short-term financing (issued promissory notes). They will conduct a comprehensive survey of the issuance and operation status of promissory notes by securities firms authorized to handle promissory notes to proactively check for maturity mismatches.

According to the government and the financial investment industry on the 8th, securities firms authorized to handle promissory notes must report detailed status of promissory notes by maturity to financial authorities starting from the third quarter of this year. A Capital Market System Team official at the Financial Supervisory Service explained, "We have been receiving liquidity ratios related to promissory notes, but from now on, we will receive detailed reports broken down by maturity," adding, "This is a measure to strengthen risk management."

Going forward, securities firms authorized to handle promissory notes must specify the funds raised through promissory notes in their quarterly business reports, segmented into a total of eight maturities ranging from ▲1 day or less to ▲over 9 months up to 1 year. The details of how the raised funds were operated must also be included, segmented into 12 maturities ranging from ▲1 day or less to ▲over 5 years. They must also report the weighted average maturity difference (duration) of the raised and operated funds, and separately indicate cases where maturity calculation is difficult.

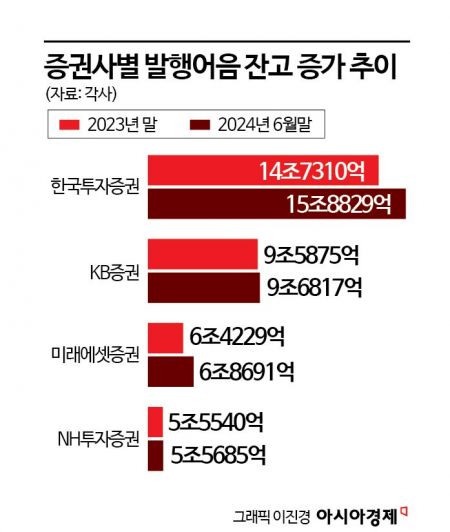

Promissory notes are a business where companies raise funds on their own credit for periods of one year or less. Since it is virtually equivalent to 'credit extension,' the banking sector strongly opposed the introduction of the promissory note system at the time. Among the so-called 'super-large investment banks (IBs)' with equity capital of 4 trillion won or more, only four out of five have been authorized to handle promissory notes (Korea Investment & Securities, NH Investment & Securities, KB Securities, and Mirae Asset Securities). Samsung Securities, the fifth super-large IB, does not engage in promissory note business.

The issue of maturity mismatch between promissory note issuance and fund raising has been consistently pointed out in the capital market since the system's inception. To prevent this, the Financial Services Commission has put in place measures to ensure that funds raised through promissory notes are primarily used for corporate finance and that the mandatory corporate finance ratio is maintained at a minimum of 50%, considering the one-year maturity characteristic.

However, as cases of maturity mismatch have been continuously pointed out, the need to strengthen the system has been raised. Lee Hyo-seop, head of the Financial Industry Division at the Korea Capital Market Institute, stated at a policy seminar last June, "The maturity mismatch status of promissory note raising and operation by comprehensive financial investment business operators (CIBs) should be regularly reported, and they should be encouraged to establish emergency response plans," adding, "Low-credit and real estate asset inclusion should also be suppressed." According to the presentation materials at that time, the proportion of products exceeding one year in the corporate finance asset composition related to promissory notes approached as high as 90%. In the loan product group, cases where maturity exceeded one year accounted for 87.5%. High proportions were also found in private bonds (83.8%), corporate bonds (83.6%), beneficiary certificates (70.5%), and commercial papers (29%).

As the first 'Integrated Investment Account (IMA)' operator has recently emerged as the biggest topic in the securities industry, large securities firms are also expected to respond swiftly to this stance of the financial authorities. Mirae Asset Securities and Korea Investment & Securities, which meet the 8 trillion won equity capital requirement, are considered strong candidates. The Financial Services Commission is reportedly revising guidelines related to the IMA system.

A financial investment industry official said, "Since the Financial Services Commission chairman has announced a comprehensive review of the CIB system improvement, we expect specific plans to be announced in the second half of the year," adding, "Large securities firms are closely monitoring the authorities' stance as they aim for the next authorization, whether for super-large IBs or IMAs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.