Debt Adjustment Implemented for Basic Livelihood Security Recipients

Support for Policy Finance Repayment Deferral and Installment Repayment

Self-Reliance Measures Beyond Simple Financial Support or Debt Reduction Also Established

"Will Continue to Develop and Supplement Practical Measures"

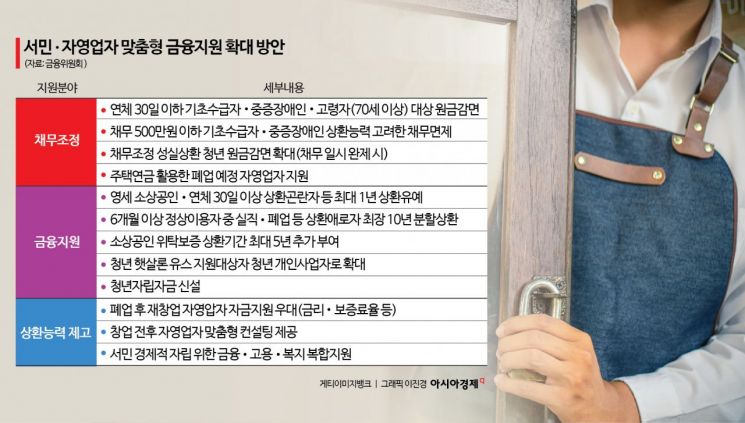

From now on, basic livelihood security recipients, persons with severe disabilities, and elderly people aged 70 or older will receive a reduction of up to 15% of the principal if their overdue days are 30 days or less. Policy-based low-income financial service users will be granted a repayment deferral period of up to one year, reducing the burden of principal repayment. Self-employed individuals who reopen their businesses after closure and have their business viability recognized will receive benefits such as reduced guarantee fees when receiving financial support.

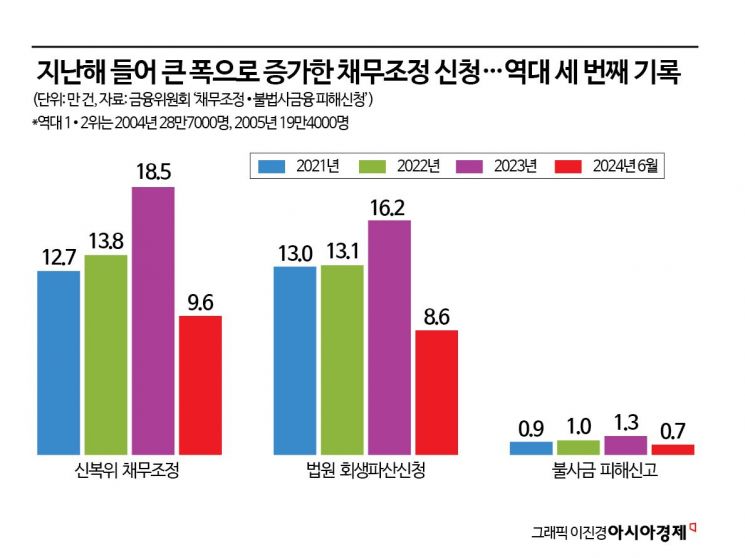

On the 2nd, the Financial Services Commission announced the "Customized Financial Support Expansion Plan for Vulnerable Groups Including Low-Income People," prepared together with related ministries after discussions at the Economic Ministers' Meeting. The plan includes measures to alleviate financial difficulties and repayment burdens for low-income groups and to support the establishment of fundamental self-sustaining conditions through competitiveness enhancement.

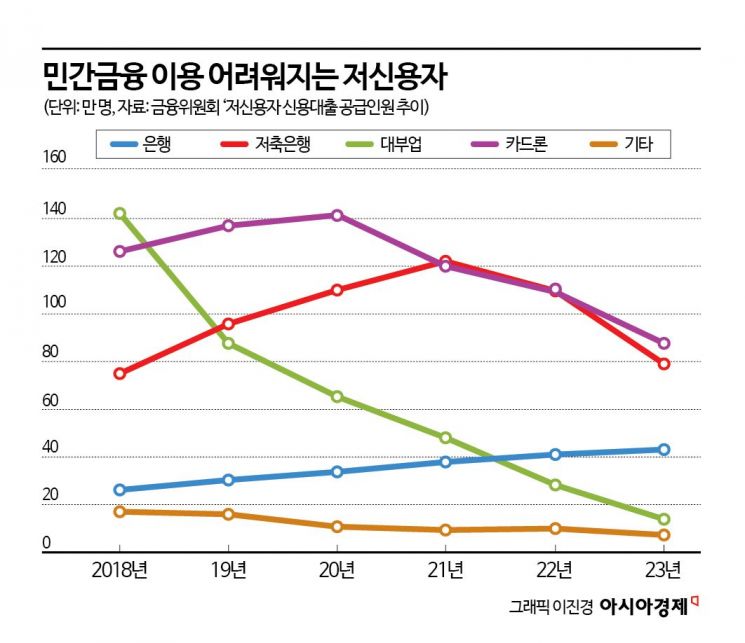

The Financial Services Commission judged that despite policy support for these groups, high interest rates persist, domestic demand recovery is delayed, and low-credit low-income individuals face difficulties in using private financial services. Accordingly, it explained that it has prepared fundamental countermeasures to ease the burden on low-income people and the self-employed and to help them gain self-reliance.

First, customized debt adjustments will be implemented for vulnerable groups. Basic livelihood security recipients, persons with severe disabilities, and elderly people aged 70 or older who have short-term arrears (overdue days 30 or less) will receive up to a 15% reduction in principal. For basic livelihood security recipients and persons with severe disabilities who have been overdue for more than one year, if the debt burden does not improve during a one-year grace period (for debt principal of 5 million KRW or less), the principal will be fully forgiven. For youth who have been overdue for more than 90 days (limited to users of the Credit Recovery Committee’s debt adjustment), if they make a lump-sum repayment after more than one year of faithful repayment, the debt reduction rate will be expanded to 20%. A housing pension product will be launched to help self-employed individuals who wish to close their businesses quickly settle their debts. The main point is to allow repayment of existing debts such as personal business loans within 90% of the pension loan limit.

Policy financial support will be provided to low-income people and self-employed individuals temporarily experiencing financial difficulties to resolve liquidity problems and ease repayment burdens. Users of the credit support programs provided by the Korea Inclusive Finance Agency, such as the Sunshine Loan (Worker Sunshine Loan, Sunshine Loan 15, Sunshine Loan Youth), will be granted a repayment deferral period of up to one year to reduce the burden of principal repayment. The target includes micro small business owners with annual sales of 300 million KRW or less and those having repayment difficulties such as overdue days of 30 or more. Sunshine Loan Bank users will be supported with installment repayment for up to 10 years. For entrusted guarantee products for small business owners, the repayment period will be extended by up to five years, reducing the monthly principal and interest repayment burden starting this December.

Not only unemployed youth and those employed at small and medium-sized enterprises for less than one year but also low-income young entrepreneurs within one year of starting a business can receive up to 9 million KRW once for living expenses or purchasing goods. With the expansion of Sunshine Loan Youth beneficiaries, it is expected that 60 billion KRW will be supported annually for 10,000 people. For youth who qualify as basic livelihood security recipients and use Sunshine Loan Youth, a "Youth Self-Reliance Fund" will be newly established in the second quarter of next year, providing a government subsidy of 600 million KRW to support bank interest by 1.6 percentage points, enabling loans at interest rates in the 2% range.

Beyond simple financial support or debt reduction, measures have been prepared to help low-income and vulnerable groups become self-reliant. Self-employed individuals who reopen their businesses after closure and are recognized for business viability by the Credit Recovery Committee’s Re-Startup Support Committee will receive preferential treatment on guarantee fees (0.2 percentage points) from the Korea Credit Guarantee Fund and the Korea Technology Finance Corporation when receiving financial support. Customized consulting will be provided centered on policy institutions such as the Korea Inclusive Finance Agency, tailored to the management situation of self-employed individuals before and after startup. Through collaboration with Shinhan Bank’s delivery platform 'Ttaenggyeoyo,' the Korea Inclusive Finance Agency will provide linked support for self-employed individuals using policy finance who wish to participate in the platform.

The Financial Services Commission stated, “We will continue to monitor financial conditions and the economic situation and discover and supplement ‘tangible’ measures that can alleviate financial and non-financial difficulties of low-income people and the self-employed and strongly support their economic self-sufficiency.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)