Mirae Asset Securities announced on the 30th that Mirae Asset Investment and Pension Center, in joint planning with the Korea Workers' Compensation and Welfare Service, conducted a survey on retirement benefit management targeting 2,000 employees of small and medium-sized enterprises (SMEs) with fewer than 30 employees.

The survey results showed that a significant number of employees at SMEs with fewer than 30 employees feel the need to introduce a retirement pension system and have a favorable view of 'Pureun Seed (Small and Medium Enterprise Retirement Pension Fund System),' which allows the use of professional management institutions for retirement benefit operation.

The purpose of this survey was to address the urgent need for improvement in retirement benefit management for employees of SMEs with fewer than 30 employees, many of which are not enrolled in a retirement pension system.

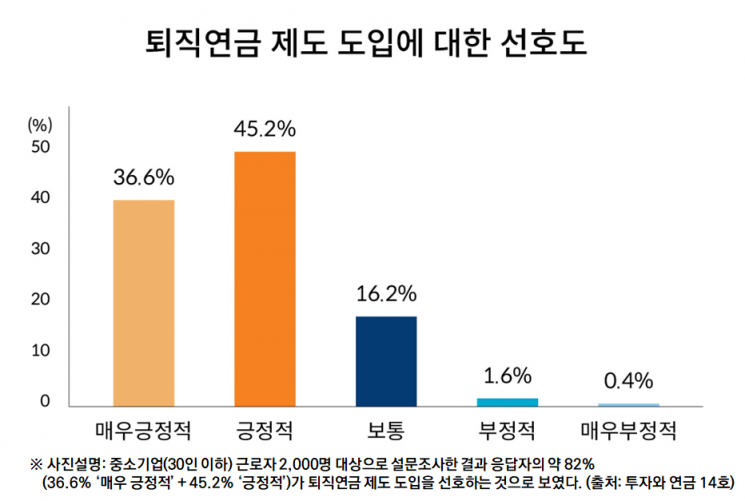

The survey revealed that a considerable number of employees at SMEs with fewer than 30 employees feel the necessity of introducing a retirement pension system. As of 2022, only 24% of companies with fewer than 30 employees have introduced a retirement pension system, while the rest remain under the retirement allowance system. According to the survey, one-third of employees working at companies operating the retirement allowance system expressed concerns about delayed payment of retirement allowances. Approximately 82% of respondents viewed the retirement pension system, which guarantees retirement allowance payments by outsourcing to an external institution, positively.

Additionally, employees at SMEs with fewer than 30 employees operating the retirement allowance system indicated a preference for entrusting the management of retirement benefits to professional management institutions (64.3%) rather than managing it themselves (21.5%). This response is closely related to the high interest shown in Pureun Seed, a customized retirement pension system for SMEs operated by the Korea Workers' Compensation and Welfare Service, as indicated in other survey questions.

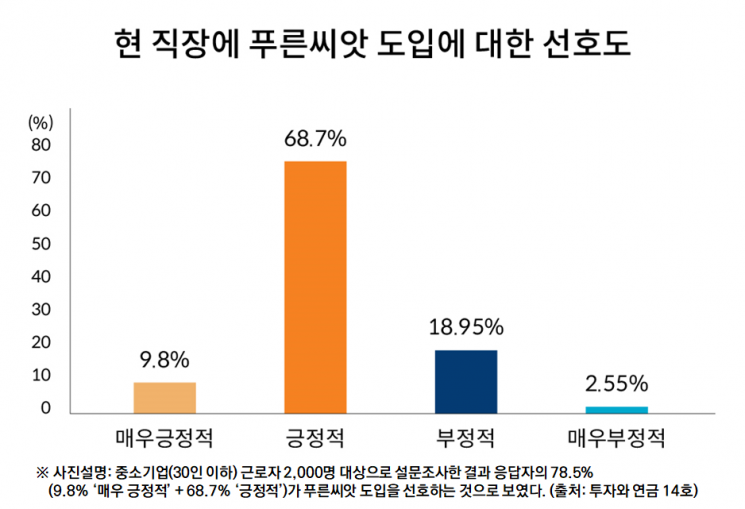

Pureun Seed is a system introduced in 2022 that pools retirement allowances of SMEs with fewer than 30 employees into a joint fund and entrusts management to a dedicated management institution under the supervision of the Korea Workers' Compensation and Welfare Service. According to the survey, 78.5% of respondents responded positively when given an explanation of the Pureun Seed system. Factors contributing to the positive responses included the guarantee of retirement benefit rights, the expectation of stable returns, high trust in the government and professional management institutions, and the simplicity of the enrollment process.

A representative from Mirae Asset Securities, the dedicated management institution for Pureun Seed, explained, "Managing retirement pension returns is truly important for a stable life after retirement. As of the 23rd, Pureun Seed's cumulative return rate stands at 13%, achieving excellent returns of 7% last year and 5% this year. Since experts handle diversified investments in global quality assets, this system helps improve retirement pension returns for employees of SMEs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)