"Wake up at dawn to check the US stock market"

"It's fun when you study hard and make a profit"

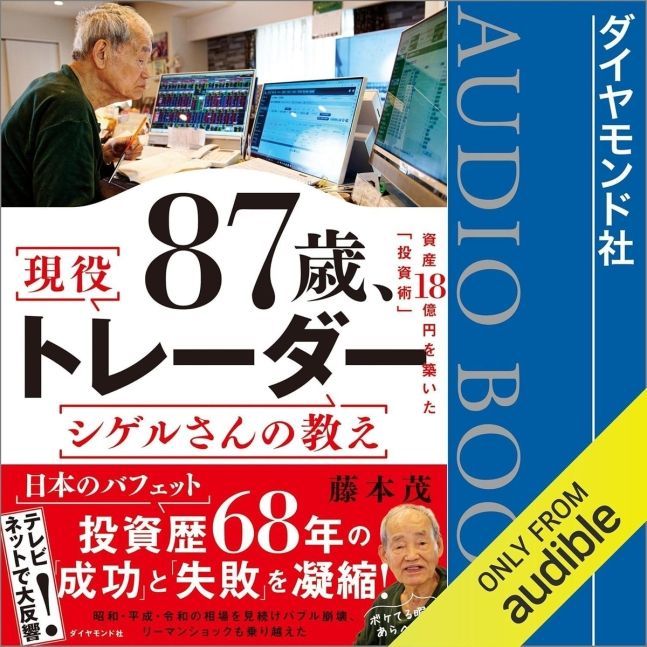

An elderly man in Japan who amassed 2 billion yen (approximately 18.3 billion KRW) through stock investment over 69 years is becoming a hot topic. The man, Shigeru Fujimoto (88), known as Japan's "Warren Buffett," is the protagonist.

On the 30th, according to Bloomberg News, his stock investment began 69 years ago when he was 19, after talking with an executive from a securities company who often visited the pet store where he worked. The first stocks he bought were electronics company Sharp and oil company ENEOS Holdings. However, Fujimoto did not start as a full-time investor from the beginning.

Fujimoto, a lovebird enthusiast, also opened and operated a pet store and a Japanese-style mahjong parlor. Later, in 1986, he sold the mahjong parlor and started serious investing with 65 million yen from the sale, and since 2015, he has been engaged in day trading. Even now, he wakes up at 2 a.m. to watch the U.S. market through CNBC and prepares for stock investment.

As news spread that Fujimoto had accumulated assets through stock investment, he gained followers, and he also authored investment books about his investment strategies. Notably, when it was revealed last October that he held more than 5% of the shares in the Japanese asset management company Storage-OH, the stock price surged by 17%.

Bloomberg analyzed that the reason Fujimoto became famous is "because he took risks and actively invested to accumulate assets for his retirement." Japan is one of the countries that prefer safe assets such as bank deposits. After Japan's asset bubble burst in the 1990s, Japanese people, especially the elderly, became reluctant to invest in stocks. However, as inflation rose and the elderly had difficulties living solely on public pensions, Fujimoto began to actively invest.

However, his investment strategy differs from Buffett's preference for long-term value investing. Fujimoto has focused on day trading for the past 10 years, and according to a 2022 survey by the Japan Securities Dealers Association (JSDA), only 3% of investors hold stocks for less than a month like him.

Fujimoto, who does not own a smartphone, car, or even a credit card, said in an interview with Bloomberg that it is good for young people to start investing in stocks, adding, "If you think hard, study, get good results, and make profits, it is fun." He is currently using a walker after injuring his waist earlier this year. While feeling embarrassed to be compared to Buffett, he said the only things he shares with Buffett are age and love for stocks, and he added that he does not want to recommend risky day trading to young investors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.