No Funding Secured

Only Disclosure Obligations and Costs Incurred

Business Structure Reorganization Due to Delisting

Shinsegae Group plans to voluntarily delist Shinsegae Construction after conducting a tender offer for its shares. Concerns have grown that Shinsegae Construction's liquidity crisis could escalate into a financial strain for the group, and management appears to have judged that remaining a listed company would cause more harm than good, especially as Shinsegae Construction has been shunned in the capital markets.

According to the electronic disclosure system on the 30th, Emart held a board meeting on the 27th and approved the tender offer for its subsidiary Shinsegae Construction's shares. The tender offer period is 30 days, from that day until the 29th of next month. The tender offer price is 18,300 KRW per share. The shares subject to this tender offer amount to 2,120,661 shares, which is 27.33% of the total shares, excluding treasury shares of Shinsegae Construction (171,432 shares, 2.21%) and Emart's holdings (5,468,461 shares, 70.46%).

Stock Price Decline Following Liquidity Crisis... Shinsegae Construction Faces Funding Difficulties

Emart's decision to pursue voluntary delisting through a tender offer is reportedly based on the judgment that Shinsegae Construction will find it increasingly difficult to raise funds while remaining listed. Typically, companies listed on the stock market find it easier to raise capital than unlisted companies. For example, one common method for a corporation to raise funds is through a paid-in capital increase by receiving money from shareholders. In an unlisted state, it is cumbersome to raise funds from a small number of existing shareholders or to attract third parties as shareholders. Conversely, listed companies have the advantage of being able to raise funds from a much broader shareholder base.

However, Shinsegae Construction has not conducted any paid-in capital increases on its own even when liquidity crises were highlighted in the market last year and earlier this year. The stock price fell below 10,000 KRW per share, making it practically impossible to raise the required amount of capital. An industry insider pointed out, "The fundamental purpose of a company entering the capital market is ultimately to raise funds, but in the case of Shinsegae Construction, the problem is that its stock price has remained undervalued for years."

The stringent corporate disclosure requirements for listed companies also posed a burden on Shinsegae Construction, which is experiencing liquidity difficulties. Due to the corporate disclosure system, company information was exposed to competitors, but if delisting occurs, such risks will be reduced. Additionally, with institutional investors such as asset management firms and pension funds involved, costs related to managing the stock price for these investors can also be reduced.

Shinsegae Construction Viewed as the Ugly Duckling

Shinsegae Construction has long been regarded as the "ugly duckling" of Shinsegae Group. It suffered significant financial damage due to a slowdown in the real estate market and project financing (PF) failures, becoming a "risk factor" for the group. Expanding its housing business (Billiv) and increasing operations in regional areas such as Daegu proved detrimental. The surge in unsold housing units in the Daegu area dealt a direct blow to Shinsegae Construction's performance and financial structure.

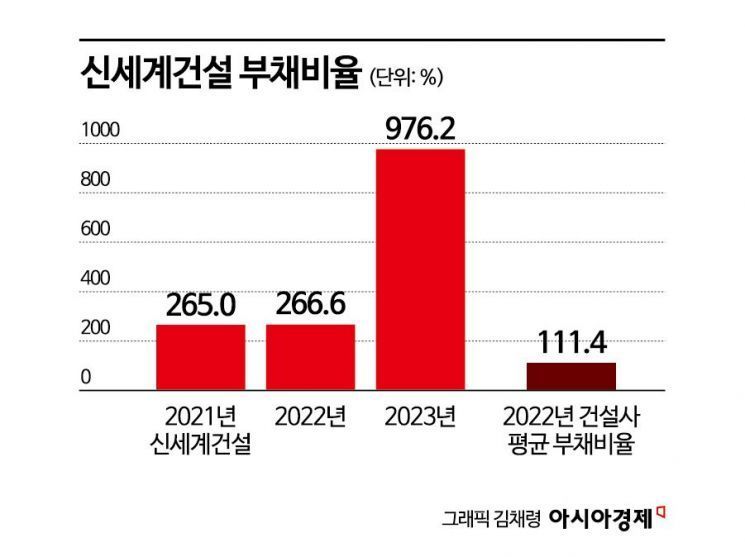

Due to deteriorating business conditions, Shinsegae Construction recorded an operating loss of 12 billion KRW in 2022, the first in over a decade. Last year, it posted a massive loss of 187.8 billion KRW. This year, the operating deficit has grown further; as of the first half, the company's operating loss was 64.3 billion KRW, about 20 billion KRW more than the 43.2 billion KRW loss in the first half of last year.

Some projects have yet to commence construction, and the current contingent liabilities from PF amount to 280 billion KRW (250 billion KRW in bridge loans and 30 billion KRW in main PF), up from 250 billion KRW at the end of the first half of last year. PF contingent liabilities refer to debts that a construction company must bear if the project developer defaults or unsold units occur, as guaranteed by the construction company for PF loans. This increase is due to the Gupo Port Station development project failing to transition from bridge loans to main PF.

Artificial Respiration Given, but Ultimately Delisting is the Course

The group stepped in to provide liquidity support to save Shinsegae Construction. In February, the low-profit leisure business division was sold to Chosun Hotel & Resort to secure cash. The sale price was 207.8 billion KRW. Shinsegae Yeongrangho Resort, wholly owned by Emart, was also transferred to Shinsegae Construction. Yeongrangho Resort is a "cash cow" generating an annual net profit of 40 billion KRW, and through the merger, Shinsegae Construction secured about 65 billion KRW in funds.

In May, Shinsegae Construction issued 650 billion KRW in hybrid capital securities under a capital replenishment agreement with Emart. Hybrid capital securities are classified as equity rather than debt, positively impacting the improvement of the financial structure. As a result, the debt ratio, which was 952% at the end of last year, dropped to 161%. The group also increased orders; in June, it secured a 920 billion KRW contract for the construction of Starfield Cheongna. However, Shinsegae Group is believed to have judged that despite such support, the deteriorated business foundation of the construction division was insufficiently stabilized.

Ultimately, Shinsegae Construction is proceeding with voluntary delisting. Emart is conducting a tender offer for 2,120,661 registered common shares of Shinsegae Construction, a KOSPI-listed company, from today until the 29th of next month, representing 27.33% of the total issued shares. Emart intends to purchase all remaining shares excluding its 5,468,461 common shares (70.46%) and Shinsegae Construction's treasury shares of 171,432 (2.21%). For a KOSPI-listed company to voluntarily delist, the major shareholder must secure over 95% of shares excluding treasury shares.

Emart stated that the purpose of this tender offer is "to simplify the governance structure to establish an efficient decision-making system and to swiftly reorganize the business structure to promote management normalization." They also added, "It aims to protect investors holding Shinsegae Construction shares and to practice responsible management as the largest shareholder."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.