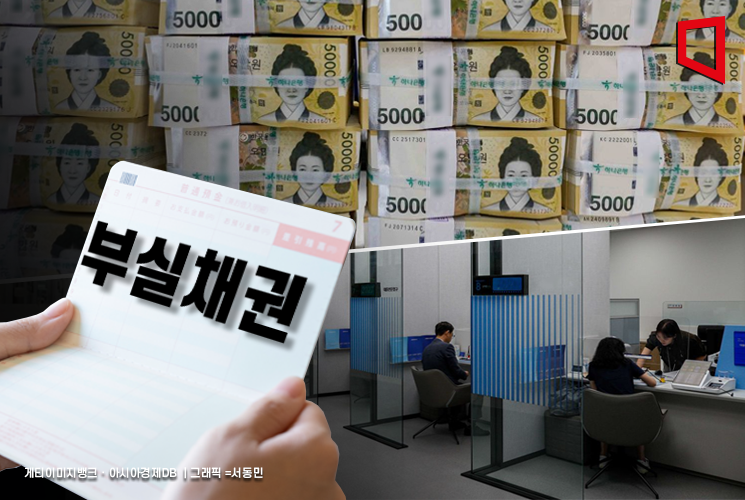

The Korea Federation of Savings Banks announced on the 30th that 12 savings banks jointly sold approximately 90 billion KRW worth of non-performing loans from individuals and individual business owners through the '3rd Joint Sale of Non-Performing Loans via Asset Securitization.'

Buyers included Woori Financial F&I, Kiwoom F&I, and Daishin F&I.

With this joint sale, the savings bank industry sold a total of 320 billion KRW worth of non-performing loans. At the end of December last year, about 100 billion KRW of non-performing loans were sold through the 1st joint sale, and by the end of the first half of this year, a total of 136 billion KRW of non-performing loans were resolved.

A representative from the Korea Federation of Savings Banks stated, "The savings bank industry, which had been conducting joint sales semiannually, has this time carried out the sales on a quarterly basis to enhance management stability, making every effort to do so," adding, "We plan to continue promoting joint sales via asset securitization to resolve non-performing loans and strengthen soundness management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.