Increase in Equipment Operation Rate and Slight Relief in Raw Material Price Burden Expected

Quick Response Needed to External Risks Such as US Presidential Election and Ocean Freight

A survey result showed that the export boom is expected to continue until the fourth quarter of this year.

The Korea International Trade Association (KITA) International Trade and Commerce Research Institute announced the '2024 4th Quarter Export Industry Business Survey Index (EBSI)' report on the 29th. The 4th quarter EBSI was 103.4, exceeding 100 for the third consecutive quarter, indicating that the positive trend of export growth will be maintained until the end of this year. EBSI is an index that surveys and analyzes the export business outlook of domestic export companies for the next quarter. An EBSI above 100 means that export conditions are expected to improve compared to now, while below 100 means they are expected to worsen.

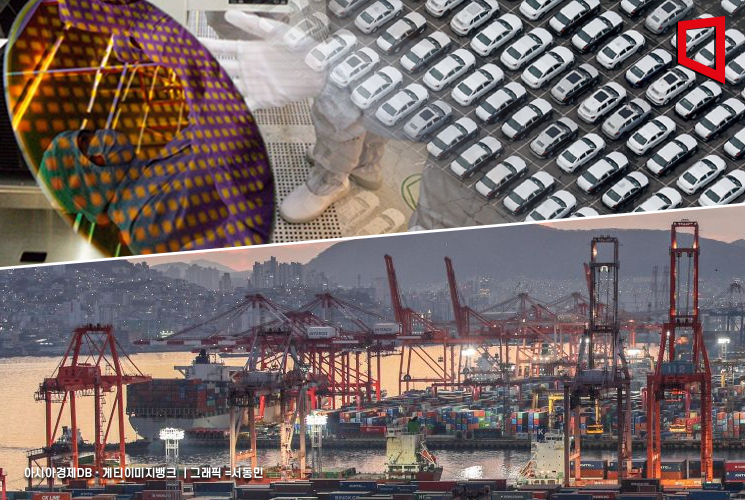

Among the 15 surveyed items, export conditions for 8 items are expected to improve in the 4th quarter. These include ships (146.7), semiconductors (135.2), and daily necessities (114.6). Expectations for strong ship exports were highest due to increased demand for ship replacement caused by environmental regulations and the expansion of delivery of existing order volumes.

Semiconductors are expected to see improved export conditions due to expanded sales of AI-related semiconductors and increased demand for existing IT products. However, steel and non-ferrous metals (66.2) showed the greatest concern for negative growth due to export price declines caused by oversupply from competing countries.

By category, export conditions are expected to improve in 6 out of 10 surveyed items, including facility operation rate (120.7) and manufacturing cost of export goods (111.9). On the other hand, import restrictions and trade frictions (83.1) and international logistics (90.8) were evaluated negatively due to expanded trade risks from the U.S. presidential election and the entrenchment of rising maritime freight rates.

Companies cited 'economic downturn in export destination countries' (16.3%) and 'rising raw material prices' (16.3%) as the main difficulties in exports. Concerns about economic downturn increased by 3.1 percentage points compared to the previous quarter due to worsening U.S. manufacturing and employment indicators, while the burden of raw material costs is expected to ease slightly (-3.4 percentage points) due to falling international commodity prices.

Heo Seul-bi, a researcher at the Korea International Trade Association, said, "It is positive that domestic conditions such as the facility operation rate of our export industry are expected to improve," but added, "Since external uncertainties such as the global economy and import restrictions are increasing, we need to closely monitor interest rates and trade trends in major countries and respond promptly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.