Shinhan Launches 'Bring-Up & Value-Up' Project

Shinhan Bank Operates 200 Billion KRW Refinancing Loan Limit

Shinhan Financial Group will support credit improvement and reduction of financial costs for mid-credit customers of Shinhan Savings Bank.

On the 29th, Shinhan Financial announced that it will carry out the "Bring-Up & Value-Up Project" containing these details through collaboration among group companies.

This project is a win-win initiative that converts personal credit loans held by mid-credit salaried customers trading with Shinhan Savings Bank, with principal within 50 million KRW and a Debt Service Ratio (DSR) of 70% or less, into a new refinancing product exclusively from Shinhan Bank under certain excellent transaction conditions.

Although this means that Shinhan Savings Bank will lose some excellent customers, Shinhan Financial plans to attract them to bank transactions, supporting credit rating upgrades and financial cost reductions to increase the number of high-quality customers across the entire group (Bring-Up), and strengthen mutual growth with customers by helping them enhance their own value (Value-Up).

Accordingly, Shinhan Savings Bank plans to support credit upgrades through customized credit management programs such as ▲supporting customer financial cost reduction by connecting refinancing loans through banks ▲providing pre-credit management guides for credit upgrades ▲operating dedicated counters for vulnerable borrowers and supporting financial consulting for low-income earners. To this end, Shinhan Bank will operate a refinancing loan limit of 200 billion KRW exclusively for savings bank customers and will conduct the refinancing loan process entirely through a non-face-to-face method to increase convenience for applicants.

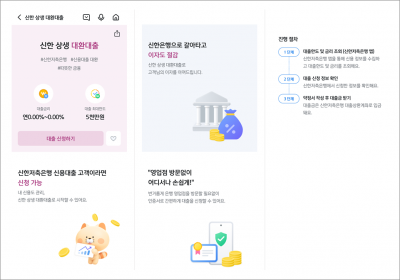

Eligible customers can ▲check refinancing eligibility and interest rates for Shinhan Bank loans through the Shinhan Savings Bank app ▲move to Shinhan SOL Bank to apply and proceed with agreements ▲and proceed with refinancing loans by repaying existing loans at Shinhan Savings Bank with new loans from Shinhan Bank.

Shinhan Financial expects that about 12,000 eligible customers will benefit from financial cost reductions as of now, and the cumulative level of reductions is expected to increase further with the continuous operation of the project. Shinhan Financial also sees this as completing a proactive virtuous cycle structure that attracts excellent savings bank customers to the bank, moving beyond the previous one-way support of introducing customers who had difficulty banking to savings banks through mid-interest and low-income financial loans.

Furthermore, Shinhan Financial plans to expand the scale of the virtuous cycle of mutual growth by ▲making the refinancing loan project a permanent program ▲expanding the target group companies to include card loans ▲and extending the target customer group to corporate customers in the future.

Jin Ok-dong, Chairman of Shinhan Financial, said, “This project has significant meaning in institutionalizing the support for credit upgrades to increase customer value despite the reduction in profits due to interest cuts.” He added, “Shinhan Financial will actively fulfill its role as a ‘financial ladder for mutual growth with customers’ with the commitment to practicing the group’s mission of ‘Warm Finance.’”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)