The Small and Medium Business (SMB) Business Outlook Index for October showed a slight increase compared to the previous month, but many negative forecasts indicated that business conditions would not improve.

The Korea Federation of SMEs announced on the 29th the results of the "October 2024 SMB Business Outlook Survey," conducted from September 6 to 13, targeting 3,075 small and medium enterprises.

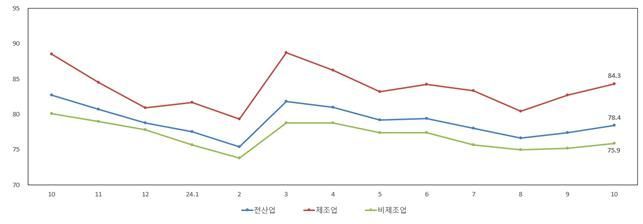

Business Outlook Index Trends by Industry for Small and Medium Enterprises. (Source: Korea Federation of SMEs)

Business Outlook Index Trends by Industry for Small and Medium Enterprises. (Source: Korea Federation of SMEs)

According to the results, the Business Outlook Index (SBHI) for October was 78.4, up 1.0 point from the previous month. This marks the second consecutive month of increase following September, but it is 4.3 points lower than the same month last year.

The SBHI uses 100 as the baseline; a score above 100 means that more companies responded positively than negatively, while a score below 100 indicates the opposite.

The October business outlook for manufacturing rose 1.6 points from the previous month to 84.3, while non-manufacturing increased by 0.7 points to 75.9. Construction (72.2) fell by 1.0 point, whereas services (76.7) rose by 1.1 points compared to the previous month.

Within manufacturing, 17 sectors showed an increase compared to the previous month, led by ▲Printing and Recorded Media Reproduction (82.2→94.4, up 12.2 points) and ▲Other Transportation Equipment (87.8→95.2, up 7.4 points). Conversely, 6 sectors including ▲Beverages (102.3→87.2, down 15.1 points) and ▲Furniture (73.8→70.2, down 3.6 points) declined.

In non-manufacturing, construction (73.2→72.2) decreased by 1.0 point, while services (75.6→76.7) increased by 1.1 points. Within services, 6 sectors such as ▲Real Estate (73.9→79.7, up 5.8 points) and ▲Repair and Other Personal Services (73.4→79.1, up 5.7 points) rose, whereas 4 sectors including ▲Education Services (84.4→82.7, down 1.7 points) and ▲Publishing, Video, Broadcasting, Telecommunications, and Information Services (89.3→88.0, down 1.3 points) declined.

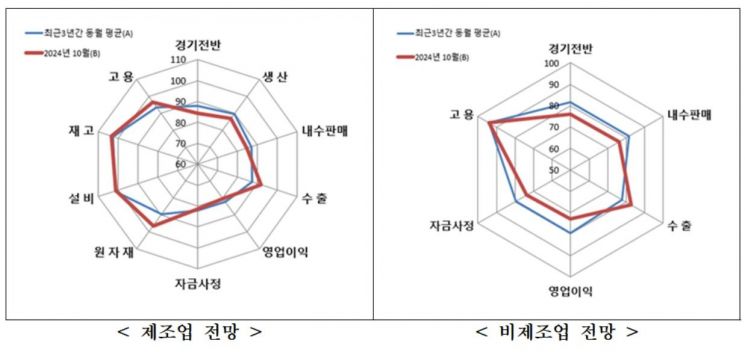

Looking at the outlook by category across all industries, ▲Exports (81.3→88.4) and ▲Domestic Sales (78.3→78.7) rose compared to the previous month, while ▲Financial Conditions (76.5→75.9) and ▲Operating Profit (75.5→75.2) declined. The counter-trend employment level (95.2→94.8) is expected to improve compared to the previous month.

Comparing the October SBHI with the average SBHI for the same month over the past three years, manufacturing is expected to improve in raw materials, exports, and facilities. However, other categories are forecasted to worsen compared to the previous three-year average. In non-manufacturing, exports and the counter-trend employment are expected to improve, while other categories are forecasted to deteriorate compared to the past three-year average.

Meanwhile, the biggest management difficulties for SMBs in September were sluggish domestic demand (61.2%), followed by ▲Rising labor costs (45.4%), ▲Excessive competition among companies (33.4%), and ▲Rising raw material prices (29.9%).

Regarding trends in major management difficulties, ▲Excessive competition among companies (28.3%→33.4%), ▲Delayed collection of sales proceeds (15.6%→19.6%), ▲Rising raw material prices (25.9%→29.9%), ▲Rising labor costs (45.1%→45.4%), and ▲High interest rates (21.0%→21.3%) increased compared to the previous month, while the proportion of responses citing ▲Sluggish domestic demand (62.0%→61.2%) decreased.

The average operating rate of small and medium manufacturing in August was 71.5%, down 0.1 percentage points from the previous month and 0.6 percentage points lower than the same month last year. By company type, general manufacturing (70.7%→70.6%) decreased by 0.1 percentage points, and innovative manufacturing (74.0%→73.5%) fell by 0.5 percentage points compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)