IMM PE, Missha Operator Able C&C Largest Shareholder

Significantly Reducing One-Brand Stores, Strengthening Online Channels

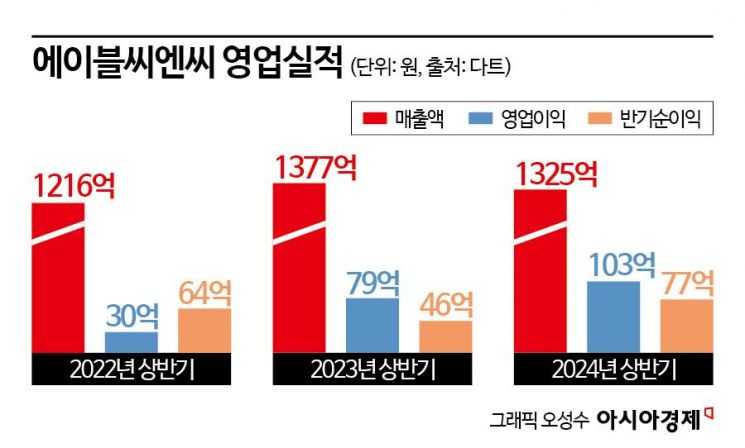

Operating Profit in H1, 7.9 Billion KRW Last Year → 10.3 Billion KRW This Year

603 stores (2019) → 273 stores (2023). This is the change in the number of offline stores (directly operated + franchises) of Able C&C, the operator of the Korean native cosmetics brand ‘Missha.’ This is the result of an operational efficiency strategy carried out by IMM PE, a private equity fund (PEF) management company and the largest shareholder. The company has recorded ten consecutive quarters of profit since the first quarter of 2022. With increased potential for corporate value growth, IMM PE has decided to slow down the sale of Able C&C, stating that it will “prioritize value-up efforts.”

Store Efficiency Improvement, Strengthening Online Channels, and Channel Innovation

IMM PE acquired Able C&C in 2017. After purchasing 25.5% of the previous owner’s shares for 188.2 billion KRW, it invested a total of about 400 billion KRW through a public tender offer and capital increase. Since then, it has actively worked on improving Able C&C’s structure through ▲store efficiency improvement ▲brand repositioning ▲overseas market expansion ▲strengthening online channels. This was a period when multi-shops selling various brands like Olive Young became the trend in the road shop market, and single-brand formats like Missha gradually lost strength.

First, stores with low profitability were actively closed. This was a strategy to increase sales per store and reduce fixed costs. As a result, the number of offline stores decreased to 273 last year, a 54.7% reduction compared to 2019. At the same time, the brand portfolio was reestablished by building a diverse lineup including Missha, A’PIEU, Chogongjin, Stila, Cellapy, and Lapothicell. In particular, A’PIEU has entered various distribution channels such as Daiso, Musinsa, Zigzag, Ably, and Toss, and its sales are growing significantly.

In 2022, to strengthen digital capabilities, the existing online platform Nunk, which focused on distribution channels, was transformed into ‘Able Shop.’ Customers can shop for Able C&C’s six brands on the Able Shop platform, and logistics efficiency was improved. An integrated online-offline membership system was also introduced, enhancing functions such as unified customer data management and advanced personalized product recommendations. As a result, Able Shop’s sales over the past year increased by 65% compared to the previous year as of last month. The number of purchasing customers and purchase transactions also rose by 67% and 58%, respectively.

Joining the K-Beauty Boom in the U.S. and Japan... Expecting a Rebound in the Chinese Market

The proportion of overseas sales has also gradually expanded. Overseas sales increased from 132.4 billion KRW in 2019 to 146.7 billion KRW last year. The share of overseas sales in total sales rose from 31.4% to 53.6% during the same period, and it recorded about 56% in the first quarter of this year. While the Chinese market was sluggish, efforts were focused on Japan and the U.S.

In Japan, connections with drugstores were increased, and in the U.S., customer touchpoints were expanded through the global e-commerce platform Amazon. According to the Korean cosmetics rankings within Amazon’s Top 100, compiled by Shinhan Investment Corp. on the 26th, Missha products ranked 66th and 64th in the overall color cosmetics and basic skincare categories, respectively. In the BB cream category, six Missha products entered the Top 100, ranking highest among Korean brands.

The potential rebound of the Chinese market is also a key factor to watch. On the 24th, the People’s Bank of China (PBoC) announced a large-scale economic stimulus package including monetary policy easing, real estate market support, and stock market stabilization. Hyunjin Park, a researcher at Shinhan Investment Corp., said, “China’s announcement of additional stimulus policies within the year will positively influence the improvement of sentiment around Chinese-related consumer stocks for the time being. If local consumption power improves due to interest rate cuts in China, demand for cosmetics will naturally recover. Local cosmetics manufacturers will also benefit from lower financing costs.”

On May 1, 2017, Myeongdong Shopping Street in Jung-gu, Seoul, appeared relatively quiet due to the aftermath of THAAD and the ban on Korean wave content.

On May 1, 2017, Myeongdong Shopping Street in Jung-gu, Seoul, appeared relatively quiet due to the aftermath of THAAD and the ban on Korean wave content.

Meanwhile, IMM PE, which had put Able C&C up for sale in the 2022 M&A market, has shifted its focus to raising the price. In July, Able C&C stated in response to a disclosure inquiry from the Korea Exchange that it is “not considering the sale of the largest shareholder’s stake.” Able C&C’s market capitalization was about 203.7 billion KRW as of the 27th, and its cash assets are around 50 billion KRW. IMM PE holds a 61.52% stake through a special purpose company (SPC).

This judgment is interpreted as being due to the increased potential for corporate value growth following improved performance and changes in the market environment. According to the Financial Supervisory Service on the 30th, Able C&C recorded an operating loss of about 68 billion KRW in 2020 but gradually recovered profitability, turning to an operating profit of 9.9 billion KRW in 2022. Last year, it recorded an operating profit of about 11.4 billion KRW. In the first half of this year, it posted sales of 132.5 billion KRW, operating profit of 10.3 billion KRW, and net profit of 7.7 billion KRW. Although first-half sales decreased by 3.8% compared to the same period last year, operating profit and net profit increased by 30.4% and 67.4%, respectively.

An IMM PE official said, “By organizing non-core brands and products, efficiency in the number of stores and product assortment has been achieved,” adding, “We are prioritizing value-up efforts to receive better recognition of Able C&C’s value.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)